- GBP/USD fell on fresh dollar selling on Thursday.

- Thanks to more aggressive Fed rate hikes and rising US bond yields, dollar losses should be limited.

- Before the speeches by the Bank of England Governor Bailey and Fed Chair Powell, investors appeared cautious.

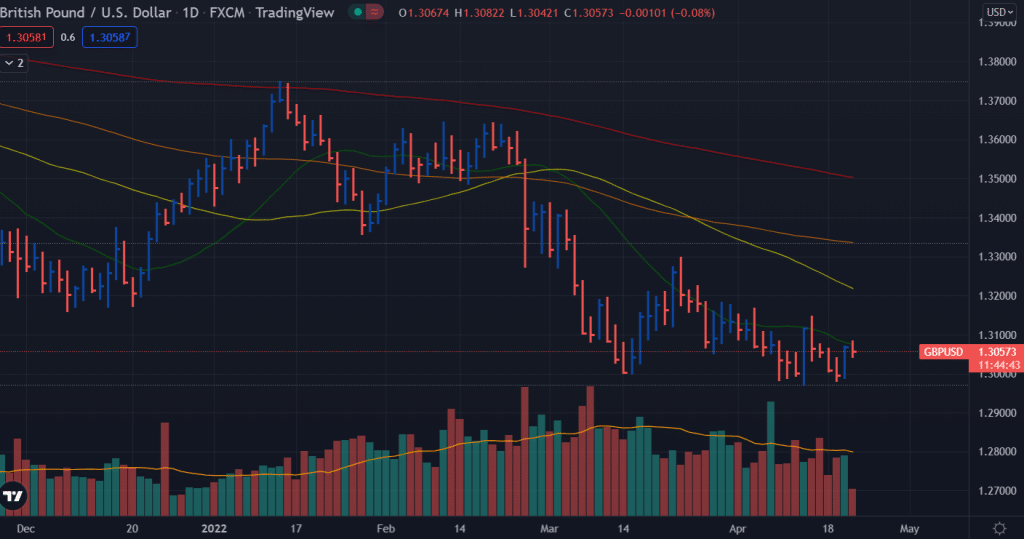

The GBP/USD outlook seems slightly positive as the price attempts an upside recovery, pushing beyond the 1.3050 mark as the USD retreats.

During the London session, the GBP/USD pair hit a weekly high of 1.3080-1.3085 but soon fell back a few pips. The pair was last trading around 1.3060 area, near yesterday’s close.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

The US dollar continued its steep decline from its highest level since March 2020 on Wednesday, posting its second straight day of steep declines. Positive equity market sentiment has undermined the safe-haven dollar, which has led to some buying around the 1.3040 area in the GBP/USD pair.

Taking advantage of dovish Fed expectations, US Treasury yields should rise modestly, helping to boost the dollar. The GBP/USD pair also requires caution before aggressive bullish bets.

Fed’s rate hike bets

Markets are convinced that the Fed will tighten faster to curb rising inflation, so rates have been raised by 50 basis points. As a result of comments made by a few influential FOMC members earlier this week, the stakes have risen. Therefore, the focus will remain on Fed Chair Jerome Powell’s speech later in the US session.

What’s next to watch for the GBP/USD outlook?

Market participants will also pay attention to BoE Governor Andrew Bailey’s speech at the Washington, DC event without market-critical economic reports from the UK. In addition, the US economic report includes the release of the Manufacturing Index from the Federal Reserve Bank of Philadelphia later in the morning North American session.

GBP/USD technical outlook: Bulls folding sleeves

The GBP/USD has formed a W pattern around the bottom of the 1.3000 level. The pair seems positive to gain further. However, the daily chart shows a strong hurdle of 20-day SMA to counter the upside move. Since 24th Feb, the pair has only once closed above the 20-day SMA. If the pair successfully breaks above the mark, we can anticipate the beginning of the fresh recovery that may lead to testing the double top at 1.3223.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

On the flip side, the pair may not be able to post a meaningful recovery amid a firm USD. So, the pair is likely to find a stiff hurdle at previous swing highs of 1.3150 and fall towards the 1.3000 area. However, the probability of this scenario is low.

The volume data shows signs of bullish reversal. However, the signs are not too obvious and need confirmation.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money