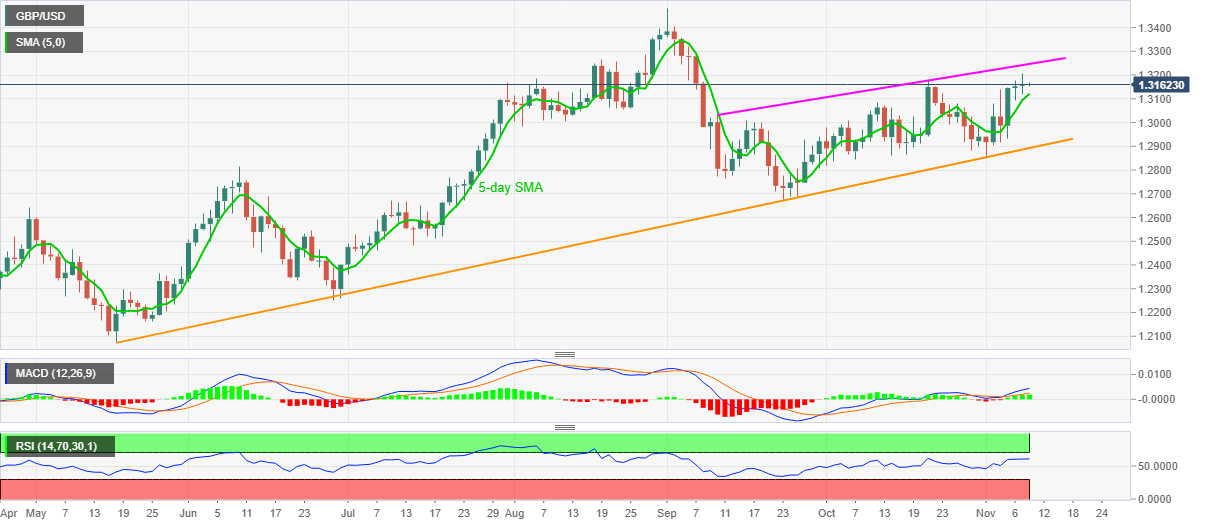

- GBP/USD fails to keep the highest levels since September 07.

- Bullish MACD, upbeat RSI conditions favor further upside to two-month-old resistance line.

- Bears will look for entry on the break of an ascending trend line from May 18.

GBP/USD recedes to 1.3160 during the initial hour of Tuesday’s Asian session. The pair refreshed the two-month peak on Monday but failed to stay positive beyond 1.3200.

However, bullish signals from the MACD joins strong RSI, not near the overbought region, favor the GBP/USD buyers to keep the optimism while targeting a resistance line stretched from September 10, at 1.3246 now. In doing so, a clear break above the recent high of 1.3208 becomes necessary.

While the quote is likely to post another U-turn from the mid-1.3200 area, any further upside can be challenged by the August 18 high near 1.3270, a break of which could challenge the yearly top surrounding 1.3485.

Alternatively, a downside break of 5-day SMA, currently near 1.3120 will aim for the 1.3100 and the 1.3000 round-figures as the next rest-points before highlighting a multi-day-old support line close to 1.2890.

If at all the GBP/USD bears manage to conquer the state support line, September lows near 1.2675 will pop-up on their radars with the monthly bottom around 1.2850 likely acting as a buffer.

GBP/USD daily chart

Trend: Bullish