- The GBP/USD remains in the red near a weekly low, weakening the recovery in early Asian trading.

- US President Biden bans flights from Moscow into US airspace, British Prime Minister Johnson supports Russia’s exclusion from SWIFT.

- Fed officials and Bank of England officials are giving mixed signals about the impact of Russia-Ukraine tensions on the next steps.

- Global markets remain sluggish, yields and stock futures offset recent losses, and the DXY remains firm.

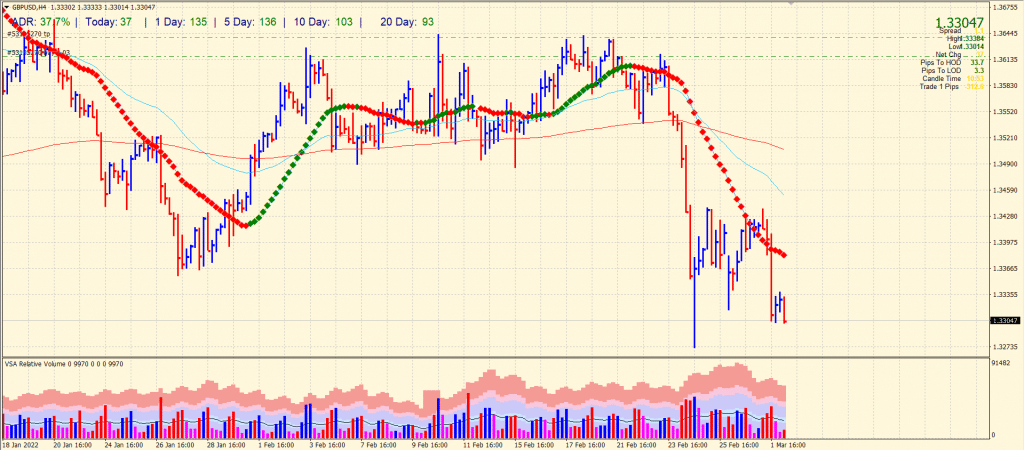

The GBP/USD price outlook remains strongly bearish as the risk-off sentiment amid Russia-Ukraine conflict weighs on the risk assets. As of early Wednesday morning in Europe, the GBP/USD currency pair is taking bids near 1.3310 as it declines for a second straight day. The cable pair is displaying mixed sentiment in the market and cautious optimism for important US data/events.

–Are you interested in learning more about managed forex accounts? Check our detailed guide-

The Russian-Ukrainian crisis has resulted in a total risk aversion over the last two days. It may have to do with President Biden’s mixed comments during his first State of the Union address (SOTU), as well as hope for a resolution of the Russian-Ukrainian crisis, as peace talks are not yet off the table.

As a result of Moscow’s invasion of Ukraine, US President Biden has banned Russian planes from entering US airspace. In addition, Biden emphasized self-reliance and the need to take systematic steps to fight inflation.

While Russia has delved into Kyiv and remains hopeful of reaching its goal, British Prime Minister Johnson said, “It is already clear that Putin will ultimately fail in Ukraine.” Johnson also declared that the government would exclude Russian banks from the SWIFT system and freeze their assets.

The recent Russian-Ukrainian crisis has already led to concern that the recovery of the global economy from the pandemic will be slowed, which in turn raises questions about the actions of central bankers. However, even as money markets dampen hopes of faster tightening, recent comments from the US Federal Reserve (Fed) and Bank of England (BOE) have yet to confirm this.

British farmers are not happy about a trade deal signed after Brexit between the UK and New Zealand worth £800million.

GBP/USD traders will keep a close eye on the Russian-Ukrainian news for fresh impetus. In addition, the US employment data from ADP for February and Jerome Powell’s biennial statement from the Fed are also noteworthy.

GBP/USD price technical outlook: Bearish pressure mounting up

The GBP/USD price is attacking the 1.3300 level. The bears are eying a test of swing lows around 1.3260. If negativity prevails, we may see the price hit 1.3200 as well. The only protection at the downside is the low of the widespread up bar.

–Are you interested in learning more about crypto brokers? Check our detailed guide-

The volume data remains supportive of further downside. However, profit-taking may provide an opportunity for upside correction after a dip. So, the pair is likely to test 1.3350 ahead of the 1.3400 area.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money