- GBP/USD drops hard on the back on the market’s reaction to Fed’s Powell sticking to the script.

- Bears seeking a break of critical support on a daily time frame.

The US dollar is on the rise as US rates continue to move higher after the Federal Reserve chair, Jerome Powell declines to jawbone or pushback on the recent moves in the bond markets.

“We monitor a broad range of financial conditions and we think that we are a long way from our goals,” he said.

“I would be concerned by disorderly conditions in markets or persistent tightening in financial conditions that threaten the achievement of our goals.”

This is not what the market wanted to hear and Treasury yields are spiking with the 10-year yield well above 1.50%, advancing to a high of 1.5470%.

The bond market is spooked, so too are US stocks as uncertainty prevails and the markets price up the risk of higher than tolerable inflation.

The dollar remains firm as risk appetite takes a hit

DXY took out last week’s high near 91.394 and is on track to test the February 5 high near 91.602. A break above that would open risk towards the November 23 high near 92.80 and weigh heavily on the pound.

GBP/USD technical analysis

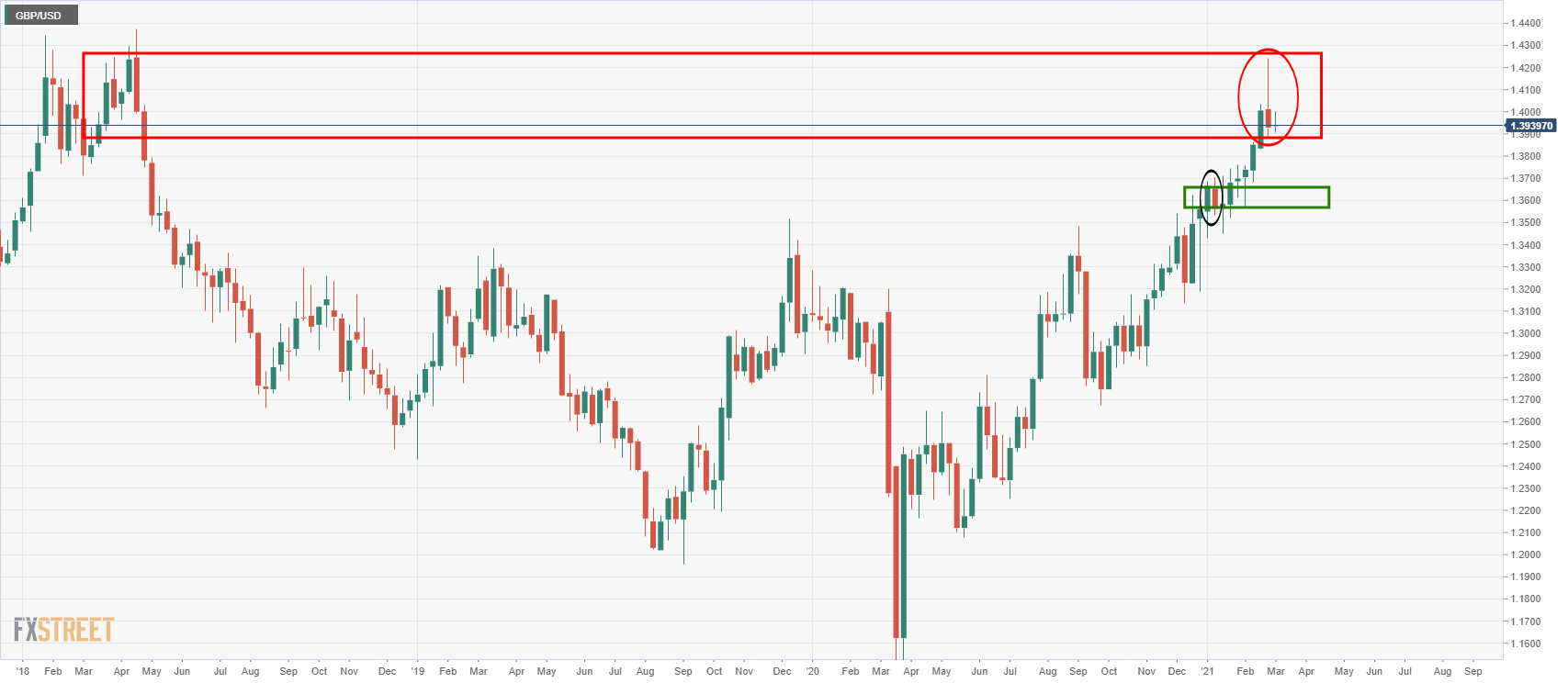

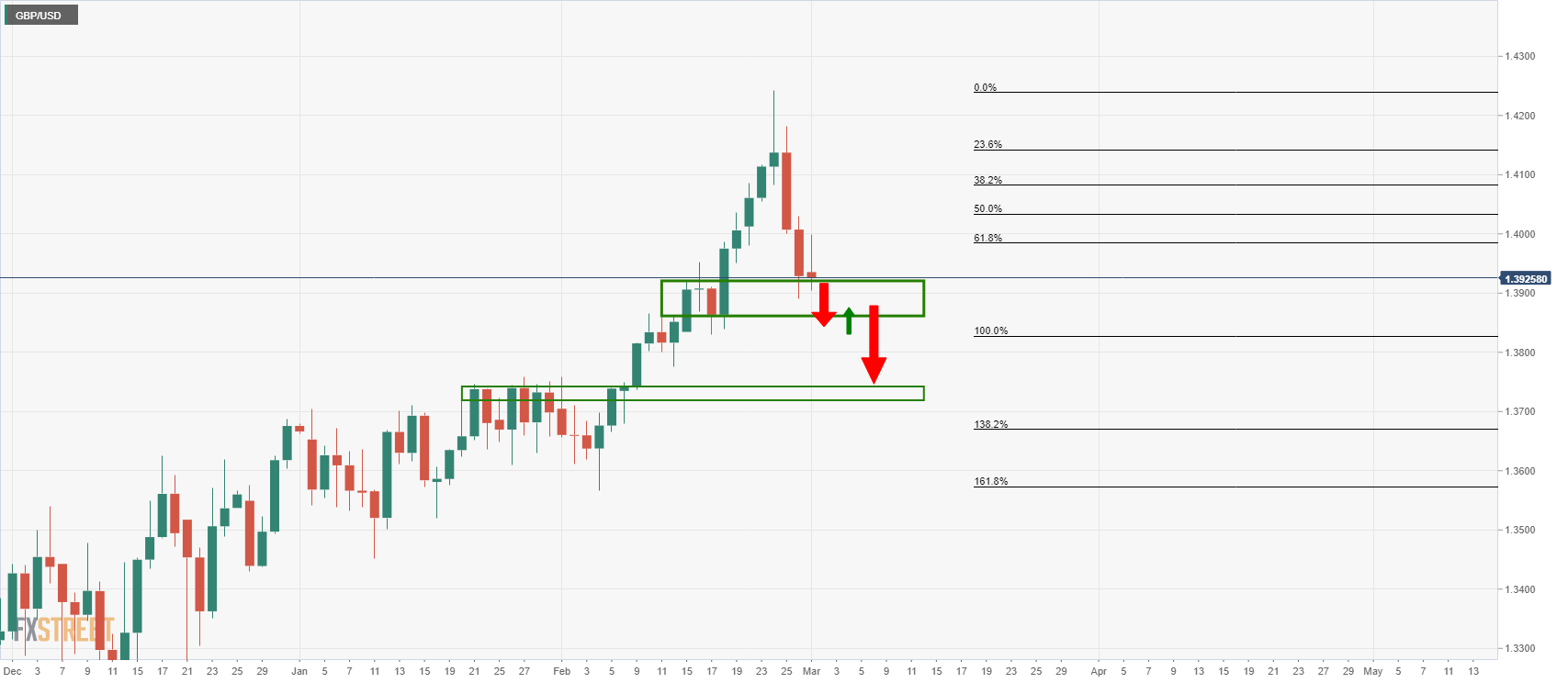

The price has been moving sideways this week following the weekly bearish wick, as note din prior analysis, GBP/USD Price Analysis: GBP weaker across the board, focus on downside:

It was explained in the analysis that ”the price has met the 78.6% Fibonacci of the last leg of the 5-wave bull trend. This is a firm area of support and until it is broken, there is still the possibility of an upside continuation, if not a period of sideways consolidation. ”

We are seeing just that, consolidation.

However, it was explained that ”a break of support will open up prospects of a run back to test old weekly resistance that has a confluence with the 61.8% Fibonacci retracement and the 10-week EMA at 1.3745.”