- British consumer price inflation unexpectedly increased to 10.4% in February.

- Investors are awaiting the BOE meeting on Thursday.

- Markets are presently pricing in a 14% chance that the Fed won’t raise rates.

Today’s GBP/USD forecast is bullish. British consumer price inflation unexpectedly increased to 10.4% in February from 10.1% in January, according to the Office for National Statistics data on Wednesday.

-If you are interested in forex day trading then have a read of our guide to getting started-

Economists expected the annual CPI rate to dip to 9.9% in January, moving further away from the 41-year peak of 11.1% in October.

On Thursday, Britain’s Central Bank is anticipated to reveal if interest rates will be increased for the eleventh meeting in a row.

Investors were waiting for details on the Federal Reserve’s expected course of action in the aftermath of the turmoil in the world financial system. This kept the dollar pinned near five-week lows.

Investors are watching to see if the Fed will continue its hawkish path to fight inflation or stop interest rate hikes in light of recent bank issues.

Markets are presently pricing in a 14% chance that the Fed won’t raise rates and an 86% chance that it will raise rates by 25bps, according to the CME FedWatch tool. Only a month ago, the market predicted a 50 bps increase with a probability of 24%.

The Fed faces a challenging decision due to the solid labor market and February inflation data that came in higher than many market analysts anticipated. If there were no worries about financial stability in such instances, a return to a 50 basis point hike would have been appropriate.

GBP/USD key events today

Investors will focus on the Fed meeting that will come to an end today, with a majority expecting a 25bps rate hike. This will likely cause volatility in the market.

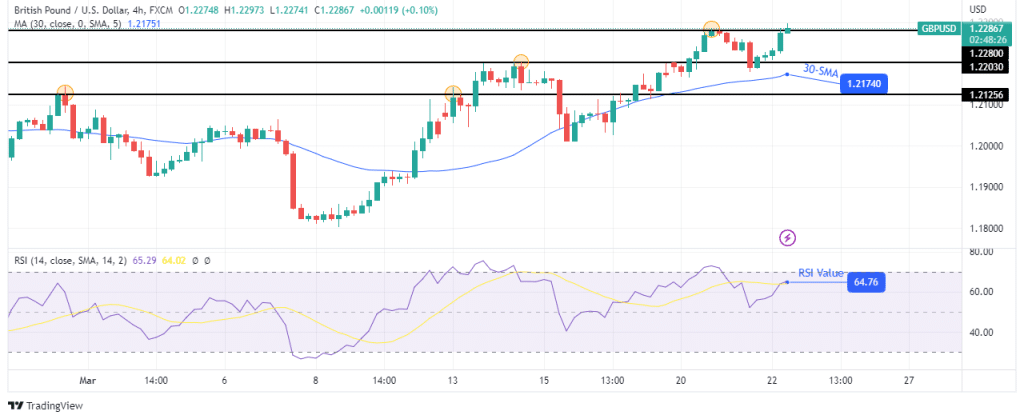

GBP/USD technical forecast: Bulls seek a new high above 1.2280

On the technical side, GBP/USD is climbing and trying to break above the 1.2280 resistance level. The price is bullish, trading above the 30-SMA, with the RSI pointing to strong bullish momentum above 50.

-Are you looking for automated trading? Check our detailed guide-

After failing to break above the 1.2280 resistance, the price returned to retest the 1.2203 support. Although bears were strong, they could not break below the support. This allowed bulls to return, and they are looking to remove the 1.2280 resistance.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.