- Markets have set an 80% probability of a 50 basis point BoE increase.

- The Sterling has increased 2.4% this month vs. the dollar.

- Sunak stated that Britain shouldn’t raise taxes any further.

Today’s GBP/USD outlook is bearish. Tuesday saw a decline in the value of the pound relative to the greenback ahead of this week’s central bank meetings, notably the Bank of England’s, which is anticipated to raise interest rates for the tenth time in a row.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

According to Simon Harvey, head of FX Analysis at Monex, the pound’s performance has been mostly uneventful, but that doesn’t necessarily indicate how the currency will trade this week.

In addition to dealing with interest rate decisions from important central banks, such as the BoE, GBP traders will also have to deal with a turbulent cross-asset risk environment as markets prepare to hear the first official assessment of how China’s reopening is progressing, the analyst said.

Markets have set an 80% probability of a 50 basis point BoE increase.

The pound has increased 2.4% this month vs. the dollar after seeing its largest yearly decline since the 2016 Brexit referendum last year.

When asked about the firing of Conservative Party head Nadhim Zahawi on Monday, British Prime Minister Rishi Sunak pledged to do whatever steps are necessary to “establish integrity” following a chaotic 2022 that saw three different British prime ministers.

Investigation revealed Zahawi violated the law by keeping a tax investigation a secret, which is the most recent controversy to affect one of Sunak’s top ministers.

In response to a query regarding the salaries in the public sector, Sunak also stated that Britain shouldn’t raise taxes any further.

GBP/USD key events today:

Investors are expecting the CB consumer confidence report for January, which will show the level of consumer confidence in economic activity in the US.

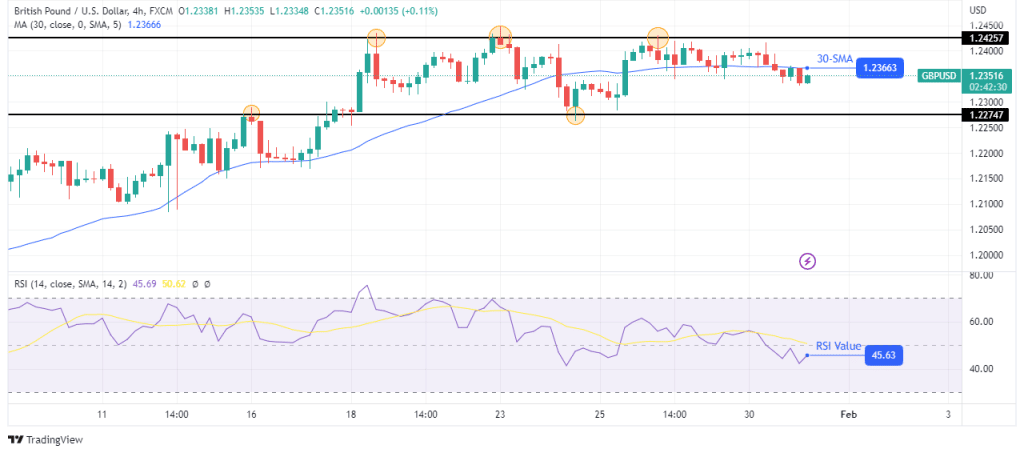

GBP/USD technical outlook: Bears may retest the 1.2274 support

The 4-hour chart shows GBP/USD trading below the 30-SMA. This comes after a tight consolidation between the 1.2425 resistance and the 30-SMA. The bears have finally managed to break below the 30-SMA.

–Are you interested to learn more about forex signals? Check our detailed guide-

The next target for this bearish move will be at the 1.2274 support level. At this point, bears will likely try to break below. A trend reversal will be confirmed if they succeed.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.