- GBP/USD is in the throes of a downside extension on failures at daily resistance.

- Bears need to see a daily bearish candlestick close below resistance.

GBP/USD has run out of steam on the upside and bears are forcing the price back up against daily/4-hour support.

Bears are in anticipation of a downside opportunity and an extension of the broader bear trend.

The following top-down analysis illustrates where the next trading opportunity could arise from a break of current support.

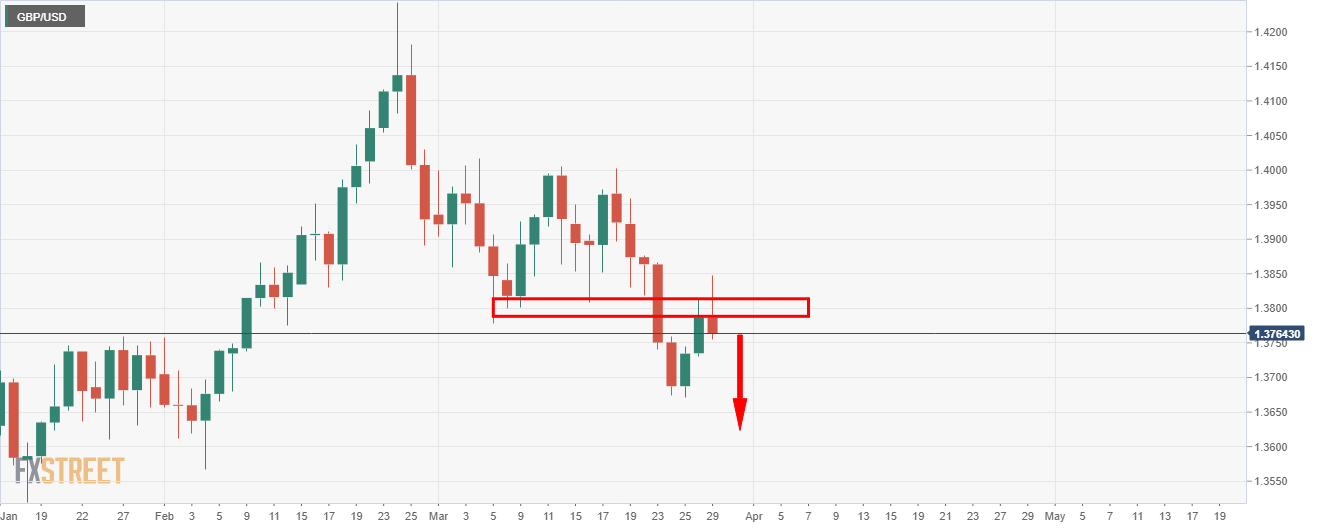

Daily chart

The bearish impulse has been corrected with the bulls taking on the bear’s commitments at resistance.

A downside extension would be expected if bears step up to protect the resistance.

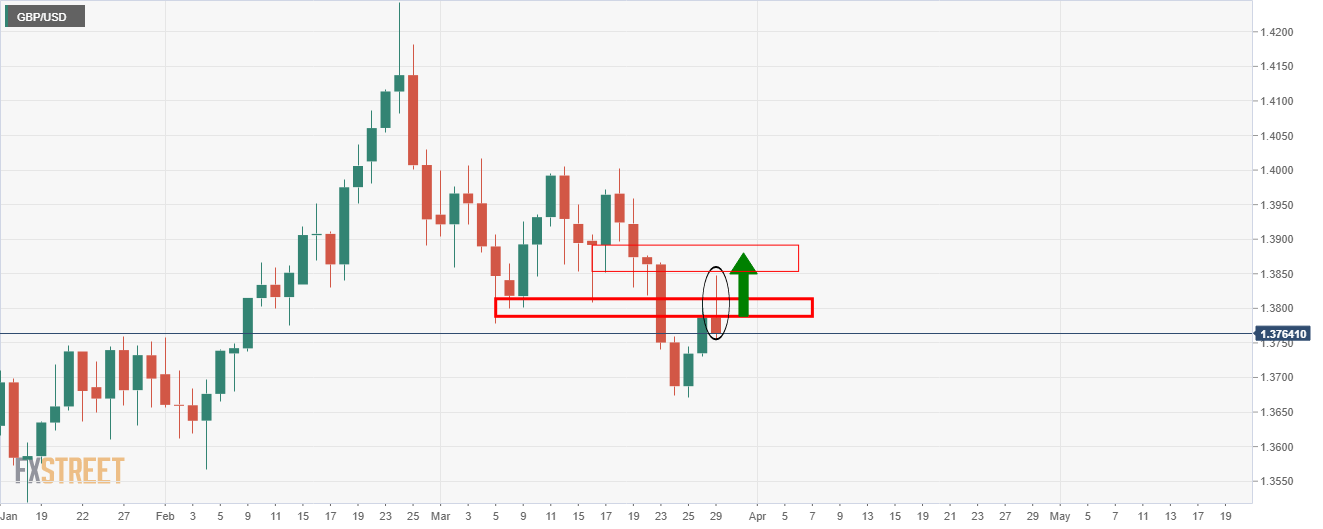

Bullish prospects, daily chart

With that being said, the currently daily candlestick will be bearish if we see a bearish close below resistance.

If the price closes bullish, then the wick would be expected to be filled on lower time frames to the upside.

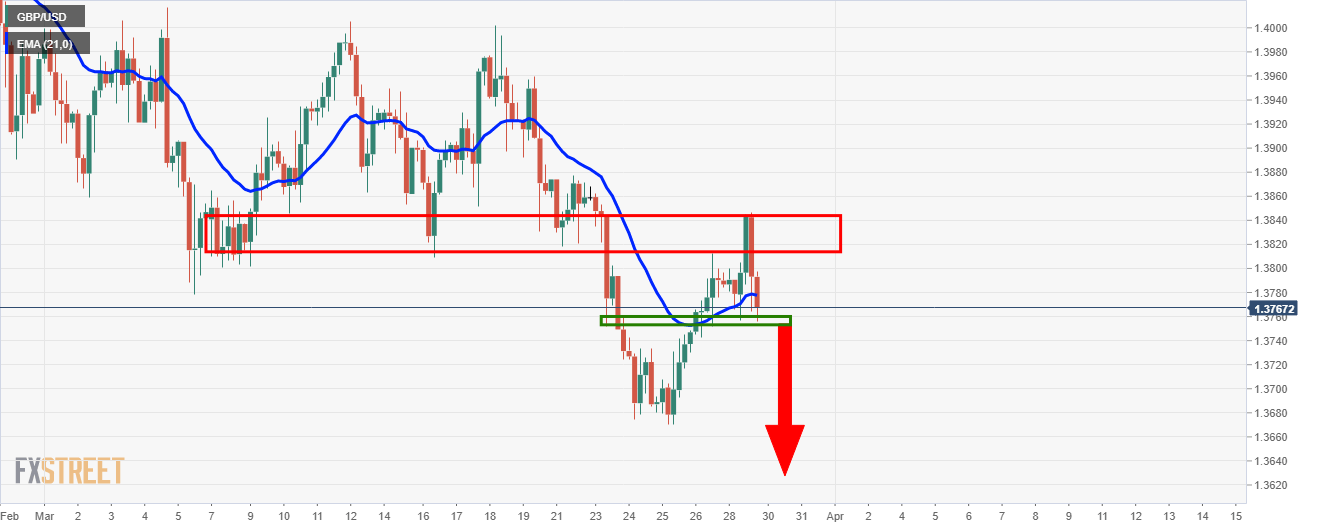

4-hour chart

From a 4-hour perspective, the price is testing below the 21-EMA but stalling at a familiar support structure.

The price can easily head higher from here, so bears will be watching for a break and restest of the structure that would then be expected to act as resistance.

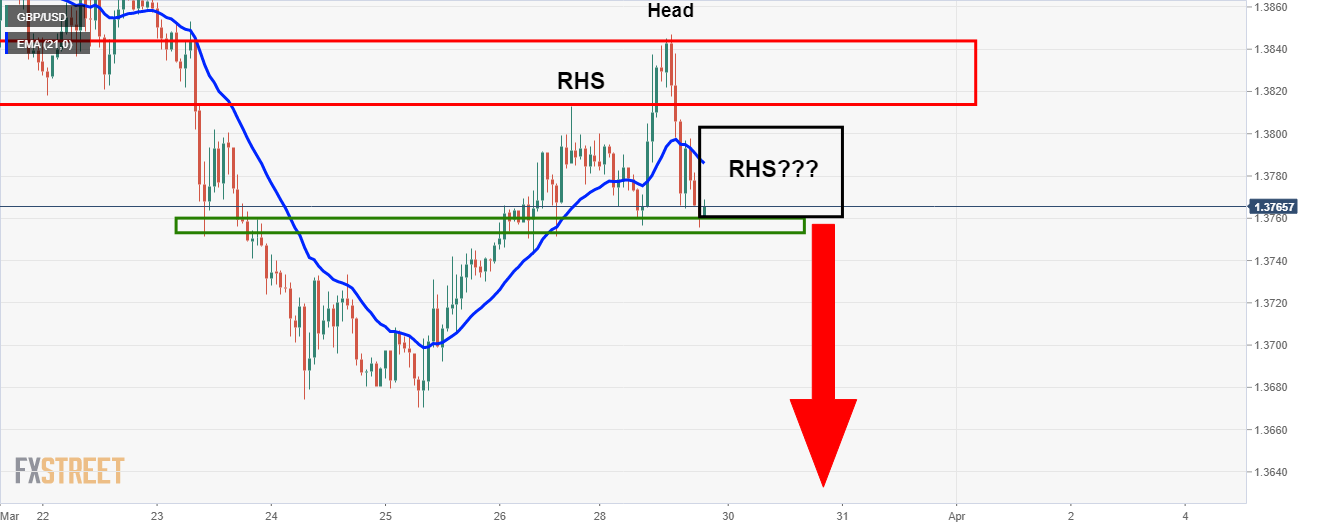

1-hour chart

Meanwhile, the hourly chart is telling ad offers a different vantage point.

There could well be some consolidation to come over the coming sessions prior to a break of the support.

A bearish head and shoulders could be in the makings.