- GBP/USD has been advancing amid coronavirus vaccine hopes, upbeat UK CPI.

- Britain’s relations with China and Brexit uncertainty may weigh on sterling.

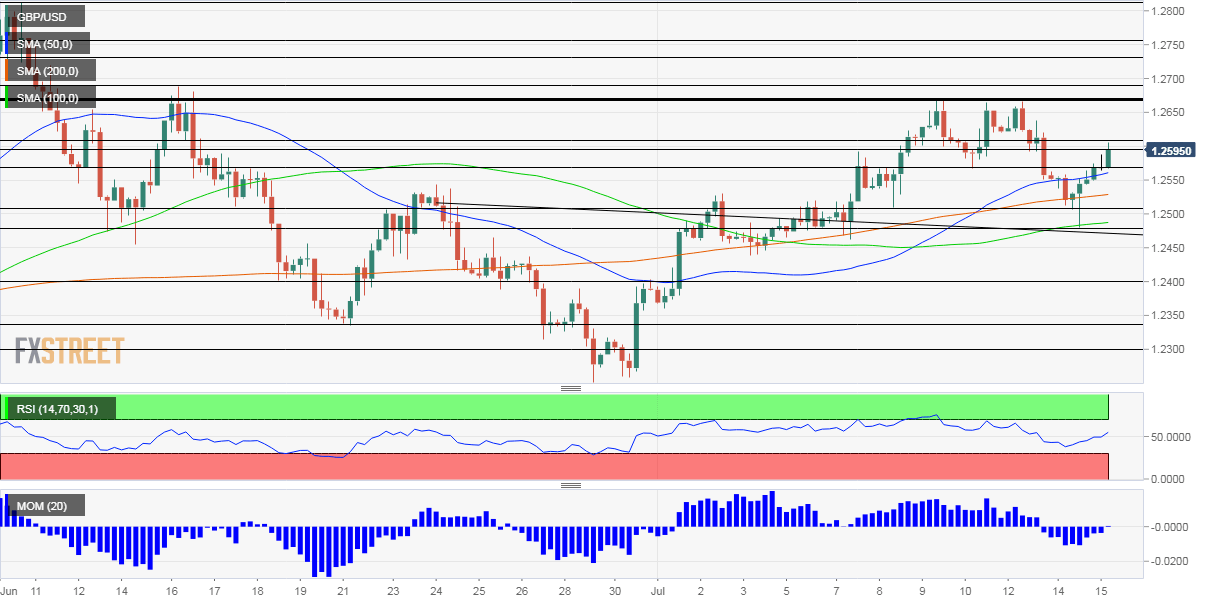

- Wednesday’s four-hour chart is showing that momentum remains weak.

Will Brexit send Britain back to the glory buccaneering days? Shackling off the EU’s chains provided promises of trade with other countries – including with China. However, relations with the world’s second-largest economy are souring.

The British government decided to phase out its dependence on Huawei – the Chinese telecoms giant that has the most advanced 5G technology amid concerns about having backdoors to the Chinese army. Beijing responses angrily and stated that the UK breached promises, accusing it of political manipulation.

Back in the days of the Empire, Britain held onto Hong Kong, and the city-state is another point of contention. Prime Minister Boris Johnson opened the door to receiving mass immigration from HK, a response to China’s tighter grip on the territory.

Brexit talks remain deadlocked, with progress expected only closer to the year-end, when the transition period expires.

Pound bulls may be encouraged by the stronger-than-expected increase in annual inflation. Consumer Price Index rose by 0.6% yearly, showing stability and a lower chance of disinflation. Nevertheless, Silvana Ternyero, a member of the Bank of England, said that she would vote for further stimulus if needed.

GBP/USD has been benefiting from dollar weakness, stemming from hopes for a coronavirus vaccine. Moderna, a Massachusets-based pharma firm, reported further progress in developing immunization after 45 humans developed a robust level of antibodies.

Investors see the glass half-full, selling off the safe-haven greenback while ignoring the disease’s rage in the US. COVID-19 cases hit new records in California and Texas, while mortalities continue moving higher. President Donald Trump, who wore a mask over the weekend, seems to be deflecting the blame to experts such as Anthony Fauci, America’s top epidemiologist.

The US Empire State Manufacturing Index and Industrial Production are of interest, but investors are already eyeing Thursday’s all-important retail sales report. Sterling may move in anticipation of the UK’s jobs report.

Overall, these are busy days for GBP/USD.

GBP/USD Technical Analysis

While pound/dollar has been moving up from the lows and above the 50, 100, and 200 Simple Moving Averages on the four-hour chart, momentum remains to the downside. Moreover, GBP/USD faces fierce resistance at 1.2670, which held it down three times in recent days.

The daily high of 1.2627 is the first cap, ahead of 1.2670 mentioned earlier. It is closely followed by 1.2690, a peak that was seen in early June. Further above, 1.2730 and 1.2755 are eyed.

Support is awaited at 1.2570, a low point last week, and then by 1.2510, a swing low from last week. The next line to watch is 1.2480, the weekly low.

More GBP/USD path of least resistance is down ahead of critical data – Confluence Detector