- Economists expect US core inflation to remain stable at 0.3% in November.

- The US dollar is exposed to selling if inflation appears to be slowing down.

- Britain’s gross domestic product increased by 0.5% in October.

Today’s GBP/USD price analysis is bullish as the dollar edges lower ahead of US inflation data. According to a Reuters poll of economists, core inflation will remain stable in November at 0.3% month on month. However, it will slow down annually, with headline prices expected to be 7.3% higher than they were a year ago.

-Are you looking for automated trading? Check our detailed guide-

As the Fed raised its benchmark funds rate to combat inflation, the US dollar was supported by high and increasing interest rate expectations. However, this has left the currency exposed to selling if inflation appears to be slowing down.

The British economy recovered from the one-time public holiday marking Queen Elizabeth’s funeral in September a little more robustly than was anticipated in October. However, a recession was still forecasted.

Following a 0.6% decline in September, the gross domestic product increased by 0.5%, according to the Office for National Statistics. Economists had expected a 0.4% rebound.

The Bank of England warned last month that the British economy was at risk of a two-year recession if interest rates rose as much as investors were anticipating. The bank is expected to increase interest rates for a ninth consecutive meeting on Thursday to contain the dangers of an inflation rate above 11%.

GBP/USD key events today

The US will release inflation figures later, which will likely cause some volatility. Investors will also be keen on a speech from the Bank of England governor Bailey.

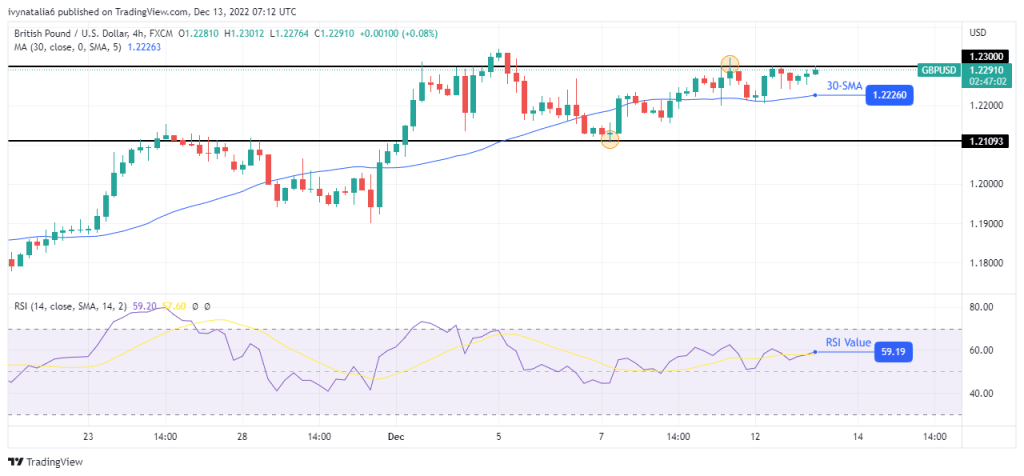

GBP/USD technical price analysis: Bulls struggle to push the price above 1.2300

Looking at the 4-hour chart above, we see the price trading close to the 1.2300 resistance level. It is also trading above the 30-SMA showing the current move is bullish. The RSI is trading above 50, also supporting bulls.

-If you are interested in forex day trading then have a read of our guide to getting started-

The 1.2300 key resistance has proven quite difficult to break as the price made several attempts but kept bouncing lower. If bulls gather enough momentum, they might succeed in breaking above this key level.

However, if bears gather more momentum, the price will likely break below the SMA and probably collapse to the 1.2109 support.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.