- Britain’s unemployment rate remained at 3.7%.

- The pound rose 1% against the dollar after the collapse of SVB.

- Investors increased their bets on the probability that the BoE will hold rates in March.

Today’s GBP/USD outlook is bullish. On Tuesday, the Office for National Statistics reported that Britain’s unemployment rate remained at 3.7% in the three months leading up to January, less than the 3.8% anticipated.

–Are you interested in learning more about making money with forex? Check our detailed guide-

According to official data released on Tuesday, basic pay growth in Britain, which the Bank of England is closely monitoring as it considers when to pause its recent interest rate hikes, slowed down in the three months leading up to January.

The sudden failure of Silicon Valley Bank (SVB), a US lender focused on technology, increased hopes that the Federal Reserve may limit the rate at which it raises interest rates.

The biggest bank failure since the 2008 financial crisis rocked markets and made the US dollar less valuable than other major currencies. Investors began to factor in the prospect that the Fed may adopt a less aggressive course for tightening monetary policy.

On Monday, HSBC paid a symbolic one pound to acquire SVB’s UK division in Britain. UK Finance Minister Jeremy Hunt said the rescue was required to help save some of Britain’s most significant technology firms.

After assisting in finding a buyer for the British division of SVB, the Bank of England declared on Monday that the country’s banking system was stable.

Additionally, after SVB’s failure, investors increased their bets on the probability that the BoE will end its recent trend of raising interest rates at its March meeting next week.

GBP/USD key events today

Investors are expecting employment data from the UK. There will also be inflation figures from the US that might affect the Fed’s next policy move.

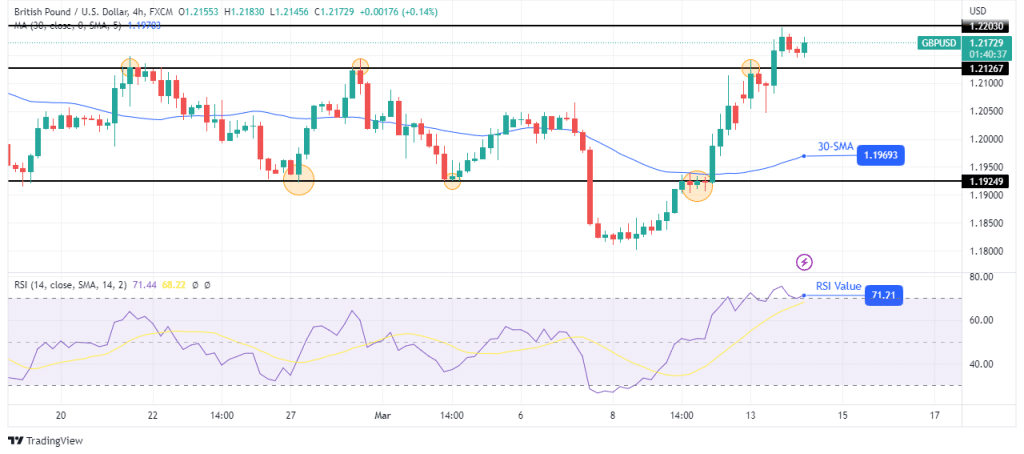

GBP/USD technical outlook: Bulls look to the 1.2203 resistance

The 4-hour chart shows GBP/USD in a steep bullish move, with the price trading far above the 30-SMA with the RSI in the overbought region. Bulls took over when the price broke above the 1.1924 key level and the 30-SMA. It then went on higher to break above the 1.2126 resistance level.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

Bulls have now paused near the 1.2203 resistance level, and the price might pull back to retest the 1.2126 level. However, the bullish move will likely continue as there is strong bullish momentum.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money