- UK unemployment fell to 3.6%.

- The economic inactivity rate in the UK went up to 21.7%.

- UK inflation is expected to hit 10.2%.

Today’s GBP/USD outlook is bullish as the unemployment rate in Britain is at its lowest level since 1974 at 3.6%. The unemployment rate was expected to stay at 3.8%.

-If you are interested in knowing about ETF brokers, then read our guidelines to get started-

According to the Office for National Statistics, 40,000 more people found work between May and July, which is less than one-third of the gain predicted.

The percentage of the population that is neither working nor looking for work, or the economic inactivity rate, climbed by 0.4 percentage points from the previous quarter to 21.7%, its highest level since the three months before January 2017.

The BoE is concerned about this increasing inactivity because it could contribute to inflation pressures as there won’t be enough people to fill open positions. Data released on Wednesday is expected to reveal that the British consumer price index increased by 10.2% in the year that ended in August.

GBP/USD key events today

Andrew Bailey, governor of the Bank of England, will talk. Bailey has more influence over the pound’s value than any other person because he is the head of the BOE’s Monetary Policy Committee, which regulates short-term interest rates.

Investors will also pay attention to the US inflation data expected later today that will influence bets on the next Fed rate hike.

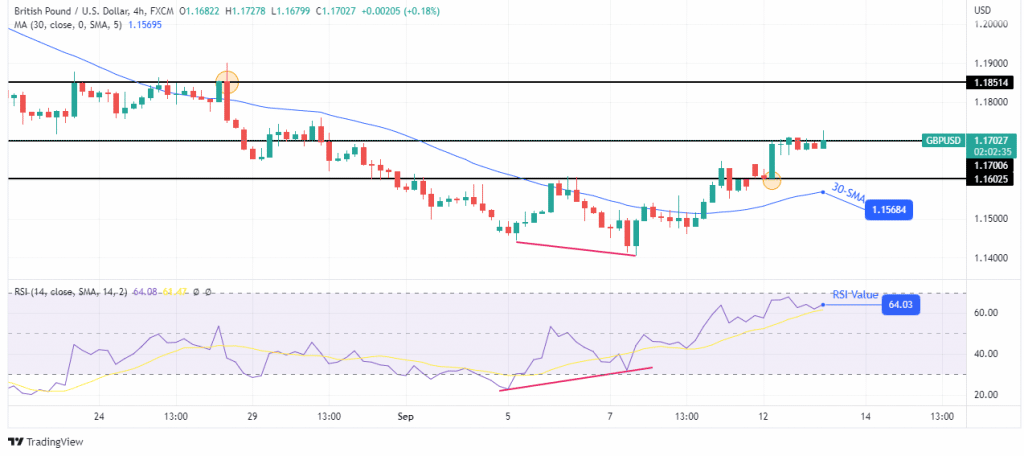

GBP/USD technical outlook: Bulls to retain control above the 1.17006 resistance level

The 4-hour chart shows the price trading above the 30-SMA and the RSI above 50. These are all signs that bulls are ahead and the trend has turned bullish. This move follows a bullish divergence in the RSI that showed weakness in the bearish trend. Buyers swiftly took over, pushing the price back above the 30-SMA.

-Are you looking for high leveraged forex brokers? Take a look at our detailed guideline to get started-

The break above the SMA was the first confirmation of the shift in sentiment. The second confirmation was the break above the previous high at 1.16025. It indicated the price was making a higher high followed by a higher low.

The price has paused at 1.17006, a strong psychological resistance. However, buyers are strong and will likely break above this level. A break above could see the price getting to 1.18514, the next key resistance level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.