- A slight gain in the GBP/USD currency pair reclaims its largest one-day loss since March 2020.

- It fueled stagflation fears by raising rates by 25 basis points and raising inflation forecasts to double digits.

- While the dollar is gaining momentum, there are doubts that the Fed will announce a 50bps rate hike soon, which adds to the importance of US jobs data.

The GBP/USD outlook remains negative. However, the bears have paused for now as the US NFP is due on the day that may impact the market.

The GBP/USD pair paused for breath around 1.2350 after hitting a 2-year low. Cable’s recent moves may have been motivated by fears about the US jobs report. However, while inflation concerns and Brexit headlines are widespread, the bears remain in control.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

In Northern Ireland (NI), the Democratic Unionist Party (DUP) election campaign has raised Brexit fears as Sinn Féin, a member of the Irish Republican Party, is known for aligning Ireland with the EU. A recent claim that Brexit has raised British chicken prices and Spain’s tough stance on British immigrants is also related.

Brexit is less important than that GBP/USD bears are fueling inflationary fears and worries that the UK economy may suffer from a recession in the next few years, largely driven by the double-digit CPI. Yesterday, the Bank of England (BOE) hiked interest rates by 25 basis points (bp) as anticipated, but the outlook for the economy sparked widespread pessimism.

Furthermore, it helped the US dollar regain bullish momentum as US dollar bulls challenged the Fed’s expectations for lower inflation and employment. In light of this, it will be important to monitor today’s US Nonfarm Payroll (NFP), which is expected to decline to 391k from 431k. Additionally, the unemployment rate in the US will likely decline from 3.6% in April to 3.5% in May.

Further, GBP/USD traders should monitor Brexit-related headlines and comments from various central bank officials during the US session.

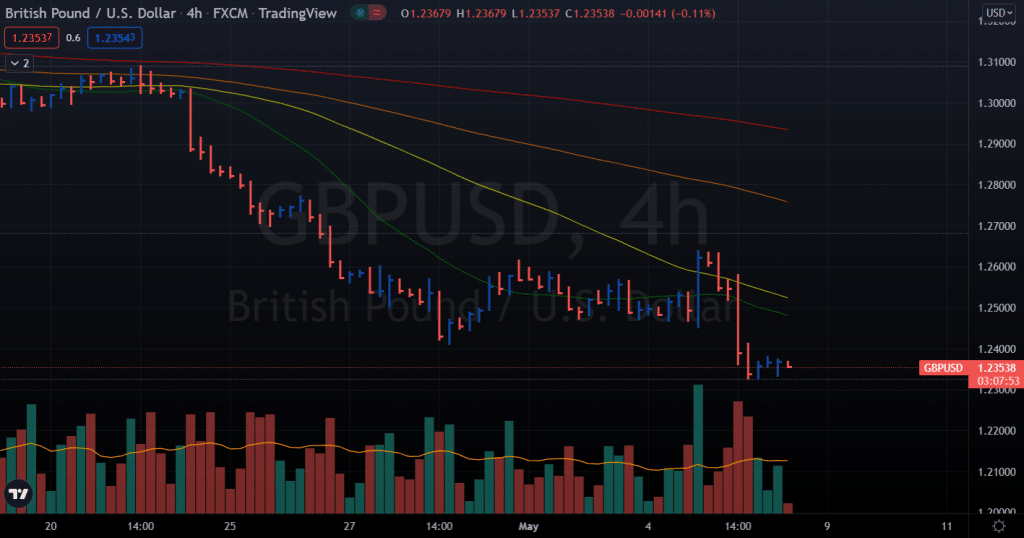

GBP/USD price technical outlook: 1.2000 in sight

The GBP/USD price remains well below the 20-period and 50-period SMAs on the 4-hour chart. The price broke the previous multi-month lows of 1.2412 and posted fresh lows above the 1.2300 mark. The outlook remains strongly bearish. However, the pair is extremely oversold as well. Hence, a minor upside correction can be expected.

–Are you interested in learning more about Australian brokers? Check our detailed guide-

The volume data is strongly in favor of the sellers. As a result, the price has the potential to fall towards the 1.2000 area.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money