- GBP/USD bears seeking a break of current support and a downside extension.

- The 1-hour and 15-min time frames offering a 1:2 risk to reward scenario.

In an ongoing analysis of the Brexit noise-related volatility in GBP/USD, the following is an update to the prior analysis according to the subsequent live price action.

For a recap, the price has developed from the last analysis, GBP/USD Price Analysis: Bears about to re-engage at critical 15-min resistance? and now offers prospects for a downside extension from a 1-hour and 15 min chart perspective as follows:

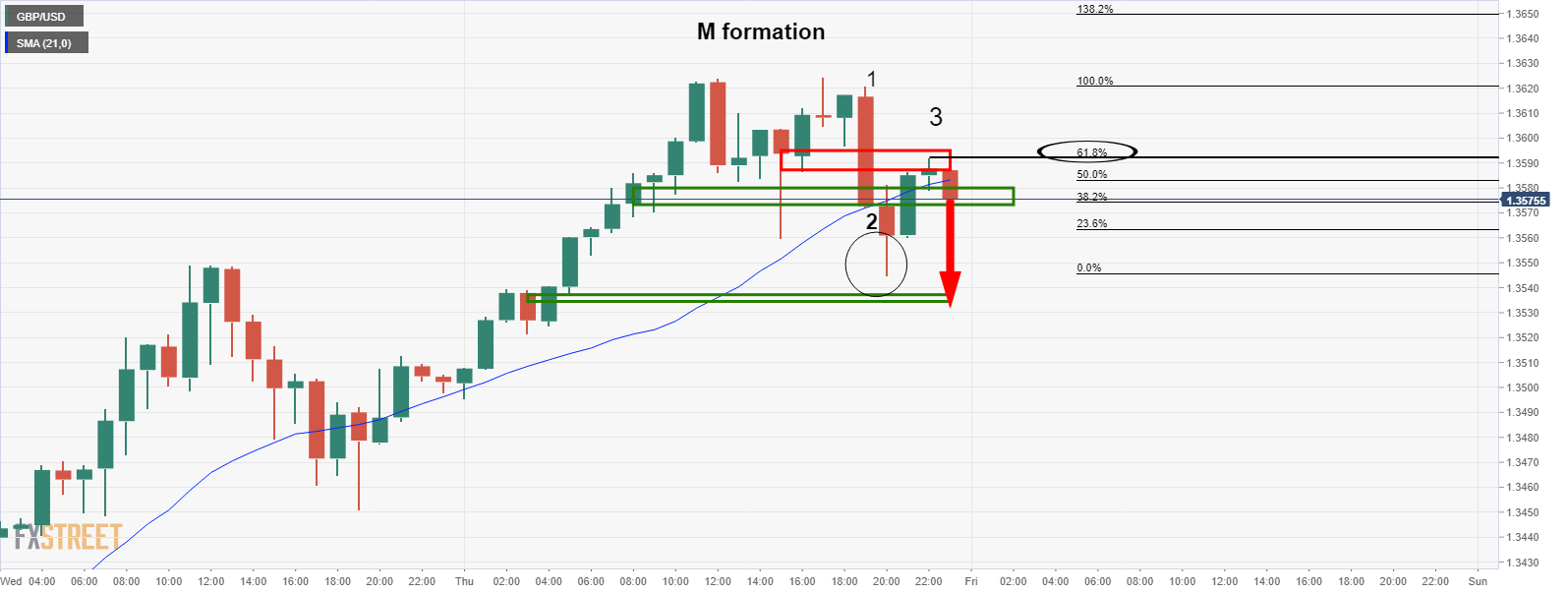

1-hour chart

The 1-hour chart’s M-formation has drawn in the bids back to test the neckline of the pattern.

The correction has completed a 61.8% Fibonacci retracement of the Brexit noise sell-off from the New York session.

Downside extensions can be expected as a result for the print of a lower low.

The -0.272% Fibonacci retracement of the correction is located at 1.3532 which meets prior structure.

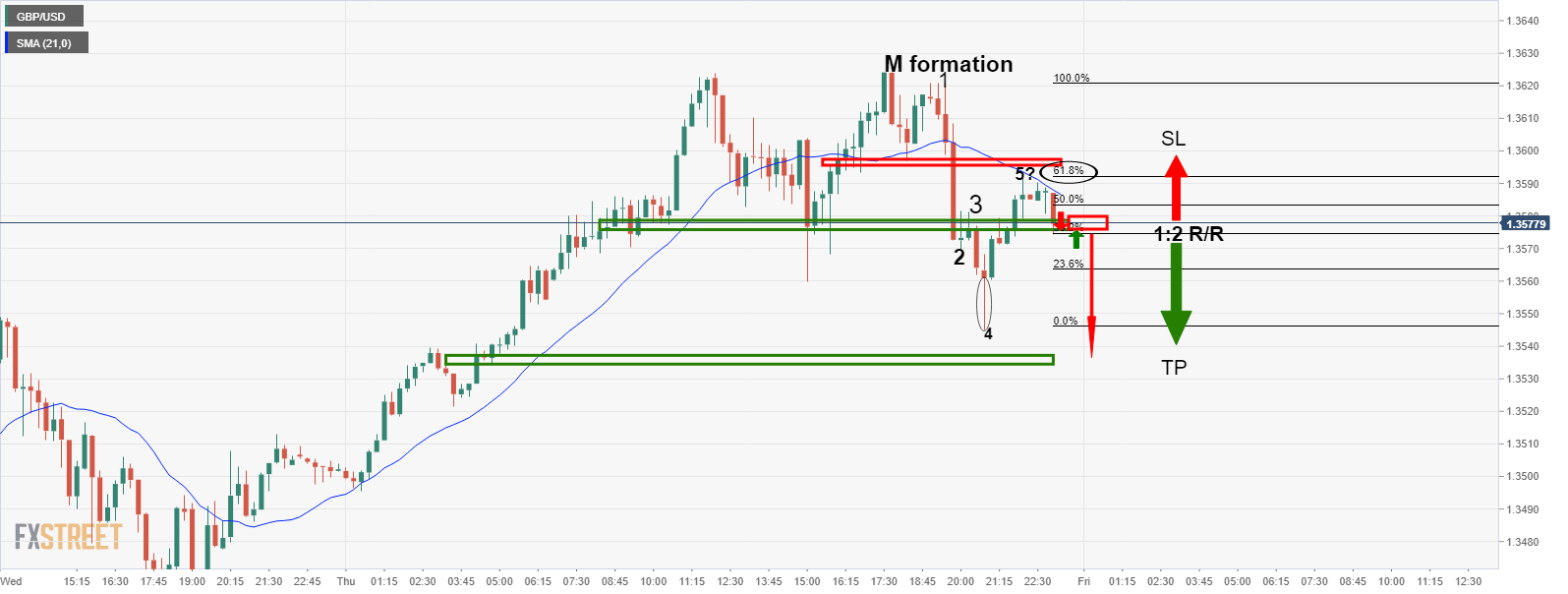

15-min chart

With bearish technical conditions on the 15-min time frame, a trade setup would entail a break of current support and a subsequent entry on a restest of that old support which would be expected to act as resistance.

A stop-loss above the corrections’ highs offers a 1:2 risk to reward scenario.

The stop loss can be moved to breakeven as soon as there is new resistance structure formed from bearish price action post entry.