- GBP/USD has been on the back foot due to rising UK and US coronavirus cases.

- Reports about the progress in Brexit talks are keeping sterling bid.

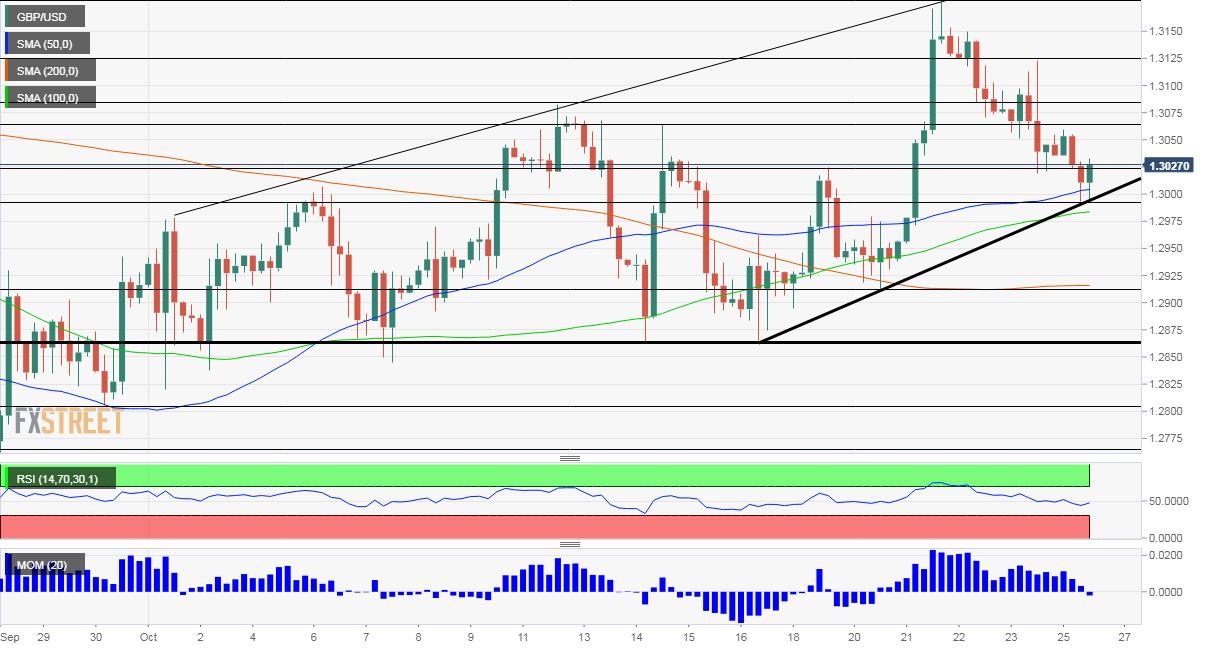

- Monday’s four-hour chart is showing the currency pair bounced at uptrend support.

London must be calling – Michel Barnier, the EU’s Chief Brexit Negotiator has extended his stay in the British capital for further talks. This development is seen as a sign that weekend talks were productive. Moreover, Northern Ireland minister Brandon Lewis said that there is a good chance of a deal with Brussels.

The UK and the EU went from a breakup in talks to resuming them and now even making progress. The thorny issues remain state aid and fisheries – and the lack of details on both topics means the mood could still sour. However, the absence of finger-pointing is also a positive development after weeks of acrimony.

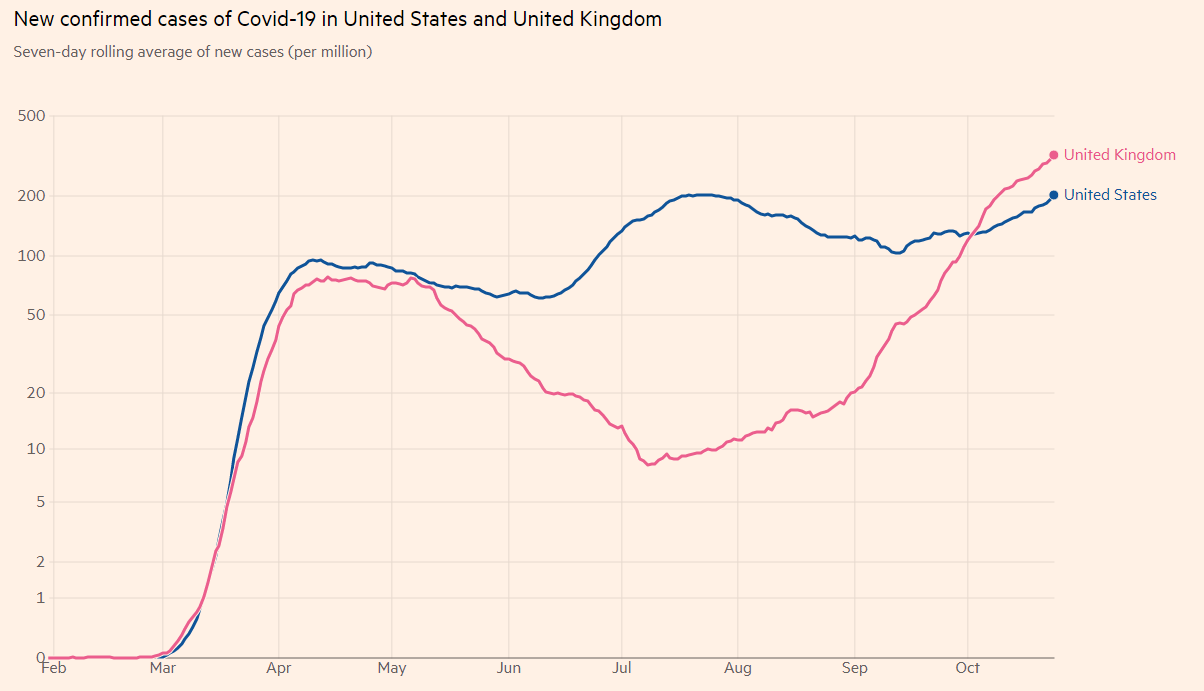

Other factors have been less favorable for the pound. COVID-19 cases have continued rising in Britain, suggesting further restrictions could be slapped. The disease is also spreading in America, with record numbers of nationwide infections and also pressure on hospitals in several states. While the pound may come under pressure from the UK’s covid situation, the dollar is already attracting safe-haven bids – despite the worsening situation stateside.

New infection records on both sides of the pond:

Source: FT

The greenback is also receiving haven flows as US stimulus talks seem to be falling apart. Democrats and Republicans moved from expressing cautious optimism to finger-pointing. Recent interviews by House Speaker Nancy Pelosi and White House Chief of Staff Mark Meadows have weighed on markets.

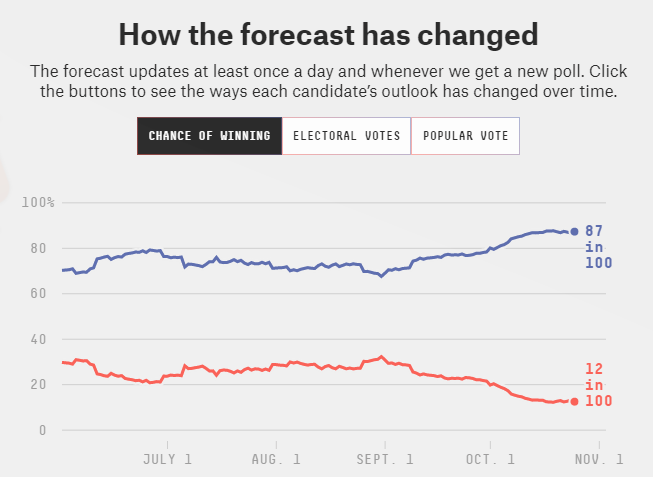

An accord already had slim chances ahead of the elections. The flow of surveys ahead of Election Day has fallen over the weekend, as pollsters went out to gather post-Presidential Debate opinions from voters. The last encounter between President Donald Trump and Vice-President Joe Biden was more civilized and in theory, could prove more favorable to the incumbent.

More: US Elections: Debates matter but how much?

Markets currently prefer a potentially business-unfriendly Democratic sweep over a Republican win – as Dems would approve a generous relief package. Biden is favored to win the presidency according to polls, but the race for the Senate is closer.

Source: FiveThirtyEight

US New Home Sales are set to show an annualized level of above one million in October, yet markets will likely focus on the virus and the elections.

GBP/USD Technical Analysis

Pound/dollar has bounced off an uptrend support line that has been accompanying it since mid-October. It also escaped dropping below the 50 and 100 Simple Moving Averages on the four-hour chart, a bullish sign. On the other hand, momentum has turned negative.

All in all, bulls are in the lead but lack full control.

Support awaits at the daily low of 1.2990, followed by 1.2910, which is where the 200 SMA hits the price. Further down, the next level to watch is 1.2865.

Resistance awaits at 1.3060, the daily high, followed closely by 1.3080, a peak from mid-October. The next levels to watch are 1.3125 and 1.3175.