- GBP/USD has collapsed as the dollar soared with bond-yields.

- Sterling may have room to recover as markets rebalance at the end of the month.

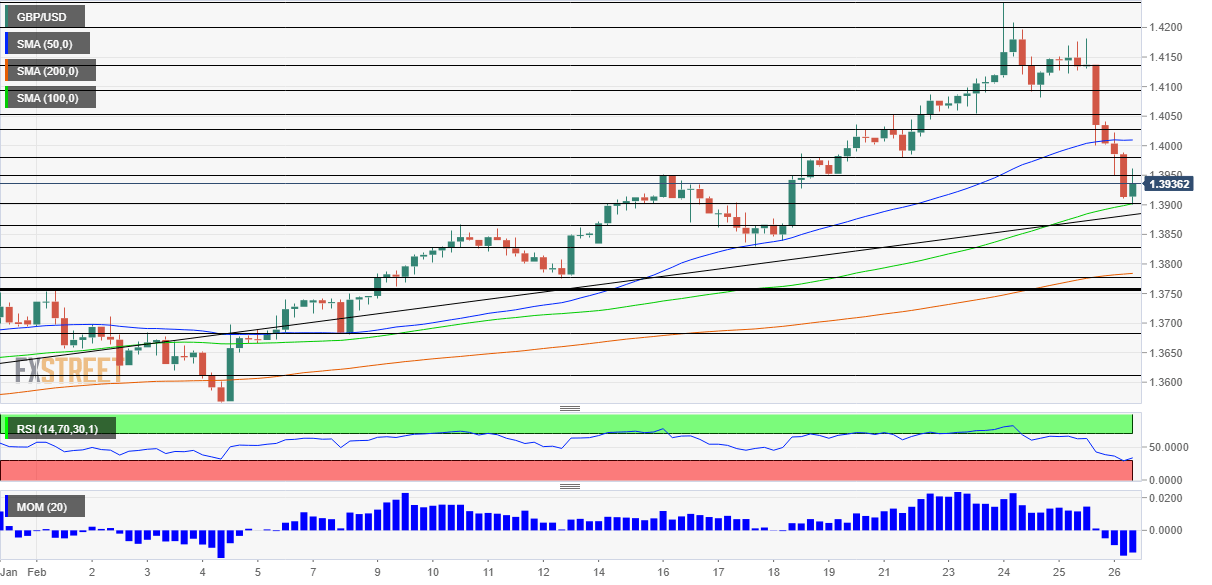

- Friday’s four-hour chart is showing that cable is nearly at oversold territory.

On the fast lane – GBP/USD has reversed all its gains and some more, in a 300-pips+ slide. Apart from profit-taking, the fall was driven by the rout in bond markets, especially in the US. Prospects of stronger growth and perhaps overheating inflation – that Federal Reserve officials dismissed – have finally triggered a sharper move.

Higher returns on solid US debt make the dollar more attractive and the fall in stocks pushed additional funds toward the safe-haven greenback. Central banks in Europe, Australia, and Japan are uncomfortable with higher returns on debt and the Fed has yet to react. Will yields continue rising and pushing the dollar higher?

Even before any new developments from the US central bank, other factors may turn things around. February is drawing to an end and money managers could undo some of the recent moves to balance their books. Another factor comes from Capitol Hill, where the Senate parliamentarian rejected the hike in the minimum wage, complicating the passage of the stimulus bill and perhaps limiting its scope.

After a mixed day of US data on Thursday, Friday’s data batch include the Core PCE – the Fed’s preferred gauge of inflation. It is set to decelerate to 1.4% yearly, a reminder that prices are not going anywhere fast and that fears of overheating may be exaggerated. That would allow yields to retreat, dragging the dollar lower.

In the UK, the vaccination campaign continues at full speed and a new study has shown that even one shot of the Pfizer/BioNTech jab can significantly reduce transmission. That vindicates Britain’s approach and raises hopes for a quick exit from the crisis.

All in all, there is room for cable to lick its wounds.

GBP/USD Technical Analysis

The Relative Strength Index on the four-hour chart is just around 30, near oversold territory. While pound/dollar dropped below the 50 Simple Moving Average, it bounced off the 100 SMA and trades well above the 200 SMA. Only momentum, which flipped to the downside, serves as a booster for bears.

Support awaits at 1.39, the daily low, and then by 1.3860 and 1.2830.

Resistance is at the round 1.40 level, followed by 1.4025, the daily high. Further above, 1.4050 and 1.41 await bulls.

GBP/USD Price Forecast 2021: Cable braces for calendar comeback amid three exits