- GBP/USD price tumbles to 1.3500 area as USD soars.

- Risk-off flows to Greenback amid Evergrande and the energy crisis keep the risk assets at stake.

- Market participants await speeches from BoE and Fed to find further fresh impetus.

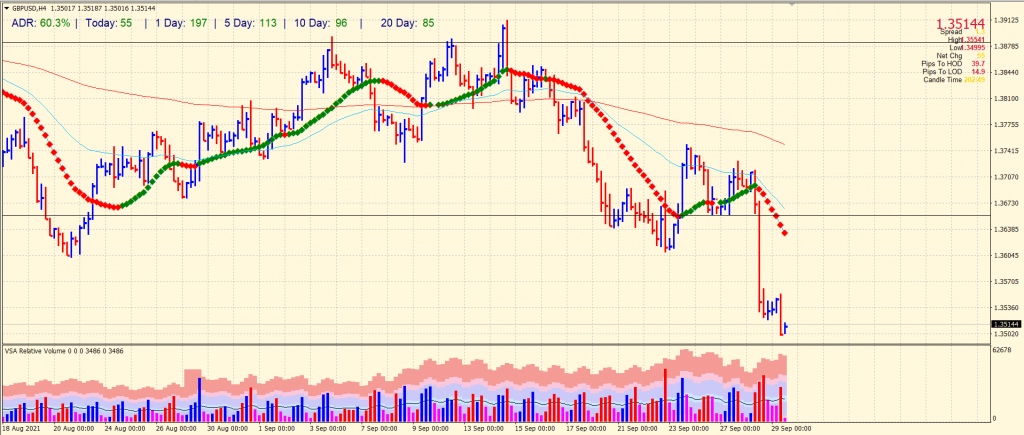

The GBP/USD price outlook remains bearish after falling the previous day. In response to renewed dollar strength and UK factors holding back the pound, the pair fell below the 1.3600 mark for the first time since July. At the time of writing, GBP/USD is trading at 1.3514, down 0.13% for the day.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

The risk of China defaulting on Evergrande and growing concerns about the pace of the global economic recovery has caused investors to abandon risky assets. As a result, the Nasdaq has lost over 2% and the Dow Jones over 570 points since March.

In reaction to Evergrande Group’s announcement that it would acquire a stake in Shengjing Bank Ltd. for $ 1.5 billion, risk sentiment eased slightly. The S&P 500 futures are trading at 4,365.50, up 0.51%.

Additionally, the pound sterling is struggling with many of its internal factors, such as the rise in gas prices and gas stations. Moreover, rising gasoline and fuel costs are fueling inflation concerns and economic growth concerns.

As the dollar index (DXY), which measures the dollar’s performance against its six major competitors, fell just below 93.70, it struggled to hold on to its gains from earlier in the day. Following the rise in US Treasury yields earlier in the day, the dollar rose to its highest level in more than a decade. The yield on the US 10-year Treasury rose to 1.54% and was driven by the Fed’s aggressive stance.

Senator Joe Biden’s offer to avoid a potentially dangerous default on US loans was blocked by Senate Republicans, limiting the dollar’s gains.

James Brian Bullard, the president of St. Louis, predicted that the US gross domestic product will grow by 5.8% in 2021.

To gauge market sentiment, traders are awaiting consumer credit data release from the Bank of England (BOE) and speeches by US and UK central bank officials.

GBP/USD price technical outlook: Buyers capped by 1.3550

The GBP/USD price seeks interim support at the 1.3500 level. However, the support is too feeble to hold, and the price may plunge to 1.3450 ahead of 1.3400. The pair has covered 60% average daily range so far, which shows that the bears may pounce on the 1.3500 level.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

The bulls may attempt a rally, but the buyers may remain capped by the key 1.3550 resistance as the price got rejected twice from here. If the buyers come over the level, we may see a surge towards the 1.3700 level. The key SMAs are all pointing for more losses.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.