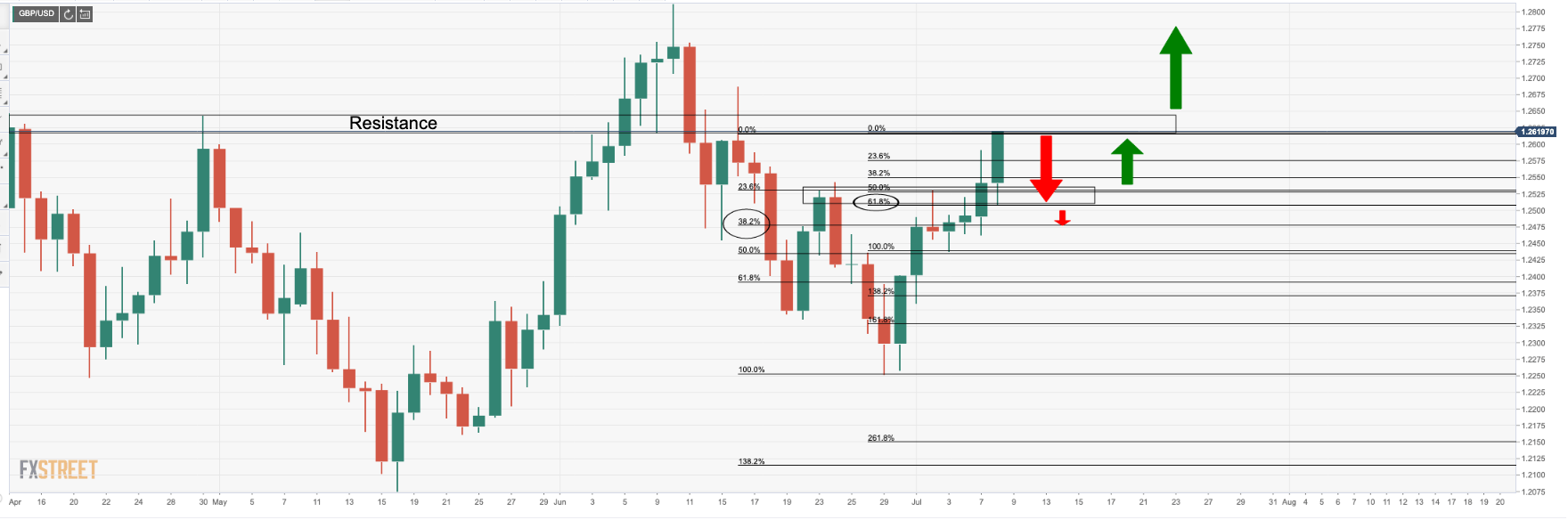

- GBP/USD bulls achieve upside targets above the 1.26 level.

- Much will now depend on the trajectory of the US dollar and Brexit negotiations.

GBP/USD is currently trading at 1.2612 having travelled between a low of 1.2508 and 1.2615 on the day so far.

As per yesterday’s Price analysis, GBP/USD bulls looking for a buy-in at a discount below a 31.8% Fib retracement, the bulls capitalised on a significant pullback within the prior impulse.

Earlier in the day, UK Chancellor Rishi Sunak announced a kickstart scheme to pay firms to hire young people and confirmed a new £2 billion green homes grant.

More on that here:

-

UK Chancellor Sunak: Economic measures announced total £30 billion

-

UK Chancellor Sunak: Confirms £2 billion green homes grant

There was some optimism over Brexit and a compromise deal, which was buoying the pound towards 1.2600. Nevertheless, no deal was forthcoming.

The latest is that the UK government is seeking to agree “special provisions” with Europe over the food supply to Northern Ireland from Great Britain.

The environment secretary is seeking to cut a deal limiting trade friction after the Brexit transition.

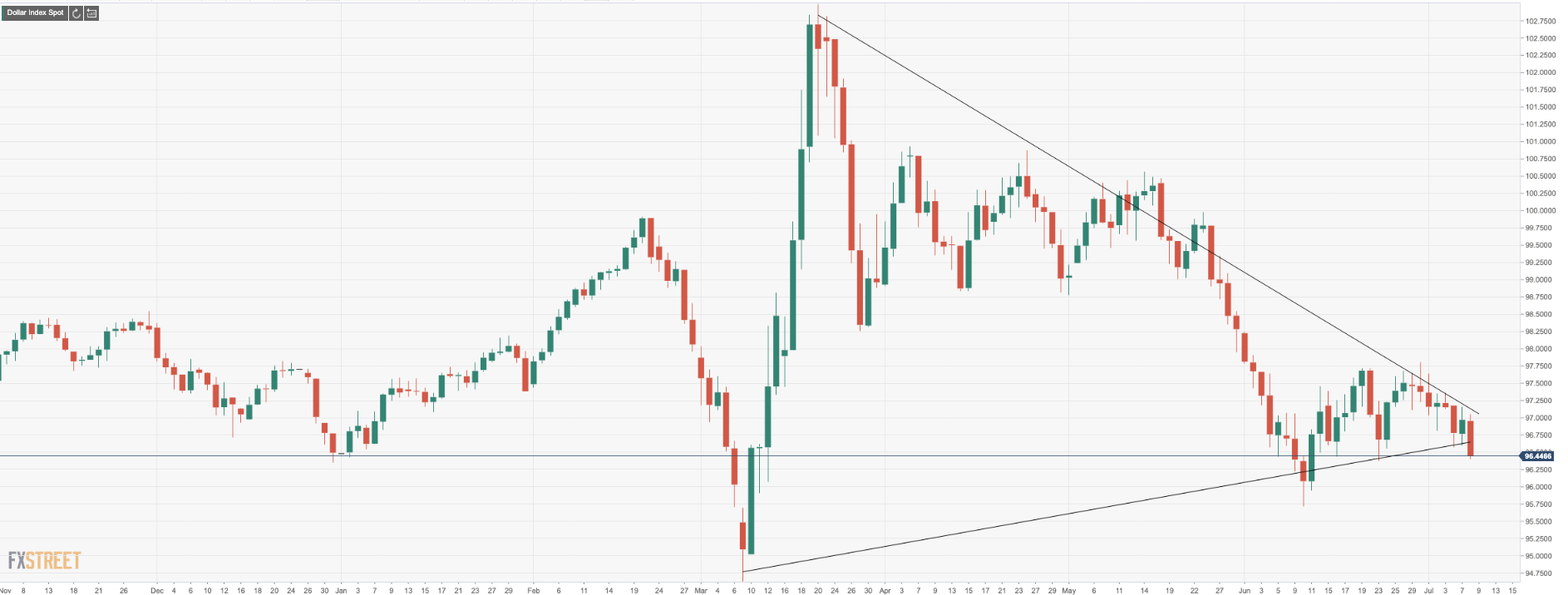

DXY under pressure

Meanwhile, the US dollar is under pressure as stocks bounce back into positive territory following yesterday’s slump on wall street and the start of Asia.

The index trades down over 0.5% at the time of writing, sliding from 97.05 to a low of 96.40.

The index is testing a support line of a symmetrical triangle at this juncture for a fourth daily encounter. The rule of three strikes and you’re out’, could playout here and propel G10 FX higher.

GBP/USD levels

GBP/USD has completed a key extension of 7th-8th July correction of the 7th July impulse at this juncture, an ask of 1.2620 round number will have been met on the scoreboard.

A period of consolidation is probable as the price moves into daily resistance.

While much will now depend on the DXY, the path of least resistance for the pound, is in fact, for a test of the 23rd June structure around a cent lower to 1.2516/40.

This will equate to a 61.8% Fibonacci retracement of the 3rd July rally which guards a 38.2% retracement of the 30th June rally.