- As upcoming US CPI data has subdued FX market volatility, the GBP/USD remains around 1.2300.

- Inflation could reach 8.1%, and the US core consumer price index could fall 6%.

- Data on employment in Great Britain and the consumer price index will continue to dominate the news next week.

The GBP/USD forecast remains negative as the price is stuck around the 1.2300 area with no respite for the buyers. The demand for the US dollar as a safe haven asset undermines the riskier assets.

–Are you interested in learning more about STP brokers? Check our detailed guide-

As we approach the US Consumer Price Index (CPI) release, the GBP/USD pair fluctuates in the 1.2290-1.2375 range. Although the entire forex market is confined to a limited amount of space, the cable is at the top of the list.

From the Federal Reserve’s (FRS) interest rate announcement to the US payrolls (NFP) data release and the US inflation data, major economic events created a highly volatile trading environment. As a result, US annual inflation is expected to be 8.1% versus 8.5% in 2014, and the core CPI excluding food and energy will be 6%, well below the previous 6.5%. Nevertheless, a significant rate hike by the Fed is likely in June.

In the UK’s view, the lack of decision on the Northern Ireland Protocol (NIP) has not further exacerbated the situation. Johnson urged the UK government to provide arms to Northern Ireland, a UK government official said. The spokesman added, “With the NIP, we hope to address some of the big issues.”

In addition, the sterling is showing signs of a recession, which is dampening the pound’s demand against the dollar. UK businesses are unable to create more jobs due to higher electricity bills. Investors are looking forward to UK jobs and inflation data next week, which will keep the UK calendar light this week.

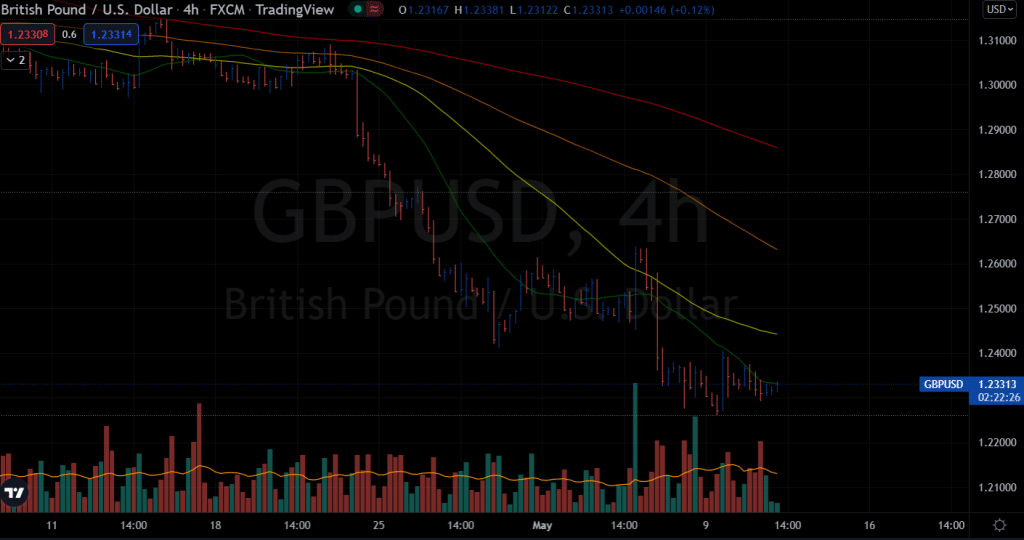

GBP/USD price technical forecast: 20-SMA is the key

The GBP/USD price is wobbling around the 20-period SMA on the 4-hour chart. The pair has posted a few small up bars but with a declining volume. Hence, the momentum cannot be considered positive for the pair. Nevertheless, any meaningful recovery above the 20-period SMA will be considered a buying opportunity.

–Are you interested in learning more about making money with forex? Check our detailed guide-

However, the 1.2400 level will be a tough resistance to bypass. The bears will dominate the market as long as the price remains below the 1.2650 area.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money