- GBP/USD may stay bullish as the prospects of BoE’s rate hike are quite high.

- Governor Bailey stated that a rate hike is inevitable amid the risk of increased inflation.

- Technically, the pair sees some selling pressure from Friday’s highs.

The GBP/USD price analysis suggests a potential bullish scenario as the BoE prepares for a rate hike, and the market may start pricing in the impact.

-If you are interested in forex demo accounts, check our detailed guide-

On Sunday, Bank of England (BoE) Governor Andrew Bailey said that the BoE was preparing a rate hike as inflation risks increased. As a result, the GBP/USD fell to 1.3716 at the start of the new trading week from its four-week high of 1.3773 marked on Friday.

Governor Andrew Bailey said that the BoE was preparing to raise rates amid rising inflation risks. Clearly, monetary policy cannot solve the supply-side problems. However, it must take action when it sees a risk, especially to medium-term inflation and inflation expectations, said Bailey. “And that is why the Bank of England is signaling, and this is another example, that we need to act, but of course, these measures will be taken in our monetary policy meetings,” he further added.

After the Corona crisis, the global economy is picking up again, which leads to shortages of supplies and staff, and energy prices are going sky high. The BoE forecast that the UK inflation rate will rise to over four percent, more than double its inflation target. We may see the Bank of England raise its key interest rate for the first time this year or early in 2022.

Rightmove’s house price index for October was released earlier today. The figures came at 1.8 percent, up from 0.3 percent in September.

-If you are interested in Islamic forex brokers, check our detailed guide-

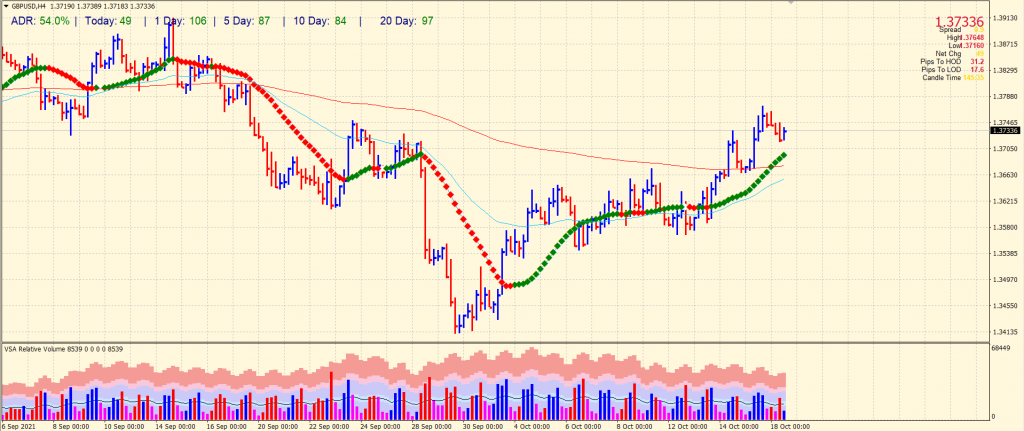

GBP/USD price technical analysis: 20-SMA to lend support

The GBP/USD price remains off the daily highs as we proceed through the London session. The price is going down towards the 20-period SMA on the 4-hour chart. So far, the average daily range is 54% which is not quite high for the pair during the London session. It shows that market participants are not actively trading the pair today. If the price does not hold 20-period SMA, we may see a test of 1.3700 level ahead of 1.3660. On the upside, 1.3775 (swing high of last Friday) may provide interim resistance ahead of 1.3800 (psychological level).

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.