- GBP/USD is trading off the 1985 lows, approaching the 1.1700 figure.

- BOE cuts rates, adds £200 billion in QE, GBP/USD recovers.

- GBP/USD correction up might have limited scope.

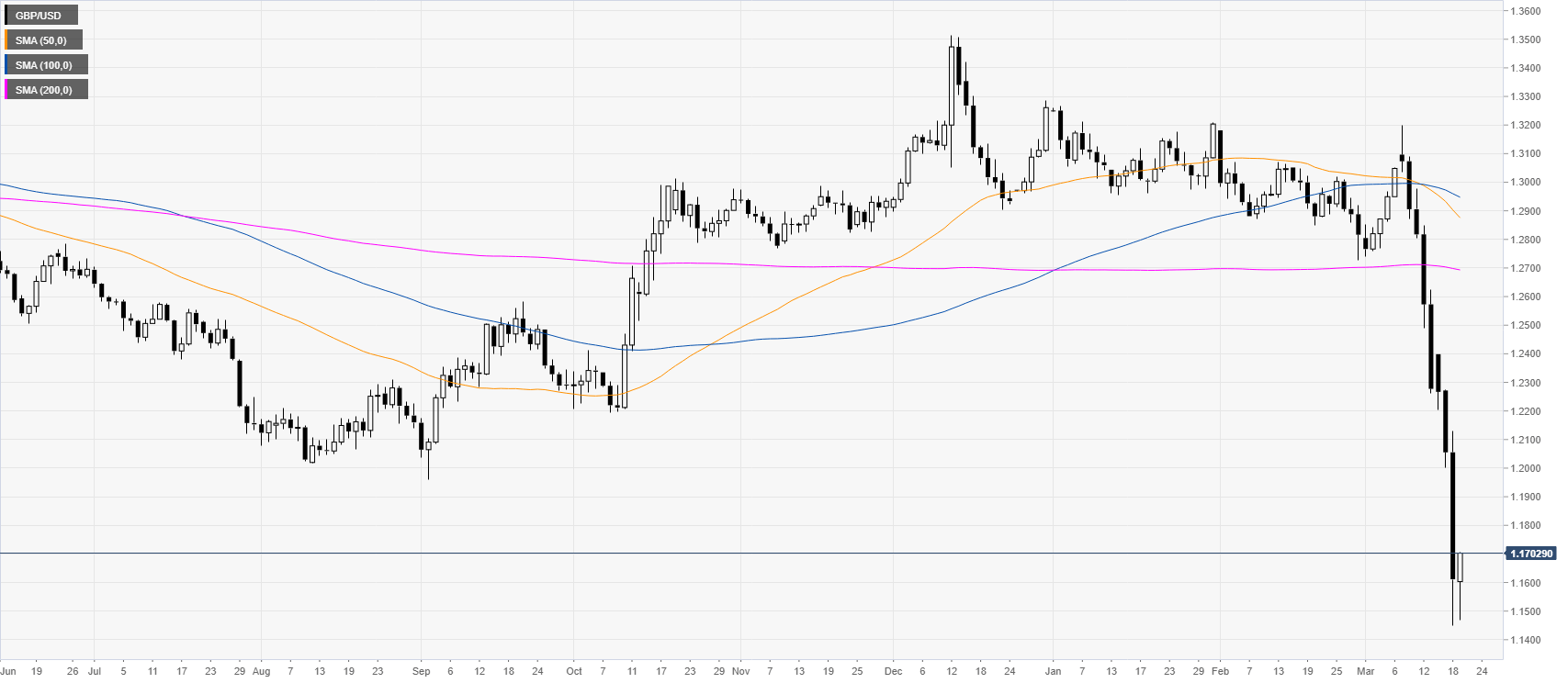

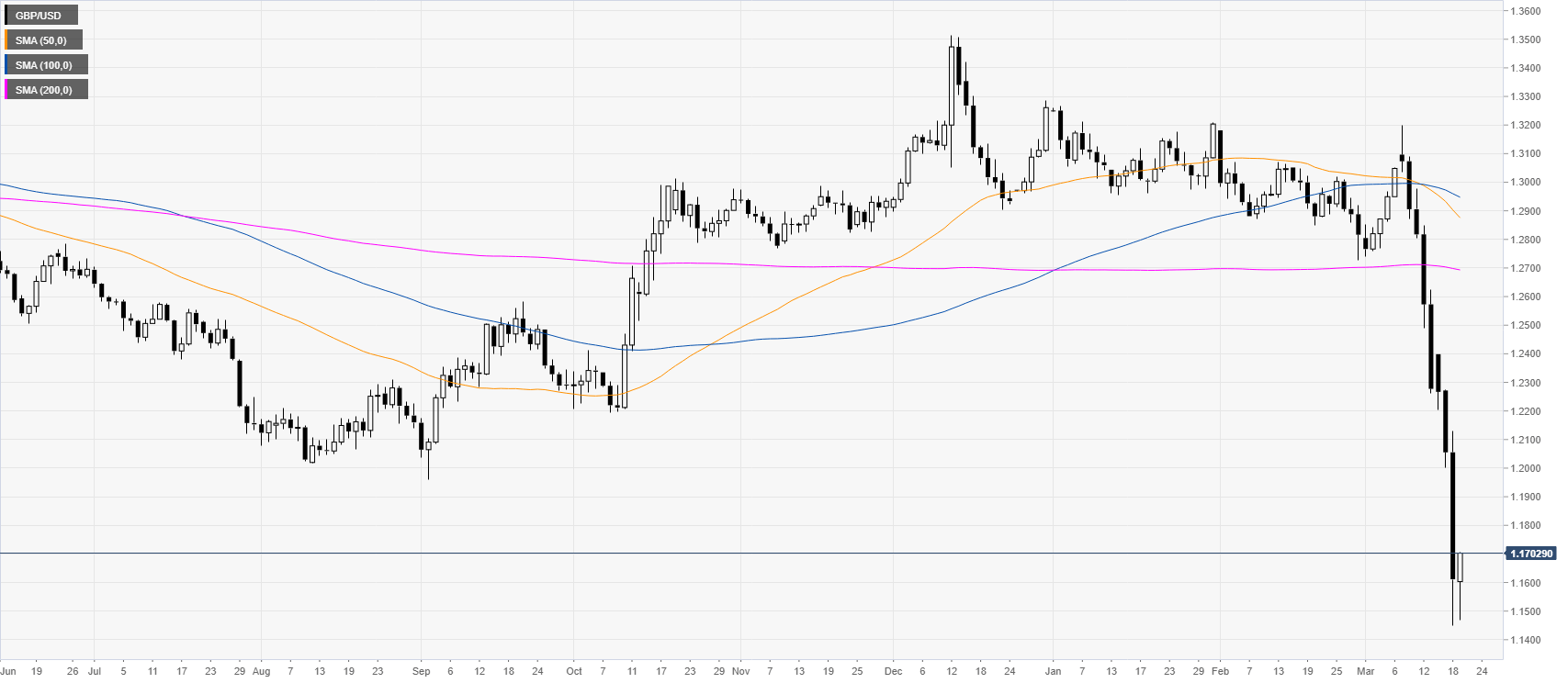

GBP/USD daily chart

GBP/USD is recovering from the 1985 lows as the Bank of England (BOE) cut interest rates and adds 200 billion in Quantitative Easing (QE).

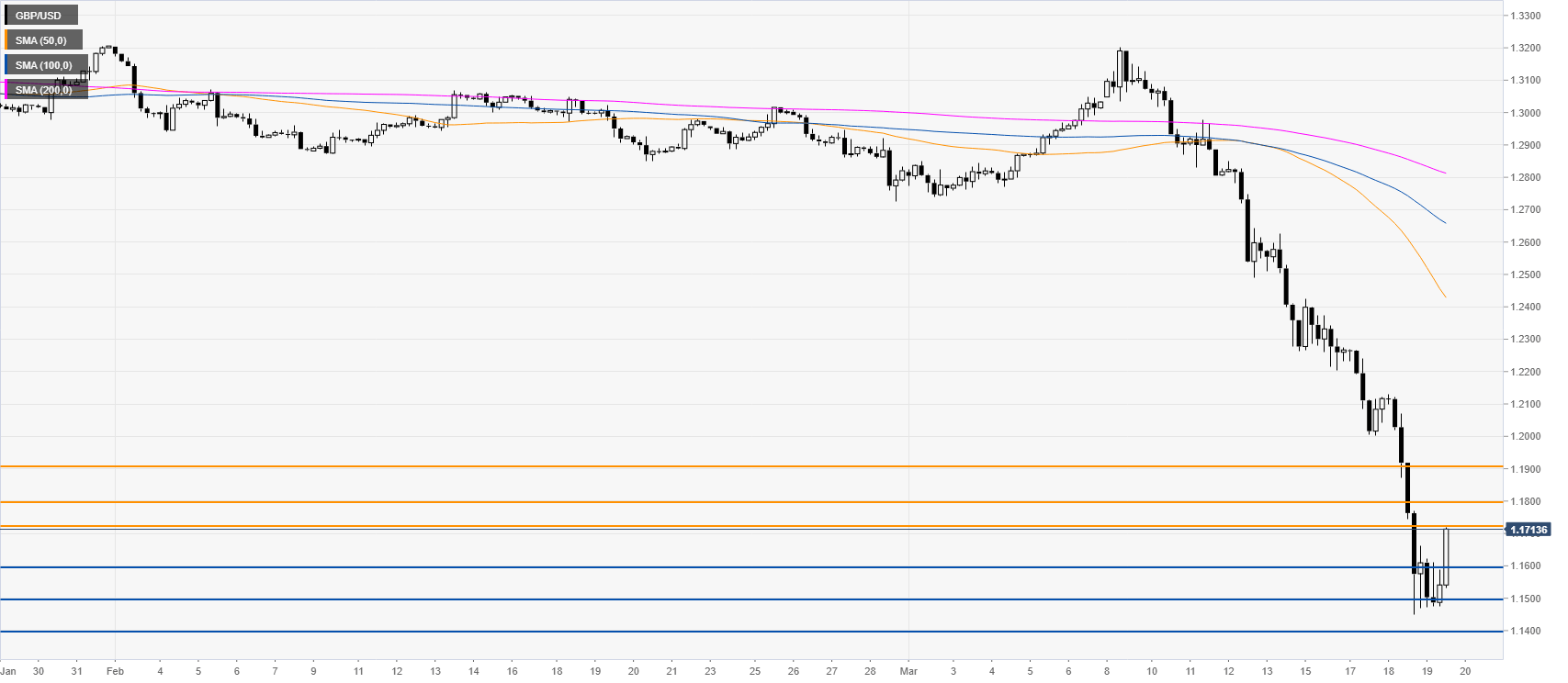

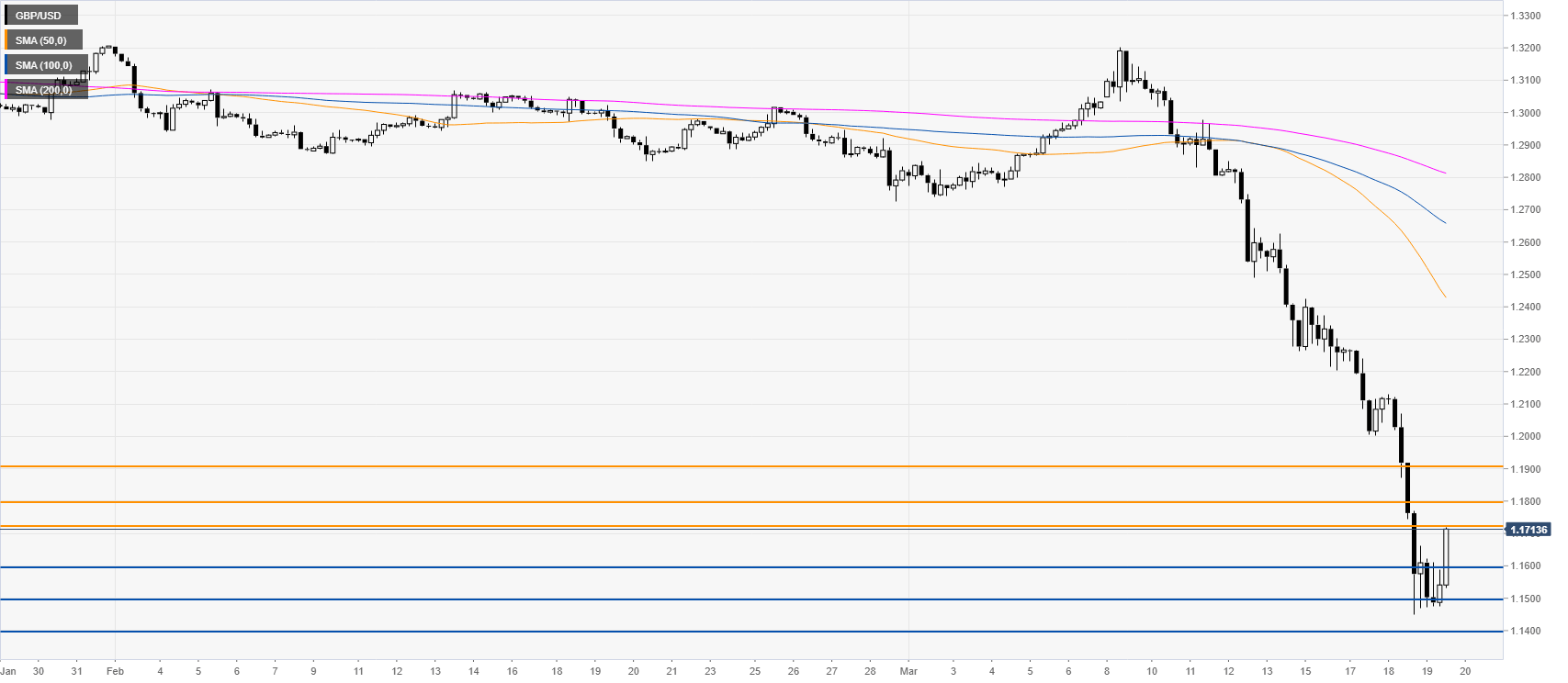

GBP/USD four-hour chart

GBP/USD is correcting up while trading off 35-year’s lows. It is unclear how far the correction can go as the market retains an overall bearish bias. Resistance can be met near the 1.1730, 1.1800 and 1.1900 levels on the way up, according to the Technical Confluences Indicator.

Resistance: 1.1730, 1.1800, 1.1900

Support: 1.1600, 1.1485, 1.1400

Additional key levels