- GBP/USD trimmed a part of its intraday gains to the 1.3520-25 confluence resistance.

- Mixed technical set-up warrants some caution before placing fresh directional bets.

The GBP/USD pair traded with a positive bias through the mid-European session, albeit has trimmed a part of its early gains. The pair was last seen hovering below the key 1.3500 psychological mark, up around 0.30% for the day.

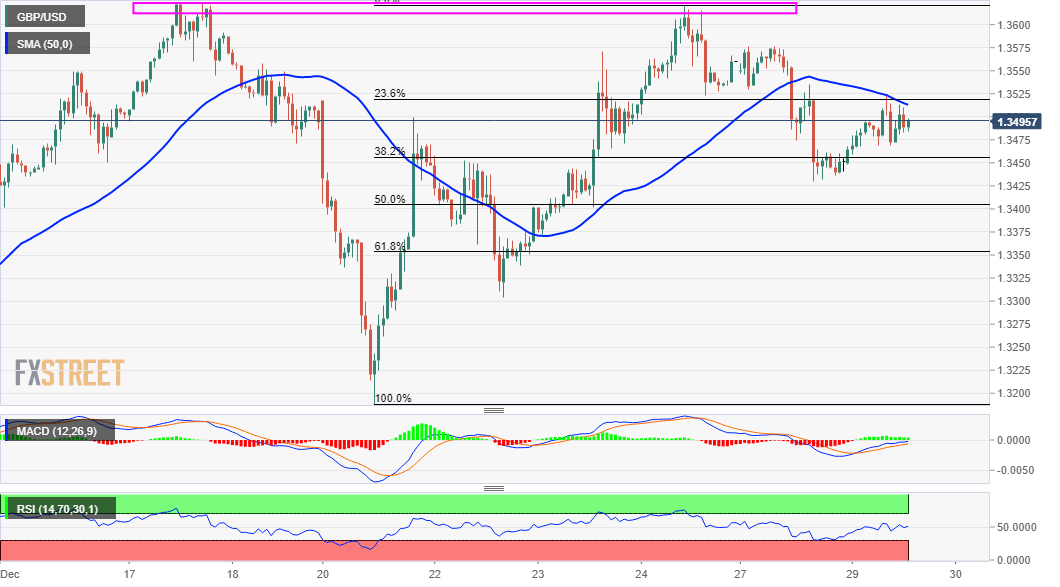

The intraday uptick stalled near the 1.3520-25 confluence resistance, comprising of 50-hour SMA and the 23.6% Fibonacci level of the 1.3188-1.3620 strong move up. The mentioned region should now act as a key pivotal for intraday traders.

Meanwhile, the recent pullback from the vicinity of YTD tops, around the 1.3620-25 region, constitutes the formation of a bearish double-top chart pattern. That said, the emergence of some dip-buying warrants some caution for bearish traders.

Moreover, oscillators on the daily chart – though have been losing positive momentum – are still holding in the bullish territory. This further makes it prudent to wait for some follow-through selling before positioning for any meaningful slide.

On the upside, the 1.3520-25 confluence region might continue to act as an immediate resistance, above which the GBP/USD pair could climb back to the 1.3575-80 area. However, bulls might still wait for a sustained move beyond the 1.3600 mark before placing fresh bets.

GBP/USD 1-hourly chart

Technical levels to watch