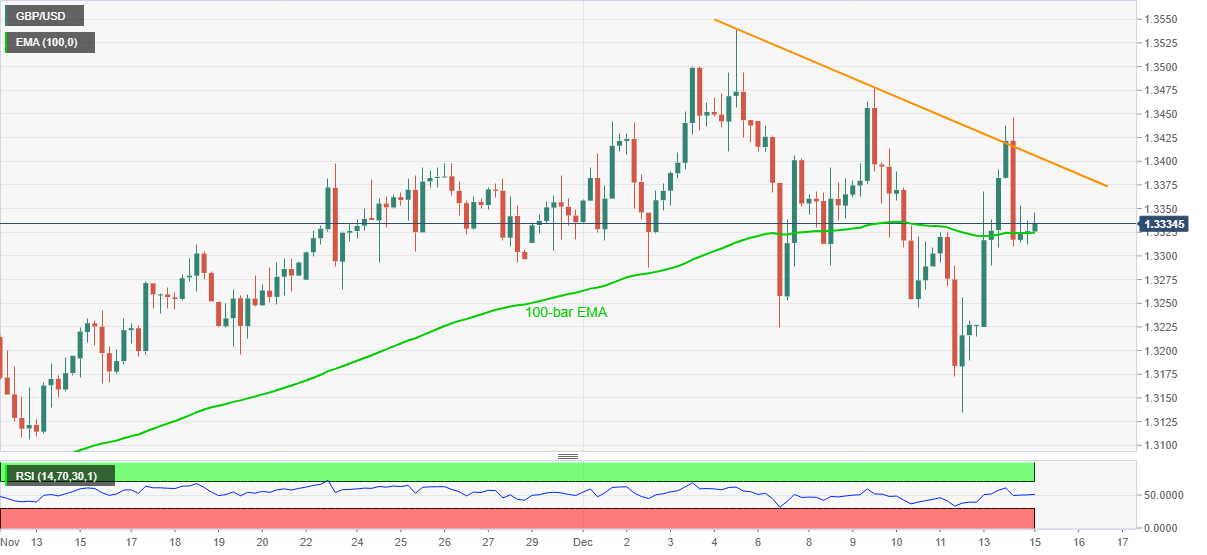

- GBP/USD extends bounce off 100-bar EMA, prints mild intraday gains.

- Normal RSI conditions, sustained trading beyond key moving average favor the bulls.

- Sellers need to refresh monthly low before retaking the controls.

GBP/USD picks up bids near 1.3340, up 0.11% intraday, during early Tuesday. The cable rose for the first time in the last three days on Monday before recently extending gains above 100-bar EMA.

The upside moves also benefit from the absence of overbought or oversold RSI conditions.

As a result, GBP/USD buyers are again targeting a falling trend line from December 04, at 1.3410 now. However, a clear upside beyond the same will be critical to watch.

Should the quote remains positive past-1.3410, odds of a fresh monthly high above 1.3539 can’t be ruled out.

Alternatively, a downside break below 100-bar EMA, currently around 1.3320, will direct the GBP/USD sellers toward 1.3250 and the monthly low near 1.3130.

Also acting as a downside filter is November’s trough surrounding 1.3100.

GBP/USD four-hour chart

Trend: Further upside expected