GBP/USD continues to show strong volatility. The pair gained 1.0% last week, recovering most of the losses of the previous week. This week’s key events are GDP and wage growth. Here is an outlook for the highlights of the upcoming week and an updated technical analysis for GBP/USD.

There was plenty of drama in Parliament last week. The House of Commons and the House of Lords voted to pass a law to prevent a no-deal Brexit, which sets up a showdown with Prime Minister Johnson. The government is in disarray, as Johnson’s attempt to call a snap election for October was rejected by lawmakers.

In the U.K., all three PMI reports slowed in August, but this didn’t slow down the pound. Manufacturing PMI continues to point to contraction, dropping to 47.4. This was the weakest reading since 2012. Construction PMI fell to 45.0, the first contraction in five months. The news was slightly better from services PMI, which fell to 50.6, down from 51.4 in the previous release. This points to stagnation in the services sector.

Over in the U.S., the ISM manufacturing PMI slipped to 41.9 in August, down from 51.2 in July. It marked the first reading in contraction territory (below the 50-level) since August 2016. Unemployment data was a mix. Nonfarm payrolls slowed to 130 thousand in August, down from 164 thousand a month earlier. However, wage growth rose to 0.4% in August, its strongest gain of the year.

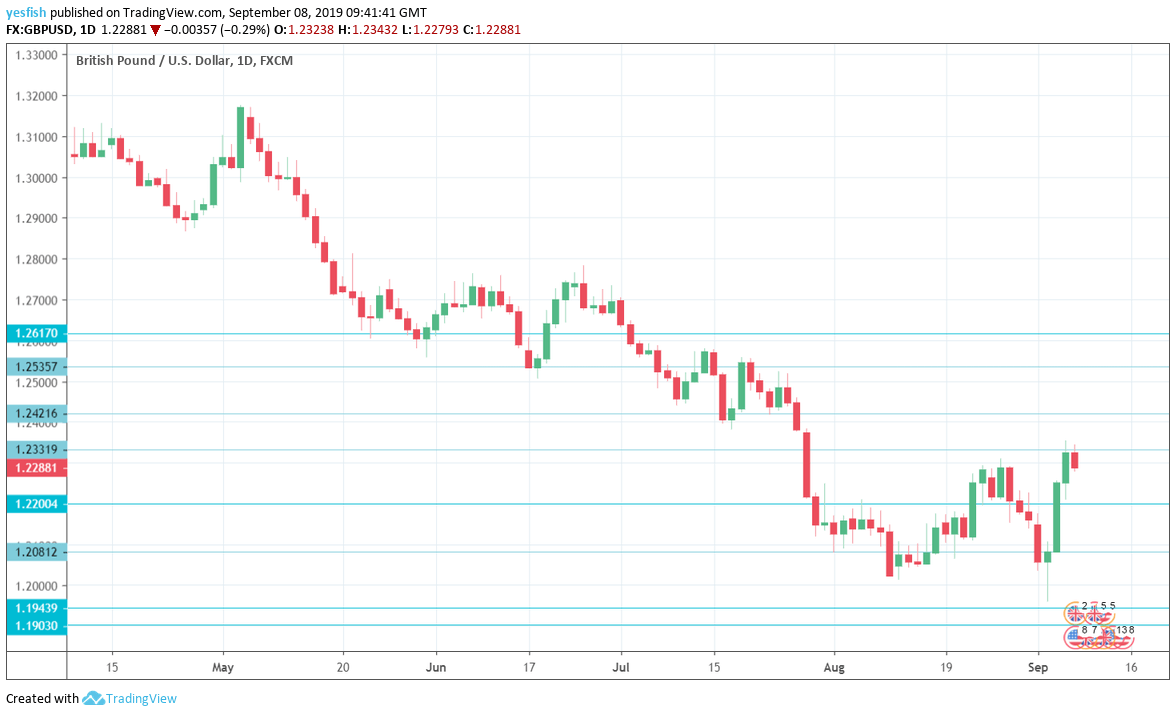

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- GDP: Monday, 8:30. This indicator gauges GDP on a monthly basis. The U.K. economy came in at zero in June, down from 0.3% a month earlier. The July forecast stands at 0.1%.

- Manufacturing Production: Monday, 8:30. The manufacturing sector continues to struggle, and the indicator has recorded two declines in the past three months. Investors are braced for another decline in July, with an estimate of -0.3%.

- Employment Data: Tuesday, 8:30. Wage growth has become a bright spot for the economy in recent months, with a strong gain of 3.7% in June, up from 3.4% in the previous release. This marked the highest monthly gain since 2010. Another gain of 3.7% is projected in July.

- RICS House Price Balance: Thursday, 00:01. Inflation in the housing sector remains weak, as a majority of property surveyors continue to report a decrease in house prices. In July, the indicator came in at -9% weaker than the estimate of -1%. The forecast for August stands at -10%.

- CB Leading Index: Friday, 13:30. This index of 7 indicators declined by 0.3% in June. Will we see an improvement in the July release?

GBP/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2616.

1.2535 has held since mid-July. This is followed by 1.2420.

1.2330 (mentioned last week) has held in resistance since the end of July.

The round number of 1.22 switched to support during the week following sharp gains by GBP/USD.

1.2080 is next.

The symbolic level of 1.20 follows was tested early in the week. 1.1943 is next.

1.1904 was the low point in October 2016.

The round line of 1.1800 is the final line for now.

I remain bearish on GBP/USD

Somewhat surprisingly, the pound posted strong gains last week, despite the political turmoil surrounding Brexit. The government remains deeply divided on how to proceed, and the uncertainty has been heightened by the possibility of a snap election. Investors remain nervous over Brexit, and the pound is likely to face further headwinds unless an agreement is hammered out with Brussels.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!