- The Federal Reserve did as the market had expected.

- Fed Chair Powell was not as hawkish as investors had feared.

- The worsening British economy is pressuring the BOE to slow its rate hikes.

Today’s GBP/USD forecast is bullish as a generally weak dollar helped the British pound move higher. This move came after the Federal Reserve hiked rates as expected, and Powell was less hawkish than feared. This saw GBP/USD close higher yesterday.

–Are you interested to learn more about forex options trading? Check our detailed guide-

“The dollar lost a bit of altitude because I think the market was bracing for the potential for Fed chair Powell to sound a bit more hawkish,” said Rodrigo Catril, a senior FX strategist at National Australia Bank.

In the UK, retailers and supermarkets raised prices by 4.4% in the year to July, the highest increase in more than a decade. Still, companies are more negative about hiring and investing than they were during the coronavirus pandemic scare in 2020.

The Bank of England is under pressure to ease its tightening monetary policy pace due to a slew of dismal economic data. The central bank is expected to increase interest rates by 25 basis points next week, but other analysts predict a larger increase of 50 basis points.

“Data for July confirms the slowdown in real demand, and that might make the (BoE) policy announcement a more finely balanced one,” said Stephen Gallo, European head of FX strategy at BMO Capital Markets.

GBP/USD key events today

GBP/USD investors will receive news from the United States, including the Q2 Gross Domestic Product (QoQ). It is expected to go up from -1.6% to 0.5%. There will also be a speech from Janet Yellen. Finally, investors will pay attention to the initial jobless claims report, which will give an insight into the US jobs market.

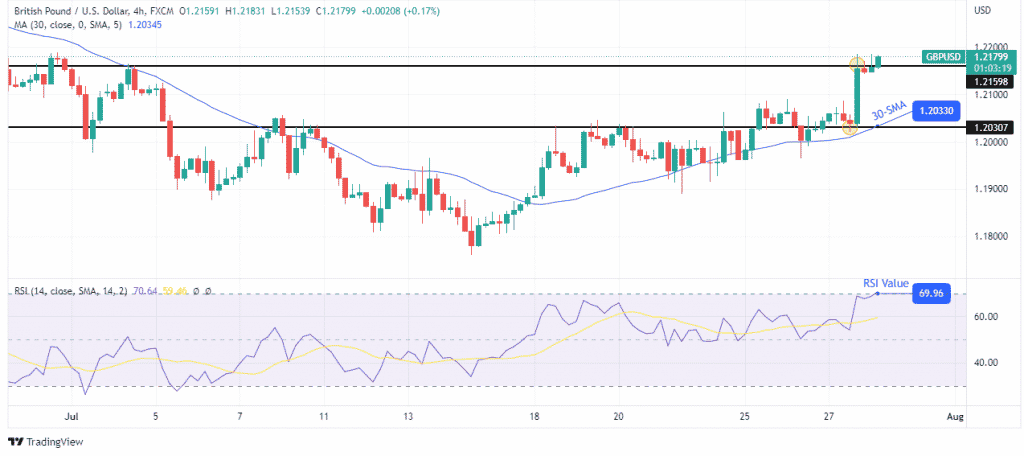

GBP/USD technical forecast: Strong bullish momentum above 1.20307

Looking at the 4-hour chart, the price strongly pushed off the 1.20307 support level, going to the next resistance level at 1.21598. This move shows strong bullish momentum, as seen in the RSI above 50.

–Are you interested to learn about forex robots? Check our detailed guide-

The price paused a little before breaking above, and this candle would have to close above 1.21598 to confirm the continuation of the upside move.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.