- US weekly jobless claims went up marginally.

- Britain had the largest house price decline in November since the beginning of the COVID-19 pandemic.

- Quarterly predictions suggest the GDP fell 0.2% last quarter and will shrink by 0.4% in this one.

Today’s GBP/USD outlook is bullish. The US dollar fell 0.2% against a basket of major currencies on Friday, including the pound.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

Investors are concentrating on US producer price inflation estimates later in the day for fresh signals about the strength of the US economy, following data overnight showing some relaxation in the labor market, with weekly jobless claims climbing marginally.

Although certainly slower than desired, the Federal Reserve is obtaining what it wants. According to US government data issued on Thursday, the number of Americans getting unemployment benefits increased to about 1.7 million last week, excluding those filing their first claim. Since early February, that figure represented the greatest number of so-called ongoing unemployment claims.

This is awful for the claimants, but it’s good for the economy since it signals that labor demand is finally slowing down. Fed policymakers have been waiting for the US hiring rush to ease, as that’s expected to make wages expand more slowly and cut overall inflation.

The Royal Institution of Chartered Surveyors reported that Britain had the largest house price declines since the beginning of the COVID-19 pandemic in November.

Quarterly predictions suggest the GDP fell 0.2% last quarter and will shrink by 0.4% in this one, fitting the precise description of a recession.

GBP/USD key events today

Investors will pay attention to the producer price index report from the US, which will give more insight into the state of inflation.

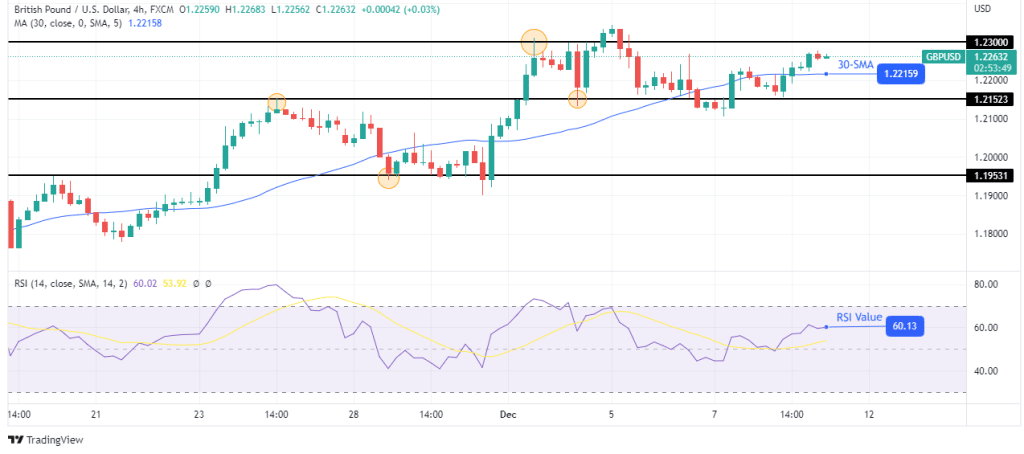

GBP/USD technical outlook: Bulls heading straight for the 1.2300 resistance

Looking at the chart above, we see the price trading above the 30-SMA, indicating that the current move is bullish. The RSI is trading above 50, pointing to strong bullish momentum. The price oscillates between the 1.2152 support and the 1.2300 resistance levels.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

Currently, bulls are pushing for a retest of the resistance level. Bears will come in if the level holds strong, and the price will likely fall to the support. However, if bulls can maintain their strength, the price will break above the resistance and solidify the bullish trend.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.