- Poor PMI data has stalled the move higher for GBP/USD.

- The Bank of England is coming under political pressure to control inflation.

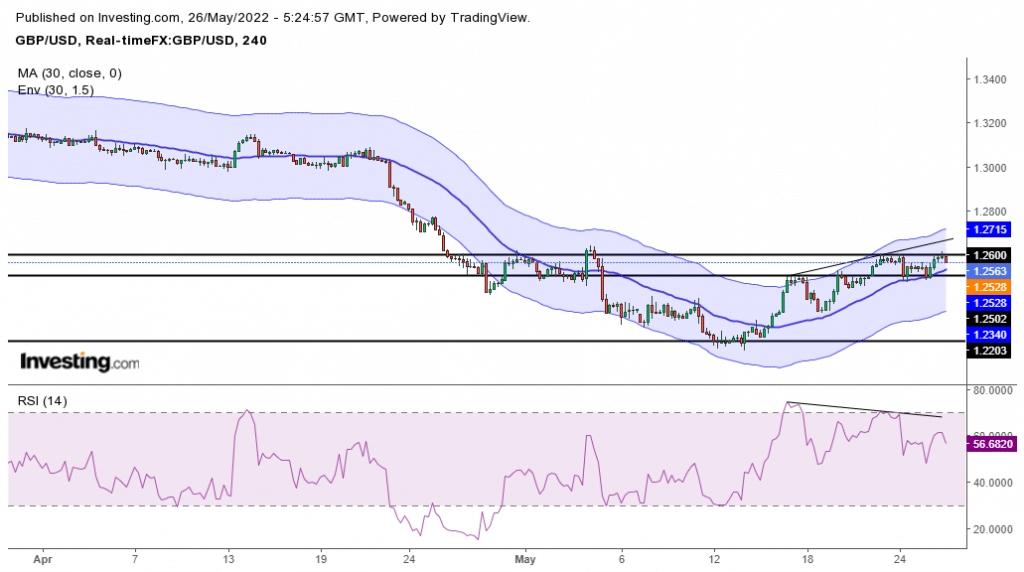

- RSI bearish divergence could lead to lower prices in the charts.

The GBP/USD forecast is neutral to bearish as the bulls have shown weakness around the 1.2600 level. This weakness comes ahead of US data releases, which could mean traders are waiting to see the outcome later in the day. There is a bank holiday in Europe that may keep volatility limited.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

With inflation at 9% this month, the highest in 40 years, the Bank of England is starting to feel political pressure. The bank is coming under attack by politicians for underestimating the threat of rising inflation.

The Bank of England governor, Andrew Bailey, said that interest rate hikes were almost entirely useless in tackling current sources of inflation despite being used by most central banks. In his opinion, increasing interest rates will do very little to cut the price of energy or change the course of the war in Ukraine. Could this mean that the central bank is powerless against this new enemy?

The bank has a strange solution for these trying times. It focuses on bringing inflation down by squeezing wages and preventing a so-called ‘wage-price-spiral.’ In essence, workers must sacrifice household incomes to control inflation and maintain corporate profits.

GBP/USD key events today

GBP/USD might experience volatility today brought on by news releases from the US, including GDP (QoQ) (Q1), which investors expect to go up from -1.4% to -1.3%. A drop from here could see dollar weakness and a rise in GBP/USD. Investors expect initial jobless claims in the US to drop from 218k to 215k.

GBP/USD technical forecast: Bulls’ exhaustion at 1.2600

The 4-hour chart shows a bearish divergence in the RSI, which is a sign that there is little bullish momentum in recent price movements. The price is currently trading between 1.2500 and 1.2600 and shows the possibility of breaking below the 30-SMA.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

If bulls cannot bring back momentum to push prices above 1.2600, then bears might retest the 1.2200 lows. This retest could see the return of a bearish market, but only if we can see the RSI getting oversold. For now, the bias remains up.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money