- BOE’s Bailey stated there was no guarantee that rates would rise again.

- The pound has risen this week after Britain and the EU reached an agreement on Ireland.

- British factory activity shrank last month at its weakest rate since July.

Today’s GBP/USD forecast is bearish. The pound lost ground against the dollar, erasing gains achieved earlier in the week after Bank of England Governor Andrew Bailey stated that there was no decision on whether interest rates would need to increase again.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

In the draft of a speech, he was scheduled to deliver at a conference, Bailey strongly warned against the notion that either the central bank had finished hiking rates or would unavoidably need to do more.

His comments caused traders’ bets on the possibility of a 25-bps rate increase at the BoE’s next policy meeting on March 23 to be considerably reduced, but this outcome is still believed to be the most likely.

The news that a deal had been reached with the EU to modify the original Northern Ireland Protocol earlier in the week has benefited the pound. On Monday, the pound saw its greatest daily rise against the dollar in six weeks.

On the data front, the most recent estimates from mortgage lender Nationwide showed that British house prices fell by the most in over ten years in February, providing more evidence of the country’s slowing housing market.

According to a study released on Wednesday, British factory activity shrank last month at its weakest rate since July, and 60% of businesses anticipate increasing output over the next 12 months as inflation pressure eases.

The monthly manufacturing S&P Global/CIPS UK Purchasing Managers’ Index (PMI) increased to 49.3 in February from 47.0 the previous month, but it is still below the 50-point mark, which indicates growth.

GBP/USD key events today

Investors will pay attention to the initial jobless claims report from the US that will show the current state of the ever-resilient US labor market.

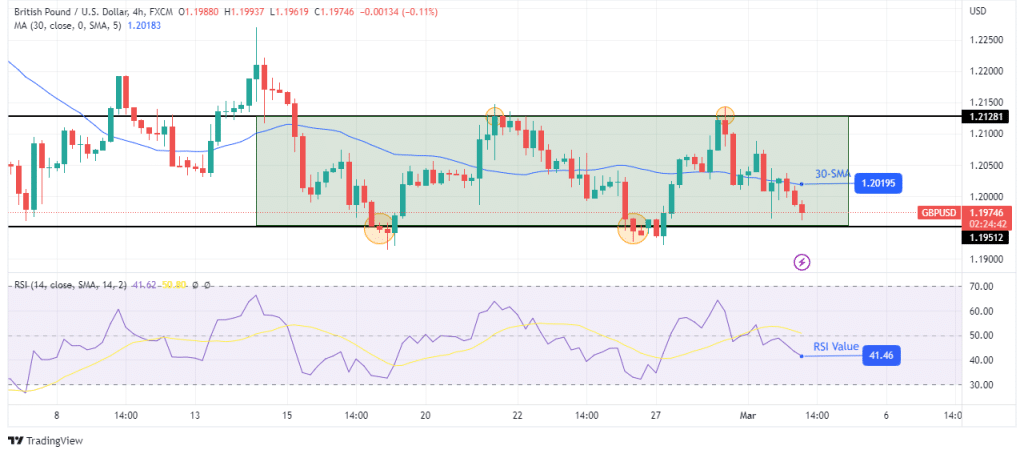

GBP/USD technical forecast: The price is oscillating in the 1.1951-1.2128 range

The 4-hour chart shows GBP/USD descending after respecting the 1.2128 resistance level. The price has gone below the 30-SMA, showing bears are stronger. The RSI has also crossed the 50-line, supporting bearish momentum.

–Are you interested to learn more about making money in forex? Check our detailed guide-

The bears are currently eyeing the 1.1951 support level. The price will break below this support if they are strong enough and trend lower.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.