- GBP/USD price stays under pressure below 1.3800 area.

- Sterling holds stronger against other peers despite a major dollar sell-off.

- Brexit pessimism may not allow the bulls to continue the upside momentum.

During the last session of the week, the GBP/USD price remains stable. It gained momentum following the previous session. The GBP/USD currency pair is trading at 1.3790 at the time of writing, down 0.01% over the day.

-Are you looking for automated trading? Check our detailed guide-

The pound sterling is holding up against major currencies despite the widespread selling of the US dollar. Following US gross domestic product (GDP) falling below forecast from 2.7% to 2.0% in the third quarter, the dollar dropped the most since October 13 the previous day. Fed monetary normalization could be slowed by weak GDP data, according to investors.

The British Chancellor Rishi Sunak’s budget for 2021 and the hawkish stance of the Bank of England (BOE) are also supporting the change, of course.

Sterling growth is constrained, however, by the pessimism associated with Brexit. For example, in response to the escalating fisheries dispute following Brexit, France has seized a British trawler, and another has been fined.

To gauge market sentiment, traders will monitor the Bank of England’s consumer credit, mortgage credit, and US consumer price indices.

GBP/USD price technical analysis: Bull seem retiring

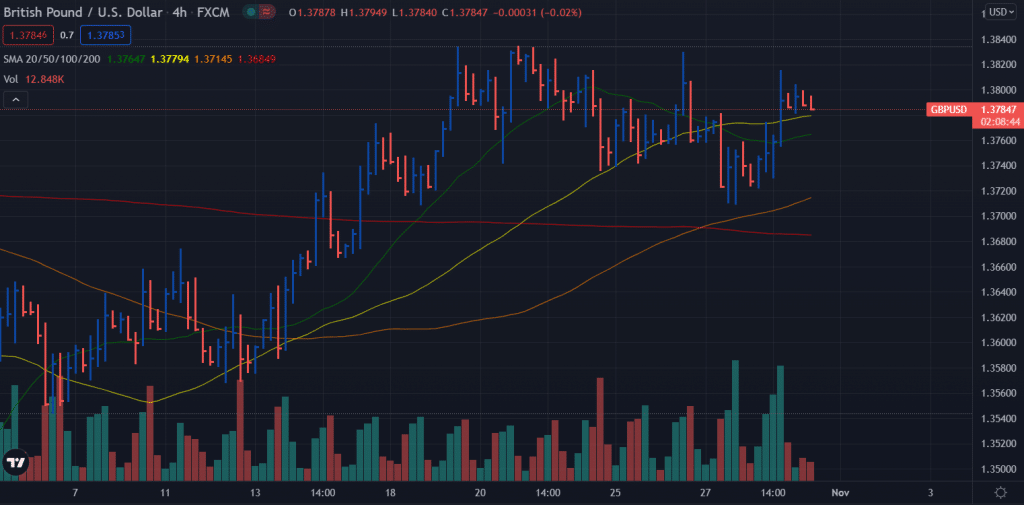

The GBP/USD price remains depressed below the 1.3800 mark. The average daily range is still 24% which shows low volatility as market participants await some catalyst. The pair is wobbling above the 20-period and 50-period SMAs, which is positive for the buyers. However, the bulls lack follow-through momentum to find acceptance above the 1.3800 level. Any upside rally may find strong resistance around the 1.3840 area as well.

– If you want to find out more about MT4 forex brokers, read our comprehensive guide –

On the flip side, sellers may dominate if the price slips towards the 1.3760 area. The 200-period SMA is flat, around 1.3680. This level can be a point of attraction for the sellers. However, bears have to combat with 100-period SMA and swing low of 1.3710 before reaching the 1.3680 area.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.