- GBP/USD remains on the backfoot just above 1.3600.

- Positive development on UK-France fisheries conflict may help the sterling bulls.

- UK PMI came better than expected, but the pair didn’t show any reaction.

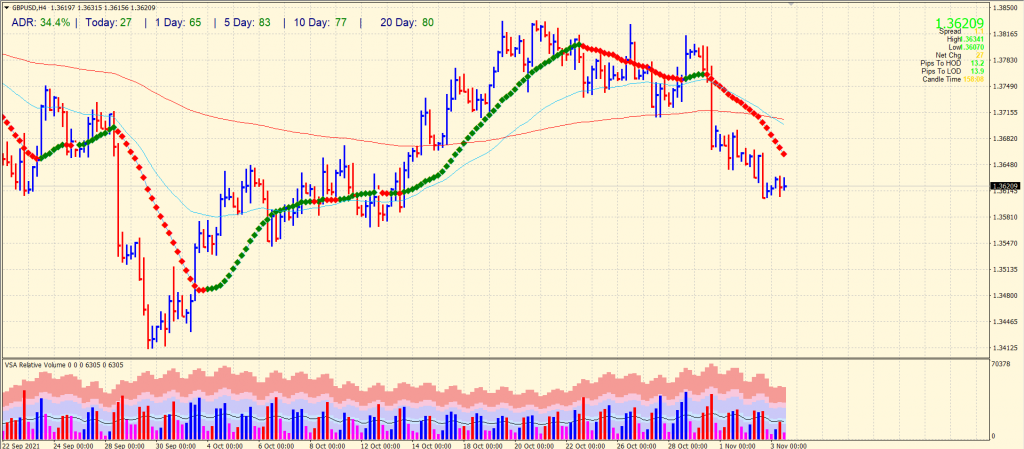

The GBP/USD outlook remains negative ahead of key data releases. The price seems rangebound and may break the lower range. The GBP/USD price traded near the daily highs in the 1.3625-30 range during the first half of the European session.

-If you are interested in forex day trading then have a read of our guide to getting started-

On Wednesday, the pair managed to hold the round 1.3600 and increase slightly from three-week lows, maintaining a losing streak for three straight days. The anticipation of an interest rate hike by the Bank of England by the end of this year proved to be a key factor in driving the pound sterling upwards. In addition, suppressed demand for the US dollar pushed the GBP/USD pair slightly despite the bullish belief in an uptrend.

In addition to the Brexit stalemate and fears that British Prime Minister Boris Johnson would lead Article 16 police to make aggressive bets after Brexit, there are ongoing negotiations over Northern Ireland. In the context of a post-Brexit fisheries rights dispute, this overshadowed the positive announcement by France that it would delay imposing sanctions on UK trade. After the UK services PMI was revised from 58.0 to 59.1 in October, the GBP/USD pair practically did not react to it.

In the weeks leading up to key central bank meetings, investors resisted sitting on the sidelines. As a result, a monetary policy announcement is expected later in the US session, along with a reduction in the Fed’s $120 billion monthly asset purchase program. In the post-meeting press conference, Fed Chairman Powell will make further comments regarding the accompanying policy statement.

Investors will likely look for clues as to when the US Federal Reserve will raise interest rates, which in turn will influence the US dollar. Nonetheless, the Bank of England’s monetary policy meeting on Thursday should aid investors in determining the short-term direction of the GBP/USD pair. In addition, ADP and ISM Services PMI data on Wednesday may give the GBP/USD pair some trading momentum.

-Are you looking for automated trading? Check our detailed guide-

GBP/USD price technical outlook: Bears remain in charge

The GBP/USD price found some respite near the round number (1.3600) and gained around 25 pips on the day. However, the outlook is still not positive, and bears are holding firm. The price consolidates while the average daily range is still 34% which indicates low volatility as market participants await some catalysts. The volume data is still bearish bias.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.