- Investors will focus on the post-Brexit trade arrangement for Northern Ireland.

- UK rates will most likely peak at 4.75% later this year.

- The FOMC minutes confirmed higher rates for longer to tame inflation.

Today’s GBP/USD forecast is bearish. After rising on the strength of better-than-expected British economic growth, the pound fell as traders awaited consumer confidence data and concentrated on Britain’s political woes.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Markets will focus on the impasse around the post-Brexit trade arrangement for Northern Ireland and the GFK consumer confidence data coming out later this week.

The so-called Northern Ireland protocol outlines the requirements for trade with the province after Brexit to prevent the establishment of a hard border with EU member Ireland and to help safeguard the bloc’s single market. It is the subject of a disagreement between Britain and the European Union that is getting closer to resolution. Nonetheless, political debates are still going on.

In contrast to the prior views of many analysts that March’s rate increase would be the final one in the BoE’s current tightening cycle, it is now thought that UK rates will most likely peak at 4.75% later this year.

The market’s tone is set by expectations that the Fed will continue on its aggressive rate-hike path, supported by the minutes from its most recent policy meeting.

The FOMC meeting minutes from the Jan. 31–Feb. 1 meeting showed on Wednesday that nearly all Fed policymakers supported slowing the rate of interest rate increases.

Nevertheless, they also said the “key consideration” in determining how much further rates need to rise would be to stop inflation from getting too high.

GBP/USD key events today

Investors expect economic releases from the US, including the Q4 gross domestic product report and the initial jobless claims report.

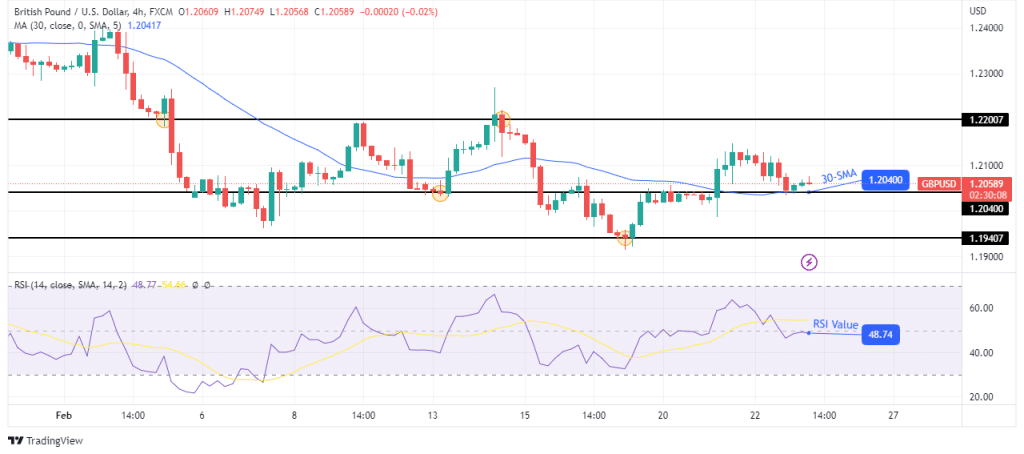

GBP/USD technical forecast: Pivotal 30-SMA level might hold as support

The 4-hour chart shows the price trading slightly above the 30-SMA with the RSI near the 50-mark. The price is trading at a pivotal level which might reverse the previous bearish move or see its continuation. Bears returned for a pullback that has seen the price fall to the 30-SMA.

–Are you interested in learning more about making money with forex? Check our detailed guide-

If bears hold on to control, the price will break below the 30-SMA and 1.2040 support level and head for the 1.1940 level. On the other hand, if bulls return, we might see a retest of the 1.2200 resistance.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money