- GBP/USD bulls stepping on as price melts to the downside.

- Price action can be monitored from a lower time frame perspective for a bearish structure within bullish attempts.

GBP/USD bears are in control, at least from a daily perspective. The following illustrates the downside targets in a 50% mean reversion of the prior bullish impulse and how price action on the lower time frames might play out on the way there.

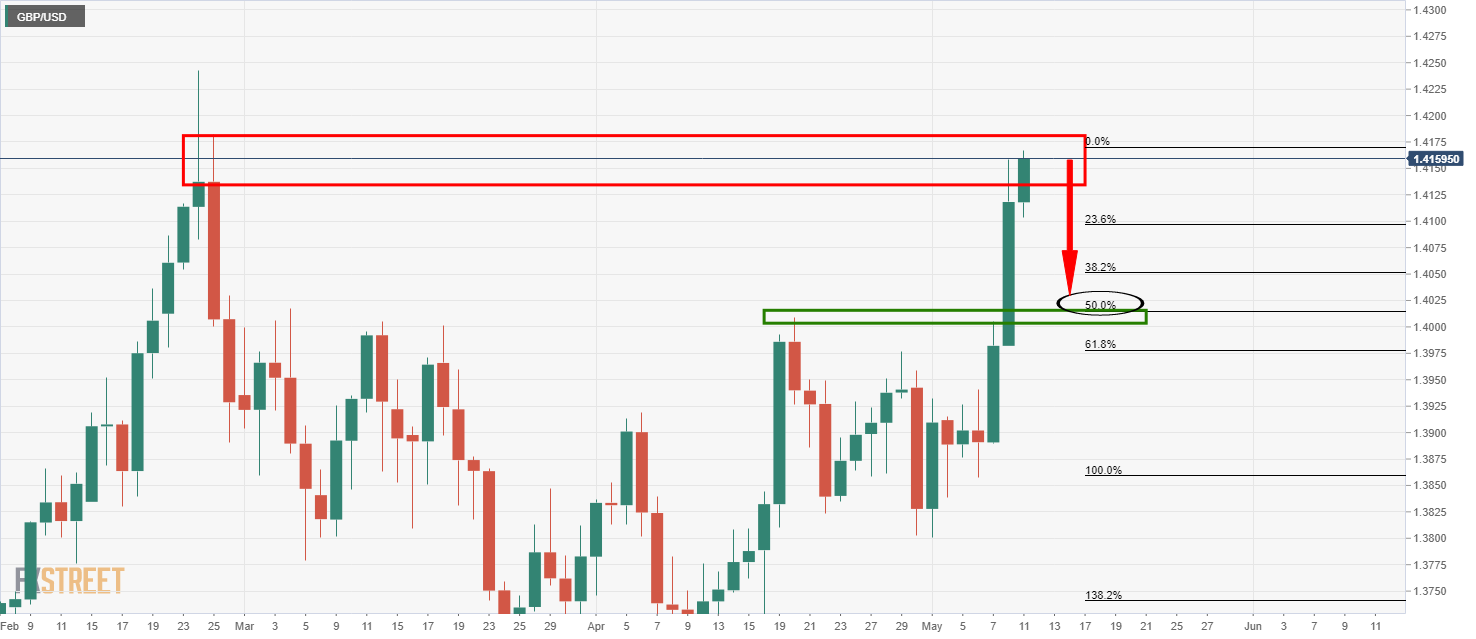

Prior analysis, daily chart

”The price is meeting a supply area and would be expected to retrace a sizeable portion of the bullish impulse.

The prior highs could be targeted considering the confluence with the 50% mean revision of the rally.”

Live market, daily chart

The market has melted and will be en route towards the 50% target on a break of the 38.2% Fibonacci retracements.

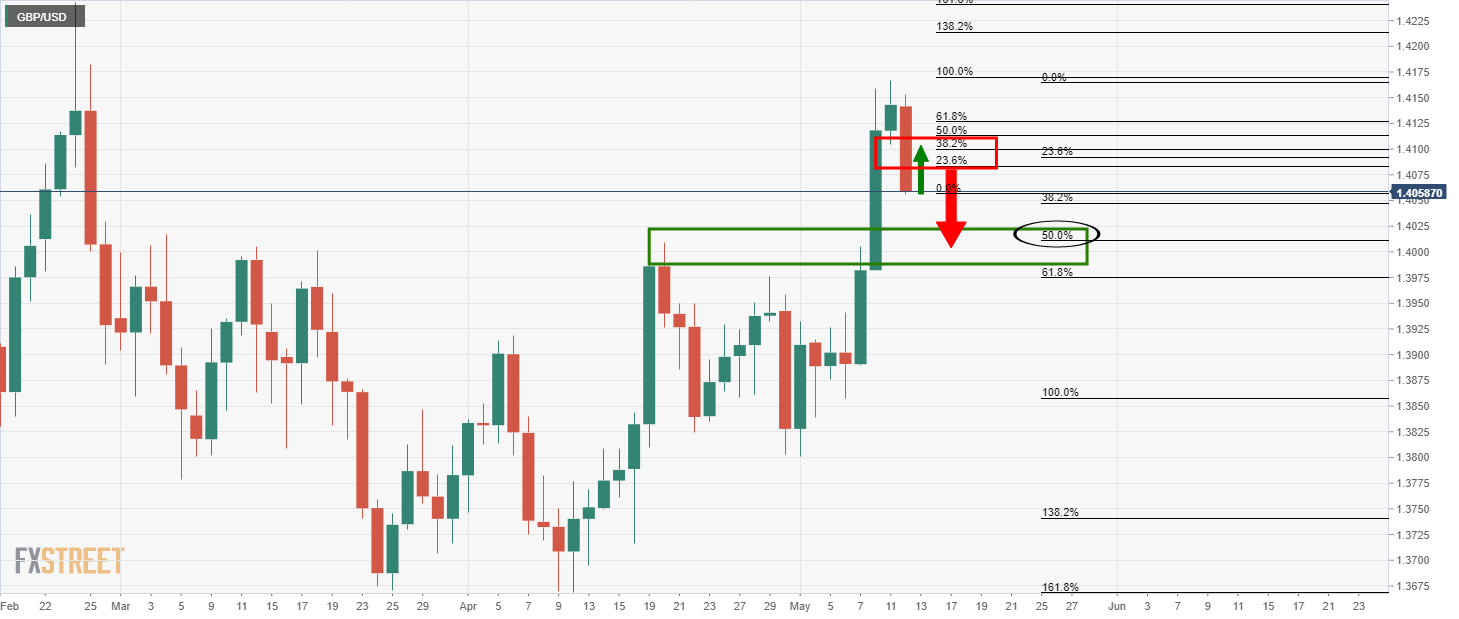

However, should the 38.2% hold, there will be the prospect of a restest of the area of the prior lows that would be expected to act as a resistance.

Drawing up the Fibs can show that the prior lows are more in the region of the current 38.2% Fibonacci retracement of the current bearish impulse’s range.

Should the bulls step in at this juncture, depending on the shape of the subsequent price action, there could be prospects of an hourly set up as follows:

Hourly chart

Should the price drift higher without leaving multiple bottoms on an hourly basis, there could be prospects of sellers taking back control from resistance.

Sellers would seek to break the hourly lows which would result in a bearish continuation towards the 50% mean reversion of the prior daily bullish impulse.