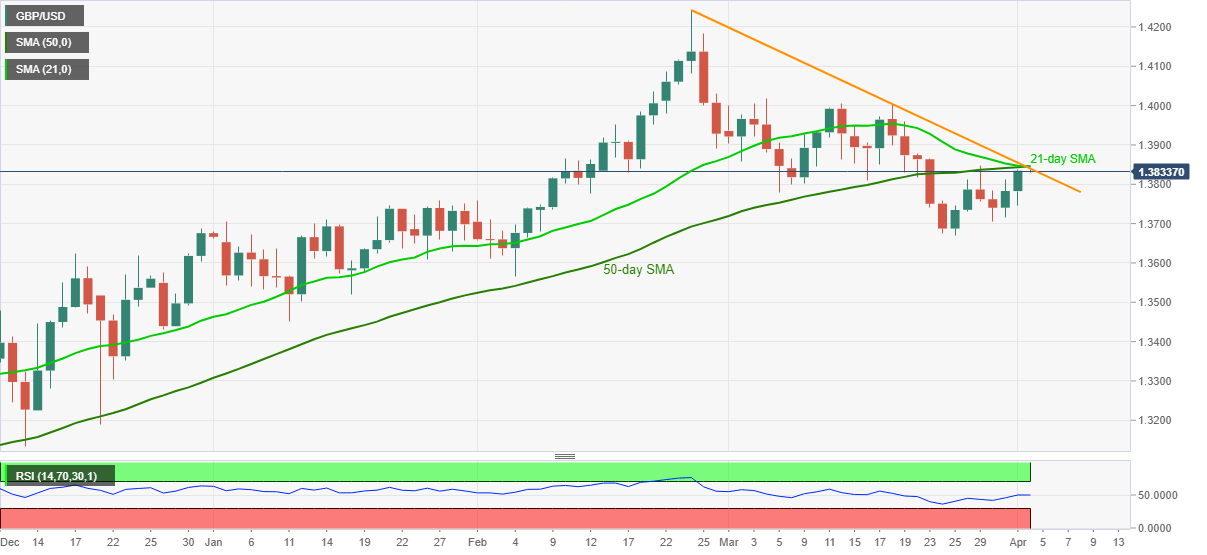

- GBP/USD fades upside momentum during holiday-thinned trading.

- Five-week-old resistance line joins 21-day and 50-day SMA to test the bulls.

- Sellers need to refresh monthly low for fresh impulse.

GBP/USD eases to 1.3833 during the initial Good Friday trading. In doing so, the cable teases a key resistance convergence comprising important SMAs and a short-term falling trend line.

Given the normal RSI conditions and the higher low formation marked during the last two weeks, GBP/USD is expected to overcome the stated hurdle around 1.3840-45.

However, a daily closing beyond the same becomes necessary if the bulls are to challenge the 1.4000 psychological magnet, not to forget March’s high of 1.4017.

Meanwhile, failures to cross the stated resistance don’t give an open welcome to GBP/USD sellers until the quote drops below the previous month’s low of 1.3670. Though, pullback moves to the 1.3700 threshold can’t be ruled out.

In a case where the GBP/USD bears dominate past-1.3670, a February low near 1.3565 will be in the spotlight.

GBP/USD daily chart

Trend: Bullish