- Following a sharp fall on concerns over Ukraine’s nuclear program, the GBP/USD rebounded to 1.3350.

- The level of uncertainty has decreased a bit, but risk aversion remains strong.

- For further guidance, investors are waiting for further developments in the shelling of Ukrainian nuclear power plants.

The GBP/USD forecast remains bearish below the 1.3400 mark as the strong risk aversion weighs heavily on the sterling while supporting the USD.

–Are you interested in learning more about managed forex accounts? Check our detailed guide-

Amid Russian attacks on Europe’s largest nuclear power plant in Ukraine, the GBP/USD pair received significant offers from market participants, falling as low as 1.3316. Investors perceived it as a further escalation of the Russo-Ukrainian war, prompting a widespread sell-off of risky assets. However, after a subsequent buy, the cable appears to be retesting 1.3350.

Representatives of the government of Ukraine have warned against detected increases in radiation levels near nuclear power plants. Energodar Mayor Dmitry Orlov said local forces and Russian militants engaged in violent clashes. Orlov also described the shelling of the Zaporizhzhia nuclear power plant as a threat to world security.

The IAEA was notified later by the Ukrainian regulator that radiation levels had changed at Zaporizhzhia NPP. The cable was able to gain some ground back and reverse losses.

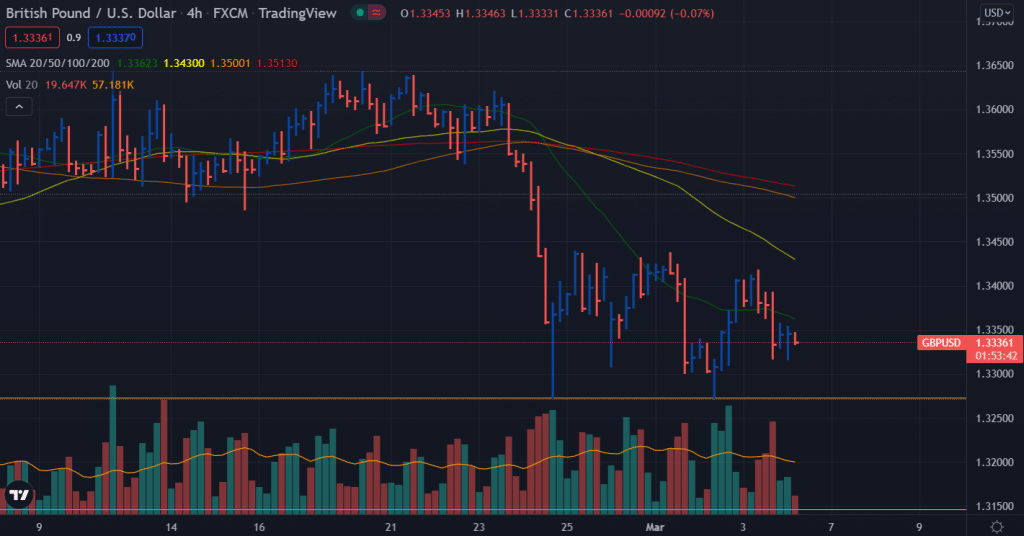

The GBP/USD has been floating between 1.3272 and 1.3437 since February 24th after falling sharply on February 18th without a potential trigger to support sterling against the dollar.

Despite growing geopolitical risks, the US Dollar Index (DXY) is expected to recover 98.00. Additionally, upbeat US initial jobless claims could further boost the US Dollar.

Although the heightened uncertainty has subsided, for the time being, the trend toward risk aversion is likely to continue. Investors will be interested in knowing more about the future shelling of Ukrainian nuclear power plants. In addition, investors’ attention will turn to Friday’s nonfarm payrolls report.

GBP/USD price technical forecast: Double bottom to protect

The GBP/USD price remains offered below the 20-period SMA on the 4-hour chart. Despite attempts to pare the losses, the widespread down bar maintains the bearish momentum. However, the double bottom at 1.3272 remains a key support for the buyers. Breaking the double bottom may trigger a sell-off towards a 1.3200 handle ahead of 1.3100.

–Are you interested in learning more about crypto brokers? Check our detailed guide-

Alternatively, regaining the 1.3400 mark may shed off some bearish momentum. However, the broader dollar strength may not allow a relief rally to the pair. The volume data is neutral at the moment, suggesting no directional bias. The average daily range is 36% so far, suggesting a normal volatile day.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money