- GBP/USD falls below the key 1.3800 level as USD demand surges.

- The rise in US Treasury yields is supporting the US dollar.

- In the absence of any data, the selling may exacerbate in the pair.

The GBP/USD price forecast shows a bearish bias as the Greenback surge stems from the better US Treasury yields. The pound sterling was sold intraday during the European session, bringing the pair down to 1.3770-65 in the past hour.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

The GBP/USD pair fell for the second consecutive year on Tuesday after an intraday uptrend reached 1.3855. A combination of factors caused the forex to drop off multi-week highs hit in response to Friday’s sharp NFP headline.

US Treasury yields have made strong gains since the previous day, which helped moderate the US dollar’s loss. Due to the pandemic, the Fed will begin to remove its stimulus measures in November, which caused the yield on 10-year US Treasuries to rise above 1.36%.

Nevertheless, the Northern Ireland Protocol impasse could still serve as a barrier for the British pound. Further, short-term trading stops were placed around the 1.3800 round number, which contributed to the intraday decline in GBP/USD.

An economic data-devoid market movement could already create conditions enabling further losses in the absence of relevant economic data. Therefore, further declines towards the adjacent support near the 1.3710 level appear imminent.

–Are you interested to learn more about forex signals? Check our detailed guide-

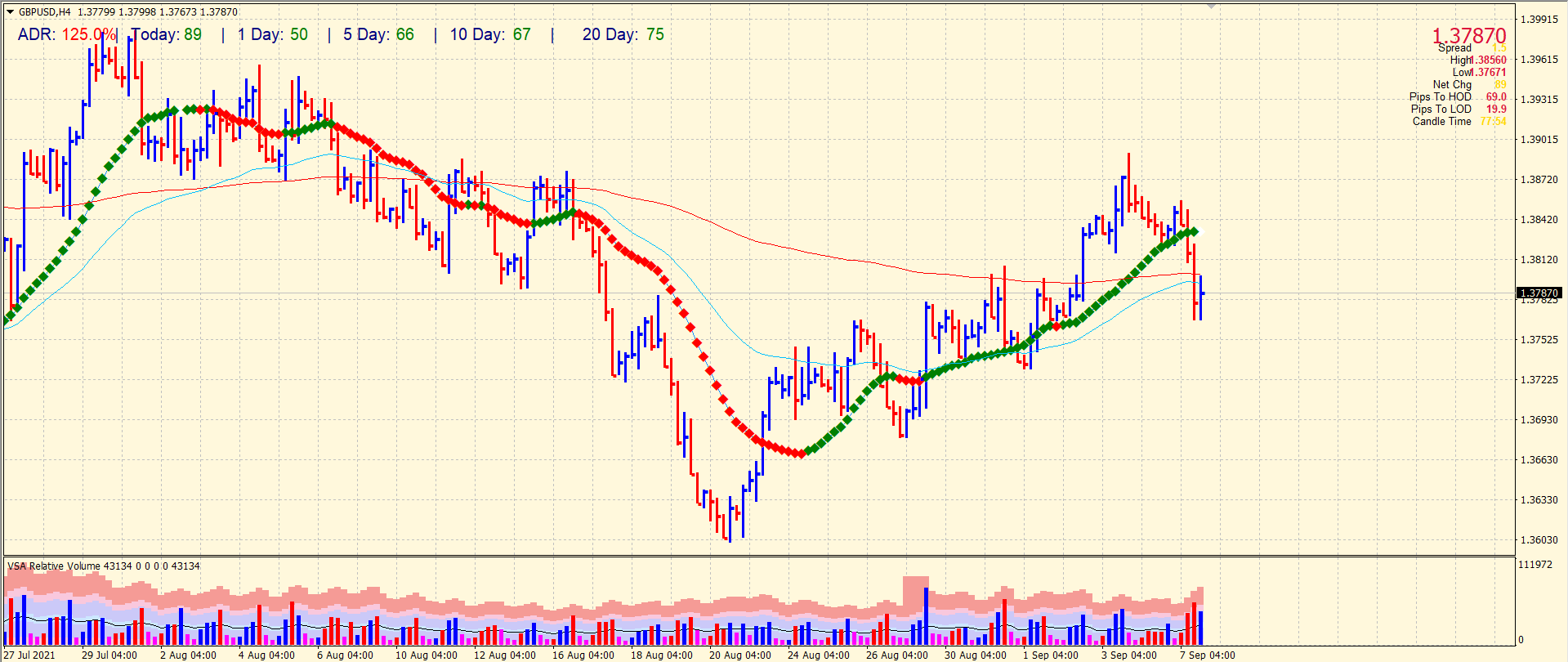

GBP/USD price technical forecast: Key SMAs broken

The GBP/USD pair falls through the 50-period and 200-period SMAs on the 4-hour chart. The price has covered the 125% average daily range so far, which indicates that the sellers have overstretched the market. The volume is increasing with the price fall. Hence, we may see further losses towards 1.3700 ahead of 1.3660. On the upside, 1.3800 remains the key resistance that may cap the gains.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.