- GBP/USD looks to recapture 1.40 amid firmer risk tone, weaker DXY.

- Powerful resistance aligns at 1.4014 while RSI stays bullish.

- The cable awaits UK final PMI amid vaccine and budget optimism.

GBP/USD is making another attempt to recapture the 1.4000 level amid the upbeat market mood-led broad-based US dollar weakness.

Investors cheer a positive start to March, as bond markets look to stabilize following last week’s rout, lending support to the risk currencies, the GBP.

Also, hopes of additional budget stimulus and successful covid vaccine rollout in the UK aid the recovery in the cable.

The bulls now await the UK final Manufacturing PMI and US ISM Manufacturing PMI for fresh trading opportunities, as the risk sentiment remains favorable.

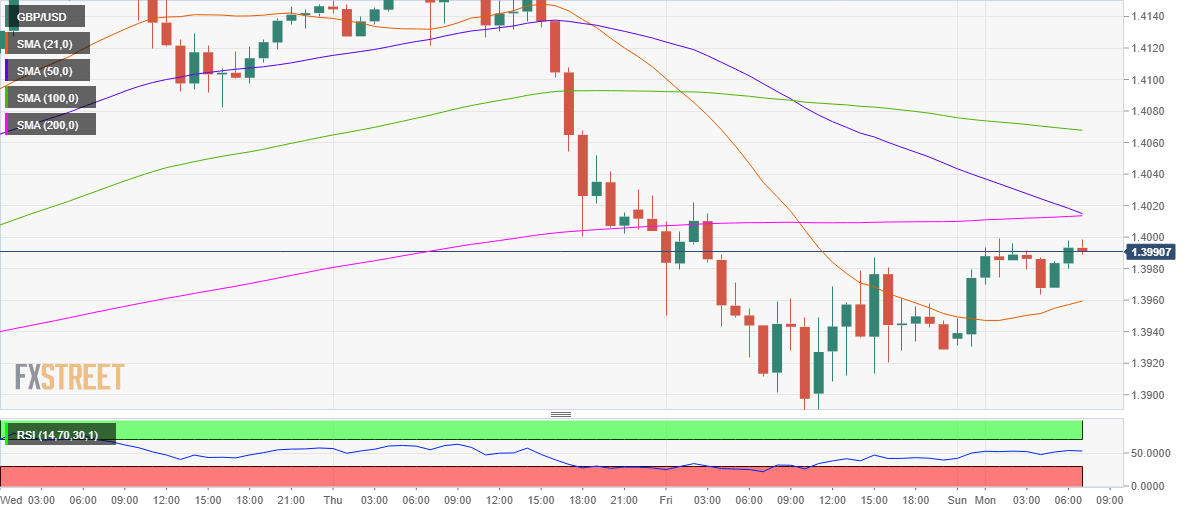

From a near-term trading perspective, the major is inching closer towards 1.4000, above which the critical resistance at 1.4014 could be challenged. That level is the convergence of the horizontal 200-hourly moving average and 50-HMA.

Note that the convergence of the 50 and 200-HMAs calls for an impending death cross on the hourly sticks. The bearish formation will get validated once the 50-HMA breaks below the 200-HMA on an hourly closing basis.

The pair could then stall its recovery momentum and turn south towards the 21-HMA at 1.3959. The further downside appears cushioned, as the Relative Strength Index (RSI) still holds above midline, currently at 53.34.

GBP/USD: Hourly chart

GBP/USD: Additional levels