- GBP/USD bears look to neckline resistance and for a break of newly formed hourly support.

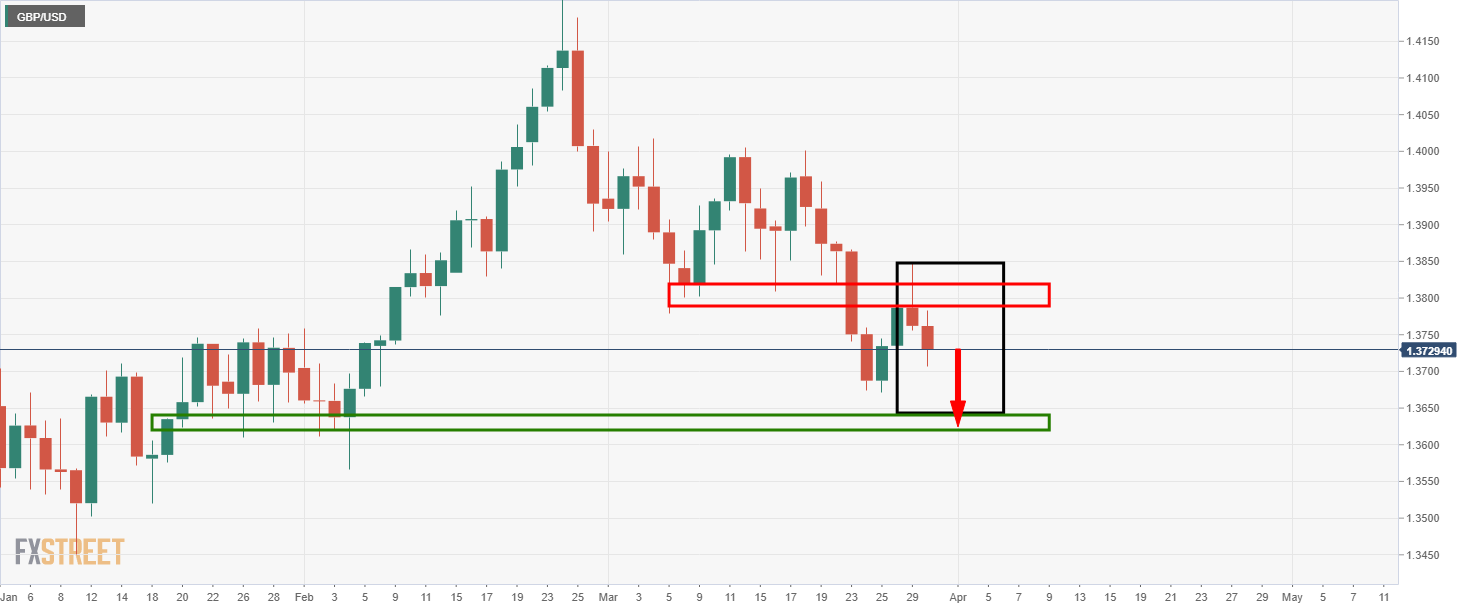

- Daily prospects remain bearish for a downside extension.

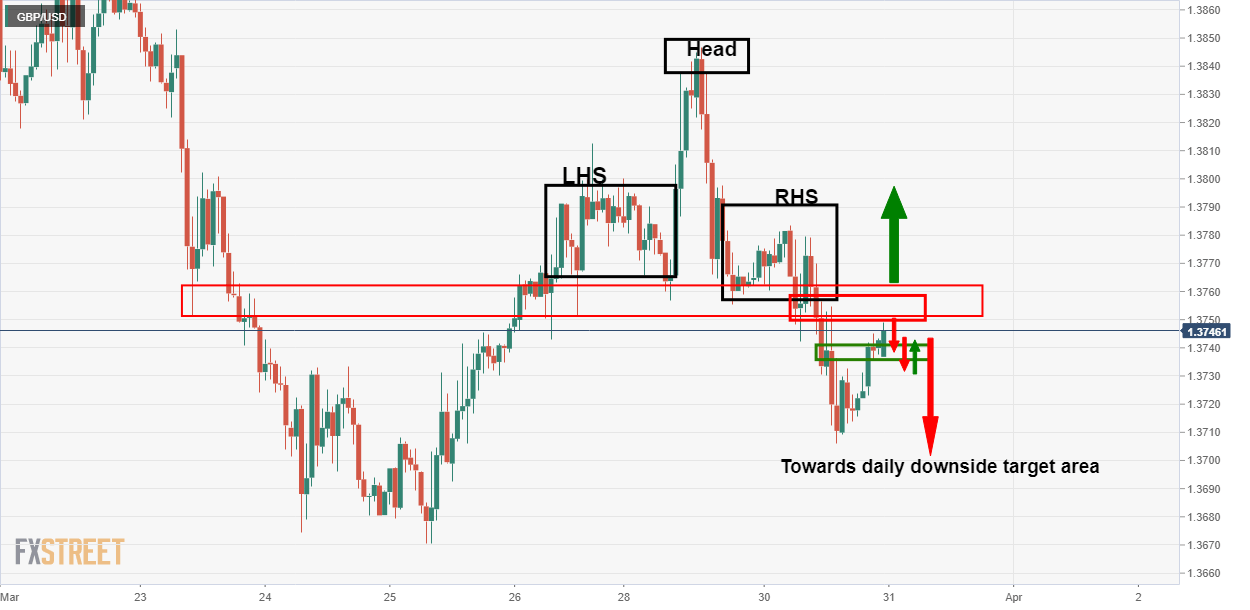

GBP/USD is carving out a slightly bullish case on the lower time frames, cutting into the bearish prospects of a downside daily extension, as per the prior analysis, GBP/USD Price Analysis: Bulls test critical hourly resistance.

Prior analysis

There are still prospects of a downside extension as the price continues to move lower.

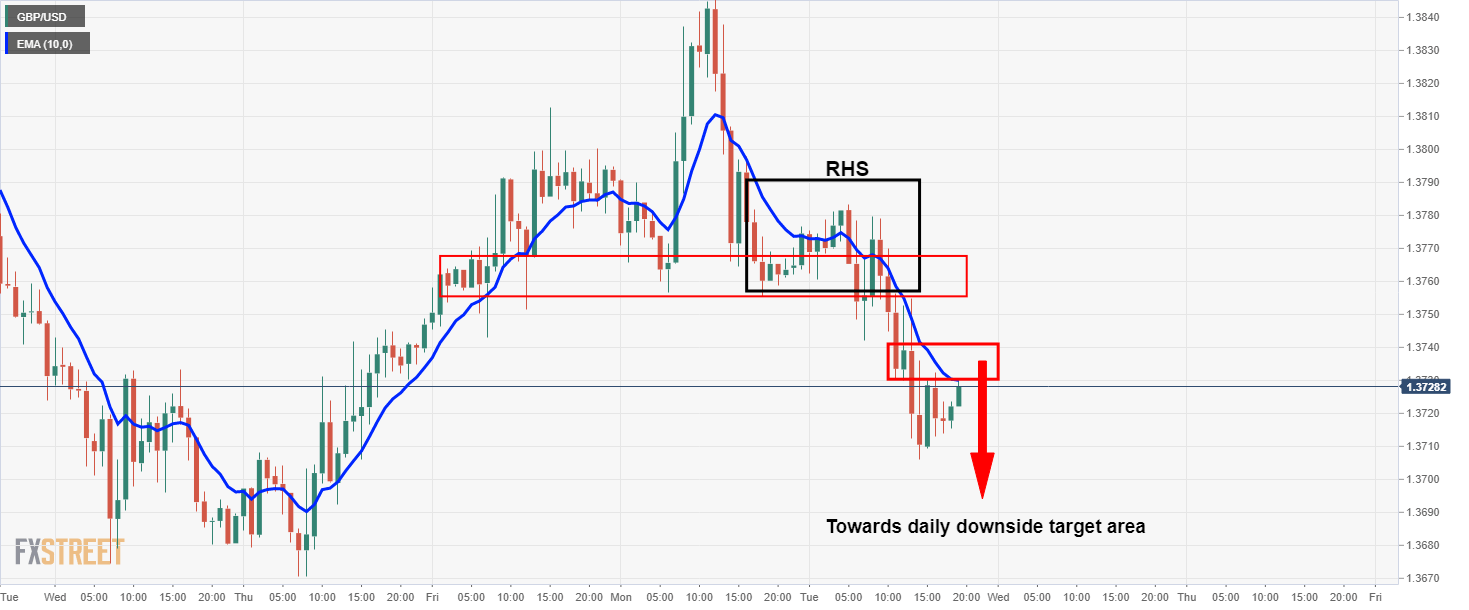

Meanwhile, as per the hourly chart, (above), the right-hand shoulder was formed and gave additional conviction to the downside bias with a perfect break and restest of the neckline for an optimal entry point.

Live market, 1-hour chart

As can be seen, the price has continued higher to test the bear’s commitments below the neckline of the head and shoulders.

This could be a final push higher before the next downside extension.

Nevertheless, a well-calculated stop loss above structure protects against such adverse price behaviour and bears can stay focussed on the longer-term bias.

In the meantime, a rejection from the resistance and subsequent break and retest of current newly formed support would be expected to result in a downside extension.

On the other hand, a break of the neckline puts the bulls back in control.