- GBP/USD bounces off intraday low of 1.2308, extends the previous day’s recovery.

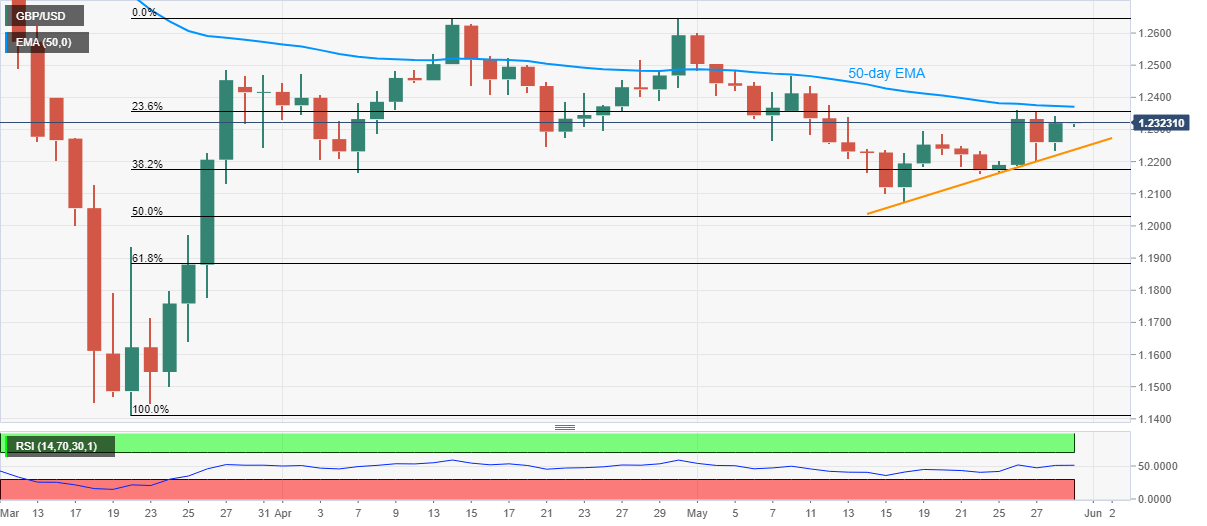

- 50-day EMA has been restricting the upside for the last 19 days.

- Short-term rising trend line keeps the bulls hopeful above 1.2240/35.

The GBP/USD pair’s pullback from the intraday bottom fades upside momentum around 1.2320/25 amid Friday’s Asian session. Even so, the pair stays mildly positive for the second day in a row.

While looking at the upward sloping trend line from May 18 and the RSI levels, the Cable is again likely to confront the 50-day EMA level of 1.2370. However, it’s further upside needs validation from May 08 high surrounding 1.2470.

Alternatively, a daily close below the immediate support line, at 1.2235 now, might recall Friday’s low around 1.2160 ahead of targeting the monthly bottom near 1.2075.

In a case where the GBP/USD prices decline below 1.2075, 1.2000 round-figure might entertain the bears before highlighting 61.8% Fibonacci retracement level of March-April upside, at 1.1883.

GBP/USD daily chart

Trend: Further upside likely