- GBP/USD has been resuming its gains amid cautious optimism about a Brexit deal.

- Headlines from the negotiations, US fiscal stimulus, and data are eyed.

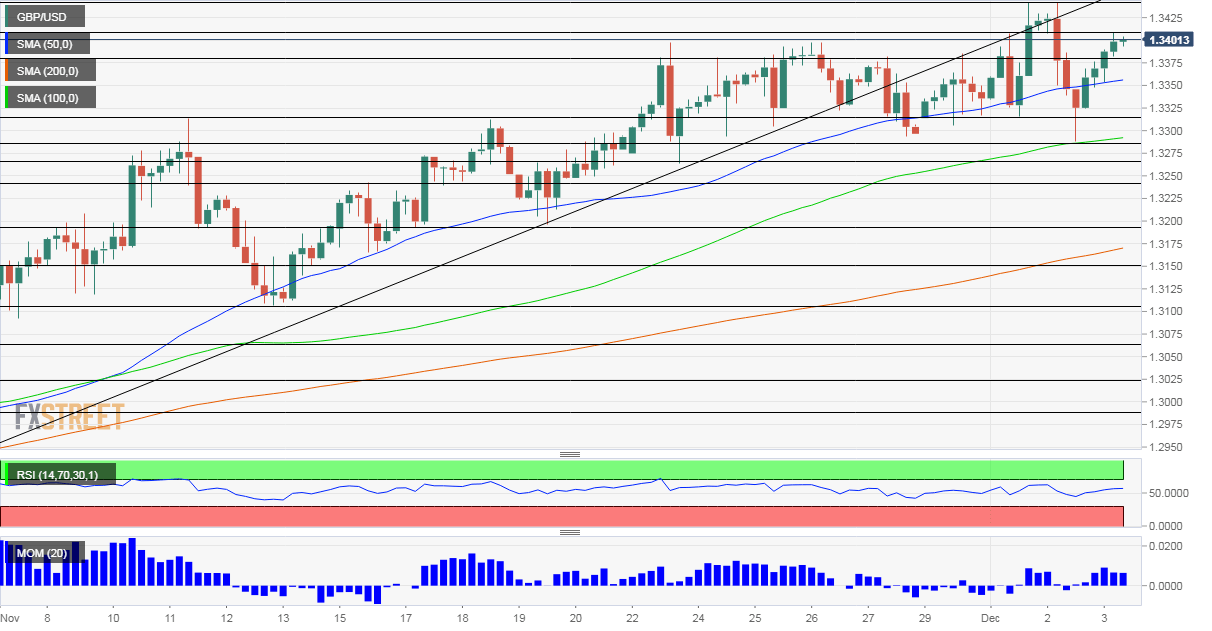

- Thursday’s four-hour chart is painting a bullish picture.

Nerves are wreaked, deal or no deal? Tensions around Brexit talks have been hitting new highs and that is reflected in the pound’s price. Every headline causes jitters ahead of official updates due on Thursday or on Friday.

The latest news pieces have been positive. Ireland’s Foreign Minister Simon Coveney said he believes a Brexit deal can be reached within the next few days. Reuters quotes unnamed EU diplomats that say a deal could come on Friday or over the weekend.

On the other hand, France is reportedly considering vetoing an agreement if it is dissatisfied, presumably on the politically sensitive fisheries issue. Paris is concerned that Michel Barnier, the Chief EU Negotiator – a French statesman – is ceding too much ground to the Brits. Governance and a level-playing field remain points of contention.

Any minor headline could cause jitters, while data coming directly from negotiators – via tweet or on-camera – will likely have a greater impact.

Other developments remain mostly upbeat. British health authorities are ramping preparations to inject the first COVID-19 vaccine on December 8. The Pfizer/BioNTech jabs require extremely cold temperatures and will initially be distributed in hospitals.

In addition to moving forward with vaccines, the UK continues bending the covid curve downwards. That cannot be said about the US, where hospitalizations have hit a record high above 100,000 and daily cases near 200,000 as regular reporting resumes after the Thanksgiving holiday.

The good news from America comes from Washington, where House Democrats have accepted the bipartisan offer by Senators for a $908 billion stimulus bill. While the sum is relatively modest, any deal in the lame-duck session would be a blessing for markets, which were pricing new relief only in 2021.

Two noteworthy data points are due out on Thursday. Weekly jobless claims are set to decline after two weeks of worrying increases. The ISM Services Purchasing Managers’ Index provides a snapshot of America’s largest sector and its employment component serves as a hint toward Friday’s Nonfarm Payrolls.

See:

- US Services PMI November Preview: Are initial claims the sign markets think?

- US Initial Jobless Claims Preview: What was old is new again

Markit’s final UK Services PMI for November beat expectations with 47.6, better than the original release of 45.8 points.

Overall, Brexit’s dominance has increased, and so has volatility.

GBP/USD Technical Analysis

Pound/dollar has managed to overcome the dip below the 50 Simple Moving Average on the four-hour chart and resume its gains, a bullish sign. Momentum remains positive and the Relative Strength Index is still well below 70, far from overbought territory.

All in all, bulls are in control.

Some resistance awaits at the daily high of 1.3415. It is followed by the recent peak of 1.3440. September’s high at 1.3495 – but if there is a Brexit deal, there is no reason why GBP/USD cannot surge beyond 1.35.

Some support awaits at 1.3380, a temporary cap. It if followed by 1.3315, a support line from early in the week, and by the swing low of 1.3285.

See Three reasons to expect a sustained Santa rally for sterling