- Unemployment in the UK dropped to 3.5% in August.

- The BoE is concerned the shrinking labor market will push up inflation.

- Investors are anxiously selling off UK government bonds.

Today’s GBP/USD outlook is bearish as panic returns to the UK markets. British Finance Minister Kwasi Kwarteng, whose unfunded tax cuts sent the bond market into a panic, tried to calm investors by pushing out the budget announcement and appointing a Treasury insider to head the department.

-If you are interested in forex day trading then have a read of our guide to getting started-

The Bank of England promised additional support for the shaky market. Still, a selloff of British government debt accelerated once more due to concerns over the size of borrowing that Kwarteng and Prime Minister Liz Truss wanted to undertake. Many investors believe that to offset the inflationary effects of Kwarteng’s tax cuts. The BoE could boost rates by one full percentage point.

In the three months ending in August, Britain’s unemployment rate dropped to 3.5%, the lowest level since 1974. However, the decline was caused by a record-high increase in the number of people quitting the labor force, which caused the Bank of England further problems.

The BoE is concerned that Britain’s shrinking labor market could increase inflation pressures, even as it works to quell the financial market turmoil brought on by the incoming Prime Minister Liz Truss’s economic plan.

In June through August, there was a 109,000 decrease in the number of individuals with jobs, which was fewer than the median estimate of 155,000 in the Reuters poll.

GBP/USD key events today

Andrew Bailey, governor of the Bank of England (BOE), will talk. Bailey has the most impact on the pound’s value because he is the head of the BOE’s Monetary Policy Committee (MPC), which manages short-term interest rates.

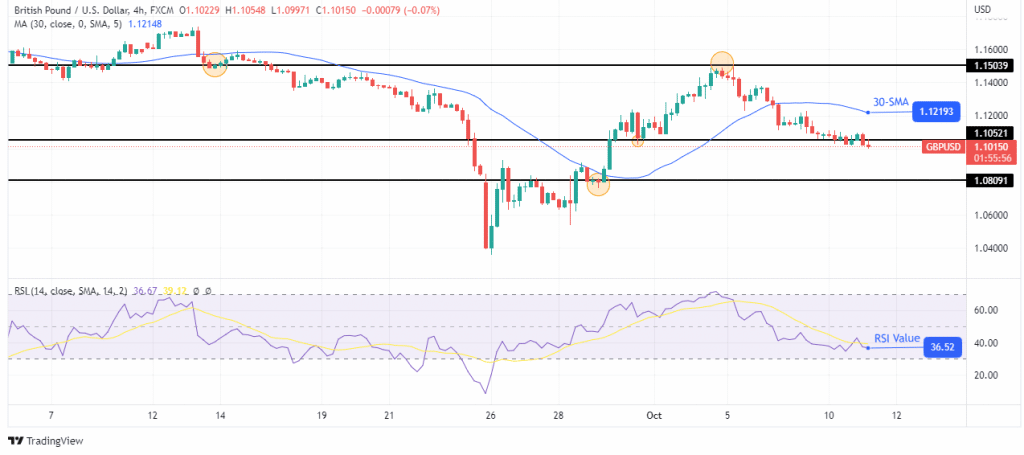

GBP/USD technical outlook: More bearish momentum needed to break 1.0809

Looking at the 4-hour chart, we see the price trading below the 30-SMA and the RSI below 50. This is a sign that bears are in charge. However, a closer look at the move down will show some weakness as the price is making small-bodied candles.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

This is a sign that bears are resting. At this point, bears need more momentum to push beyond this consolidation and head for support at 1.0809. The price might, however, retest the 30-SMA as resistance before falling further.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.