- GBP/USD has been holding onto gains amid optimism about the UK elections.

- Coronavirus cases have stabilized in the UK, supporting sterling.

- The Fed has opened the door to more bond-buying, weighing on the dollar.

- Yet Brexit headlines could ruin Friday for the bulls.

Is it 2016 all over again? While President Donald Trump is on the back foot in the elections, Brexit headlines may weigh on sterling once again.

Friday is the day when Chief EU Negotiator Michel Barnier and his British counterpart David Frost usually take stock of the talks recent reports have pointed to a fresh impasse. After several days of progress, it seems that an agreement is yet to be reached on the politically sensitive topic of fisheries.

If officials express frustration, the party could be ruined for sterling. However, if they stay silent or report progress, it would only add fuel to the fire.

Here are GBP/USD’s reasons to rise:

1) US elections: The vote count continues and Democratic nominee Joe Biden has higher chances of clinching the presidency – as early as Friday. He is leading President Donald Trump in Nevada, Arizona, and most recently Georgia. The former Vice-President is also on course to take the lead in Pennsylvania. Trump would need to win at least three states of these four states to win,

The risk comes from Trump’s unsubstantiated claims of fraud, rejected by several Republican politicians. Markets lean toward a decision rather than a contested election, and the safe-haven dollar is down.

See 2020 Elections: Where the race stands in four critical states, traders on the edge of their seats

2) BOE boost: Sterling continues benefiting from the Bank of England’s decision to enlarge its bond-buying scheme by £150 billion, more than expected. In the UK’s case, more monetary stimulus means more fiscal stimulus. Rishi Sunak, Chancellor of the Exchequer, announced that the successful furlough scheme will continue in its generous 80% mode through March. The “Old Lady also refrained from setting negative rates.

See BOE Analysis: Bailey give pound bulls three gifts, what to watch for next

3) Fed fuel: The Federal Reserve stated that the pace of the recovery is moderating, expressed concerns about the resurgence of the virus – and opened the door to expanding its own Quantitative Easing program. In America’s case, more monetary stimulus means additional funds for stocks, adding to the risk-on mood and weighing on the dollar.

See Fed Analysis: Powell adds fuel to the market fire by defending QE, rally set to extend

Markets are currently shrugging off the increase in COVID-19 cases in the US and the flattening of the curve in the UK. When the dust settles from the US elections and central bank action, this could be a factor boosting GBP/USD as well.

Apart from further election results, the US Nonfarm Payrolls are of high interest. Economists expect an increase of around 600,000 jobs and another drop in the Unemployment Rate. The pace of job restoration is slowing down.

See Nonfarm Payrolls Preview: Encouraging data but little action expected

GBP/USD Technical Analysis

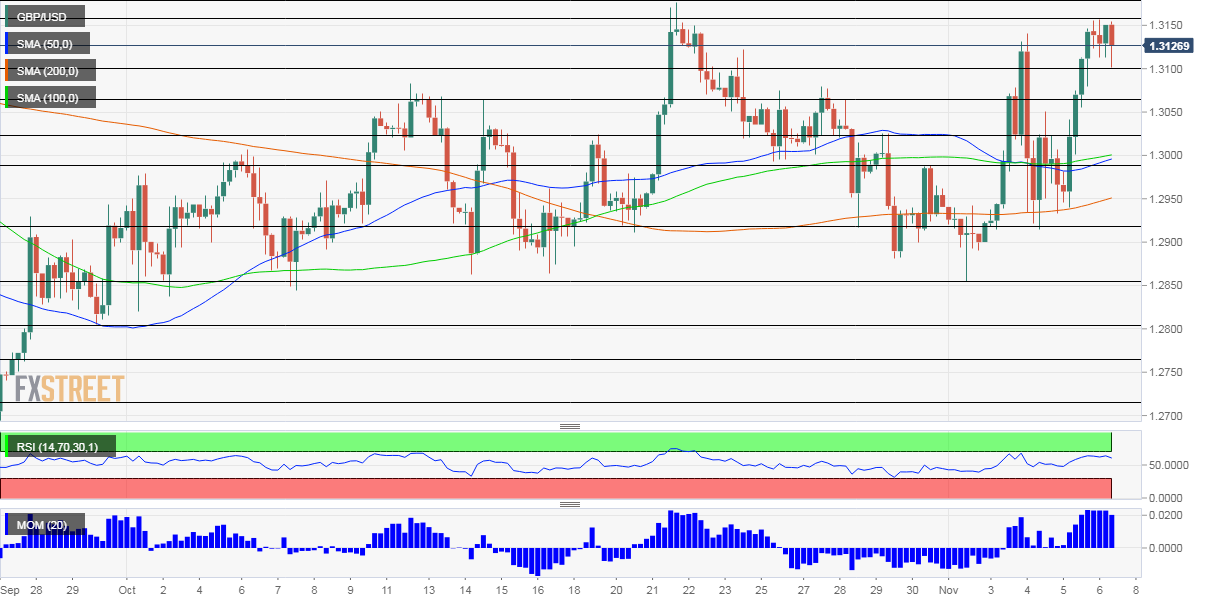

The Relative Strength Index on the four-hour chart is maintaining a distance from the 70 level – remaining outside overbought conditions. Momentum is to the upside and the pair is well above the 50, 100, and 200 Simple Moving Averages.

Bulls are in control.

Resistance awaits at 1.3160, which is the cycle high, followed by 1.3180, October’s peak. The next levels to watch are 1.3245 and 1.3320.

Support awaits at 1.31, the daily low, followed by 1.3060, which was a swing high in mid-October. Further down, 1.3025 and 1.2980 are eyed.