- GBP/USD rises towards 1.3700 as the US dollar retraces from 9-month highs.

- The rise in COVID-19 cases has dampened the speculation of Fed tapering this year.

- Despite the mixed UK PMI data, the Pound remained stronger.

- The US dollar bulls found no respite despite a rise in the 10-yr bonds yields.

The GBP/USD forecast is bullish as the pair has seen a swift rise towards the key level of 1.3700 amid a broader correction in the US dollar.

Since the beginning of the New York session, the GBP/USD has continued to steadily gain, hitting new highs within the near 1.3700 level.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

On Monday, the GBP/USD pair saw some movement as short positions were closed on the first day of a new week of trading, and it halted its recent decline to monthly highs. In the latest session, the US dollar continued its downward trend after reaching its highest level since November 2020, causing the main rate to rise well.

The recent spike in Delta-variant Coronavirus cases has led investors to lower their expectations regarding the Fed’s plan to reduce bond purchases. Another factor undermining the safe dollar was the generally positive tone in the equity markets.

The GBP/USD pair reacted cautiously to mixed UK PMI data for August as dollar momentum was the only driving force. Manufacturing PMI fell in August to a five-month low of 60.1. Additionally, the service index fell to a half-year low of 55.5 in the month under review.

While the 10-yr US Treasury bond yield rose sharply during the trading session, this did not impress the US dollar bulls and did not dampen the intraday move in the GBP/USD pair. The US manufacturing and services PMI, which is expected to be released later in the North American session, will provide some short-term trading opportunities.

–Are you interested to learn more about forex signals? Check our detailed guide-

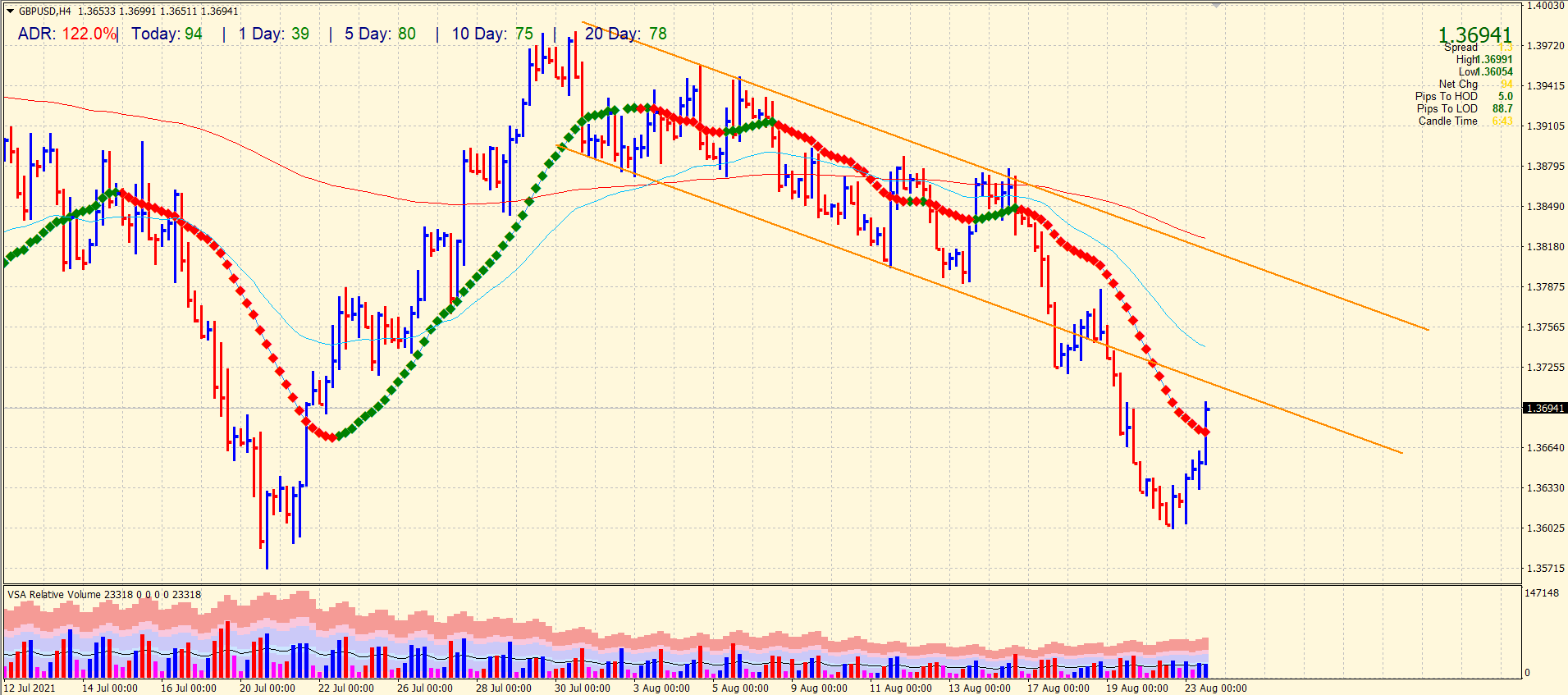

GBP/USD price technical forecast: 1.3700 to be a decisive point

The 4-hour chart of the GBP/USD pair shows a sign of bullishness. First, the price strongly moved above the 20-period SMA on the chart with an average volume. Second, the price is ranging near the 1.3700 area. Capturing the key level is important for the pair, while the descending trend channel’s resistance can limit the gains. So, the bulls have to take out 1.3700 level ahead of 50-period SMA at 1.3730. A sustained rally will call for a bullish reversal. However, we may see a retracement towards the 20-period SMA where buyers can emerge again.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.