- GBP/USD remains supported despite the upbeat US retails number.

- The pair is under pressure amid rising cases of coronavirus.

- Some hawkish comments from BOE are lending support.

The GBP/USD outlook is depressed towards 1.38 but holding above the level despite US retail sales beating the estimates and supporting the Dollar. Hawkish BOE comments support the British Pound ahead of the British reopening on Monday.

-If you are interested in forex day trading then have a read of our guide to getting started-

The GBP/USD pair remained stable near the 1.3815-20 region and was rather subdued by the positive monthly US retail numbers.

After showing some resistance below the 1.3800 level, the GBP/USD pair achieved positive traction in the first half of the European session despite struggling to take advantage of the traction. The worsening COVID-19 situation in the UK acted as a headwind for the British Pound and limited profits for the major.

The optics ran out of breath pretty quickly and found something new being offered near the 1.3860 region. However, a subdued pull in the US Dollar has added support for the GBP/USD pair. USD bulls withdrew from a sharp rise in US government bond yields and did not appear to be impressed by more robust US macro data.

The US Census Bureau reported that the total value of retail sales rose 0.6% in June, beating consensus estimates indicating a 0.4% decline. Apart from cars, core sales exceeded expectations and increased by 1.3% MoM for the month, although it did not help the Greenback.

A downgrade from last month’s already weaker levels seemed to be the only factor preventing USD bulls from placing bets. However, the data should strengthen market expectations that the Fed will tighten monetary policy more quickly. This can help the USD to attract buying and put pressure on the GBP/USD pair.

The proliferation of the Delta variant led to over 48,000 confirmed cases in the UK on Thursday, days before the Great Freedom Day reopened on 19 July. Hospital stays and deaths are also rising, escalating concerns about a financial downturn due to quarantines.

A slowdown could cause even restrictive members of the Bank of England to reconsider their position. Michael Saunders was the youngest BOE official to suggest the bank end its bond-buying program that temporarily raised the Pound Sterling on Thursday. All deaf comments can weigh a pound.

The virus is also moving rapidly in the United States, leading to an increase in almost every state. However, the US caseload is rising from low levels, which could positively impact the Dollar as a safe haven currency.

-Are you looking for automated trading? Check our detailed guide-

Concerns about rising prices are also contributing to damp sentiment and a rush towards the Greenback. Federal Reserve Chairman Jerome Powell said inflation was “uncomfortably high” but added that the situation for reopening the economy was unique. Uncertainty clouds are dollar-positive.

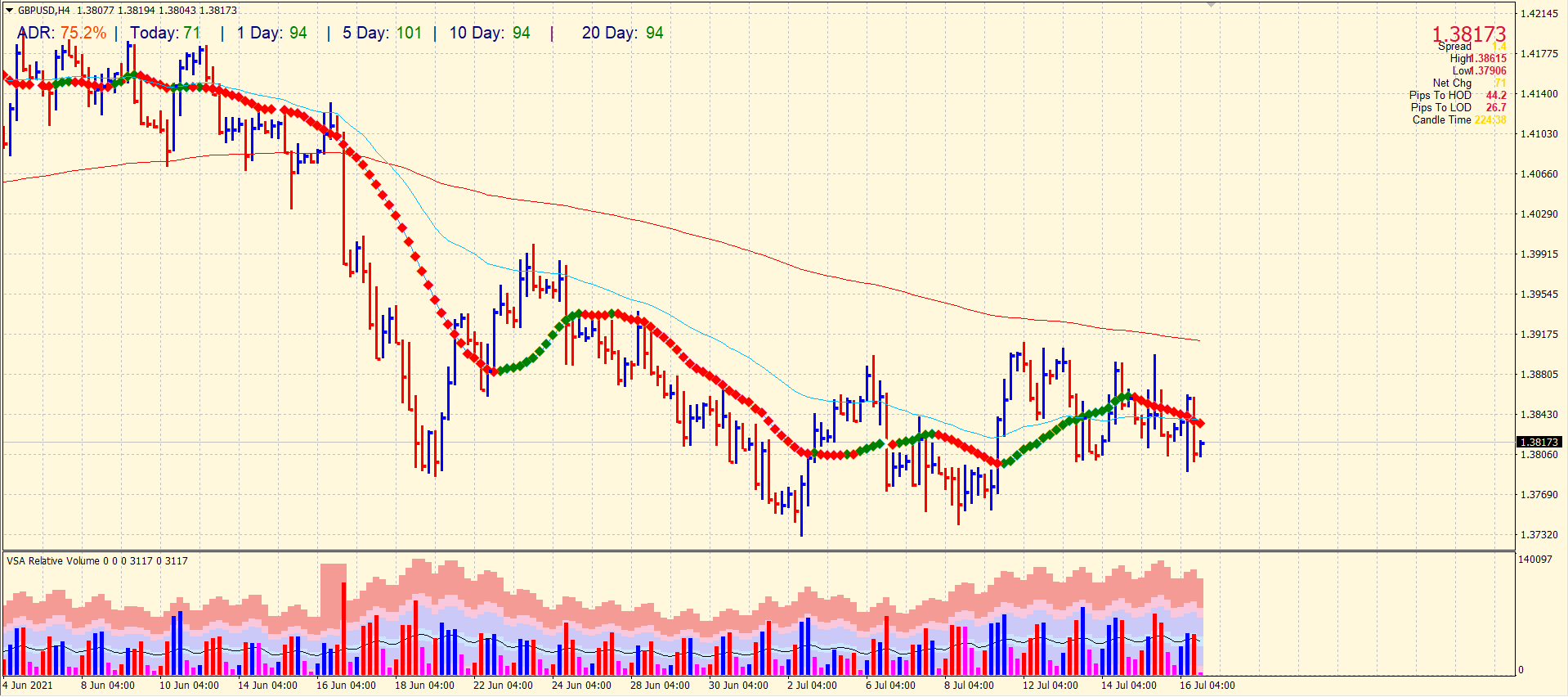

GBP/USD technical outlook:

The GBP/USD is suffering from the weakened momentum on the 4-hour chart but is still struggling with the simple moving averages of 50 and 200, creating a mixed picture if the range continues.

Support is waiting for 1.3791 daily lows followed by 1.3750 last week’s buffer and then 1.3730.

Some resistance is at the daily high of 1.3860 followed by 1.3910 which has been holding GBP/USD down for the last few days. Further up resistance levels are 1.3935 and 1.4000.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.