GBP/USD fell for another week, closing below 1.33. Will it find a bottom anytime soon? Manufacturing PMI stands out as the page turns into June, an important month for Brexit negotiations. Here are the key events and an updated technical analysis for GBP/USD.

Not all UK figures missed expectations. While inflation dropped to 2.4% y/y, retail sales leaped by 1.6%, providing promises of a Spring comeback. Q1 GDP growth remained unchanged at 0.1% q/q. Yet GBP/USD also depends on the US Dollar, which enjoyed safe haven flows. The Japanese yen was the big winner but also the USD took advantage of fears related to global trade and the cancellation of the Kim-Trump Summit. Moreover, the Fed confirmed the rate hike in June via its Meeting Minutes.

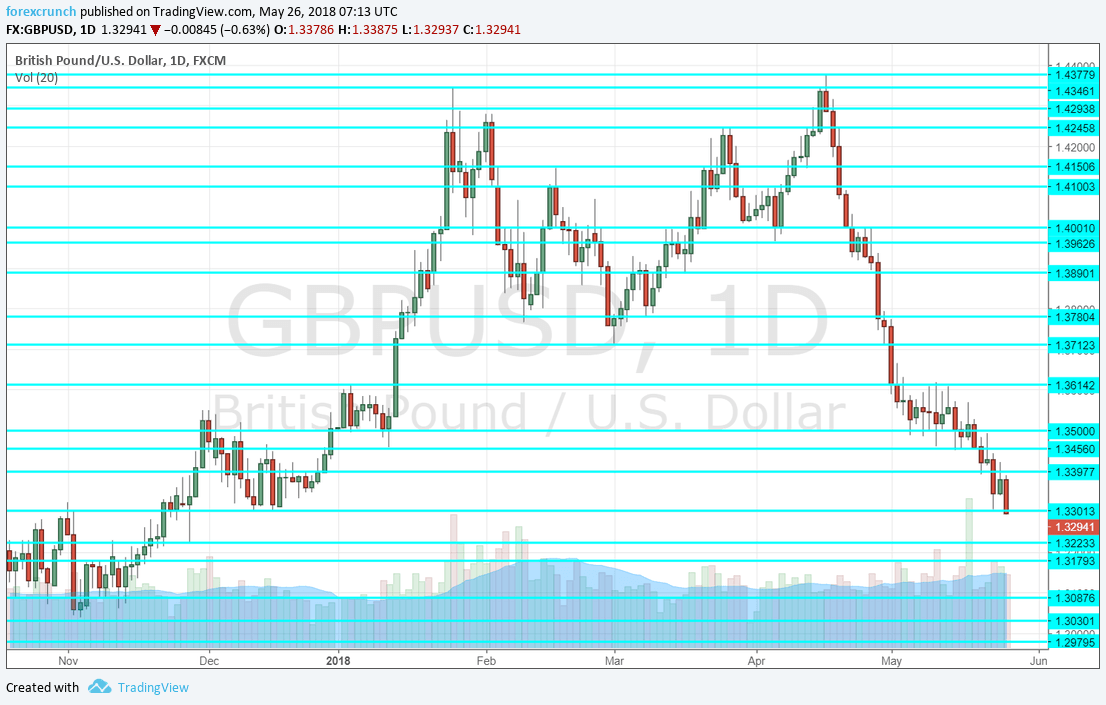

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- BRC Shop Price Index: Tuesday, 23:01. The British Retail Consortium’s measure of inflation, using its own stores, stood at -1% in April, not boding well for the economy. A similar figure is likely now.

- GfK Consumer Confidence: Wednesday, 23:01. Consumer confidence deteriorated in April according to the 2000-strong survey with a score of -9. A small improvement is on the cards now: -8. The negative number represents pessimism.

- Net Lending to Individuals: Thursday, 8:30. Growth in lending implies growth in the economy even if debt is created. A net level of 4.2 billion pounds was seen in March and April carries expectations for a rise to 5.2 billion.

- M4 Money Supply: Thursday, 8:30. The amount of money in circulation dropped by 1.4% m/m in March, a worrying sign and worse than expected, indicating a squeeze. The figure for April is projected to show a more moderate drop of 1.1%.

- Mortgage Approvals: Thursday, 8:30. The official mortgage consents figure lags the High Street one but still provides a broad view of the housing sector. The total dropped to 63K in March and is expected to maintain the same level in April.

- Manufacturing PMI: Friday, 8:30. Markit’s forward-looking index for the manufacturing sector disappointed in April with a drop to 53.9 points, reflecting more modest growth than beforehand. The 600-strong survey carries expectations for another slide to 53.5 points.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar was on the back foot throughout the week and eventually closed just under the 1.33 level (mentioned last week).

Technical lines from top to bottom:

1.3780 was a line of support in March and 1.3710 was the lowest point since early in the year.

Below, 1.3615 capped the pair in late 2017. The round number of 1.35 was a pivotal line within the higher range.

1.3460 was a swing low in early 2018 and remains relevant. The round number of 1.34 could provide further support.

Further down, 1.33, which supported the pair in December, is still relevant and the break is not yet confirmed. 1.3230 was a swing low in late November.

Even lower, 1.3180 capped the pair in November and 1.3080 served as support in the same month. The ultimate line is 1.3000.

I remain bearish on GBP/USD

While the worst of the economic slowdown may be behind us, the UK still lags its peers. Worse off, Brexit negotiations are set to come into the limelight in June and the issue of the Irish border has no magical solutions. In the US, rate hikes are set to continue.

Our latest podcast is titled Truce in trade and dollar domination

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!