- GBP/USD bears are in control and have their eyes set on a daily downside extension.

- Bulls are testing the bear’s commitments at critical hourly resistance.

Further, the start of the week’s, GBP/USD Price Analysis: Bears testing bullish commitments at critical support, a trade-pick from this weeks, The watchlist: Bullish gold, CAD bullish, EUR/USD bearish discount, CHF on the march, the price has deteriorated within bearish territory.

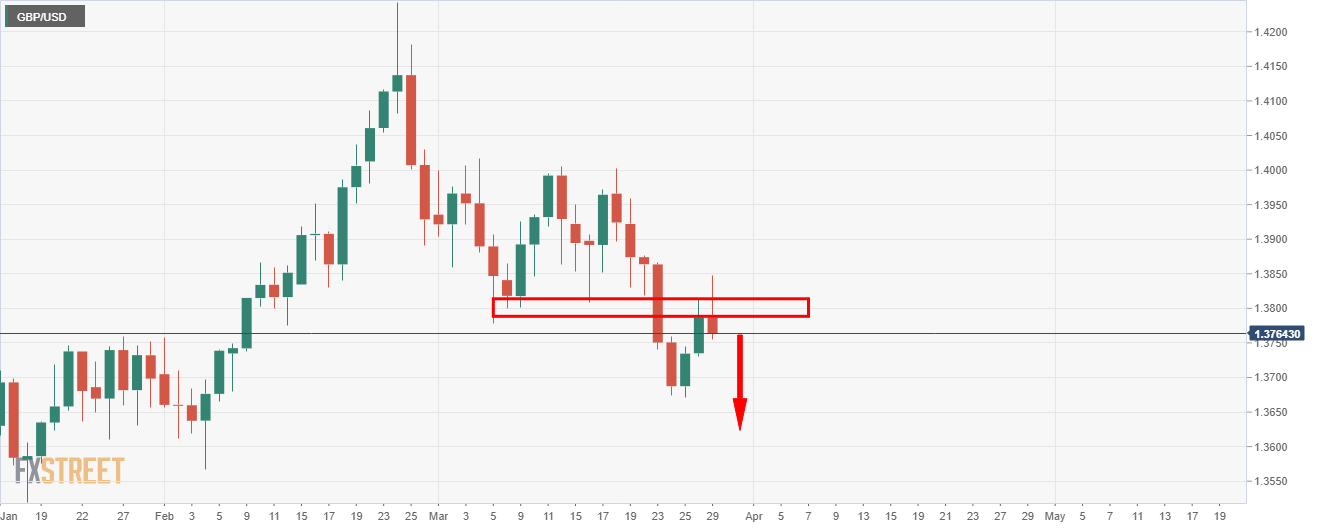

The focus remains on the downside as per the prior analysis:

Prior analysis, daily chart

The bearish impulse has been corrected with the bulls taking on the bear’s commitments at resistance.

A downside extension would be expected if bears step up to protect the resistance.

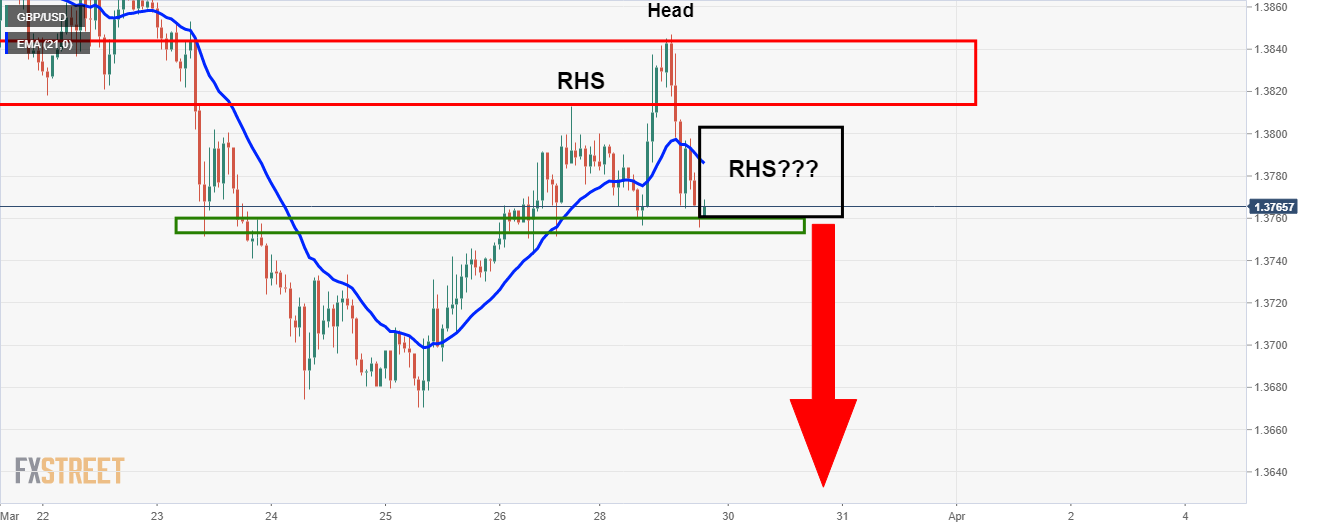

Prior analysis, 1-hour chart

Meanwhile, the hourly chart is telling ad offers a different vantage point.

There could well be some consolidation to come over the coming sessions prior to a break of the support.

A bearish head and shoulders could be in the makings.

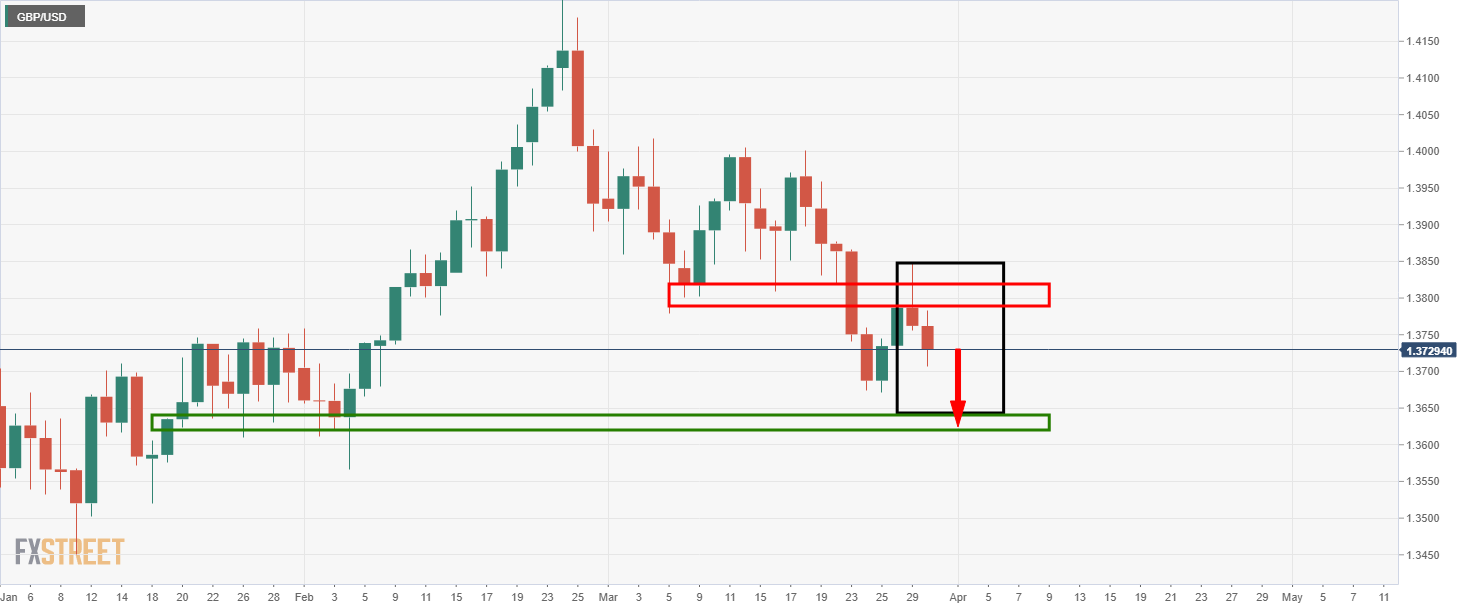

Live market, daily & 1-hour charts

There are still prospects of a downside extension as the price continues to move lower.

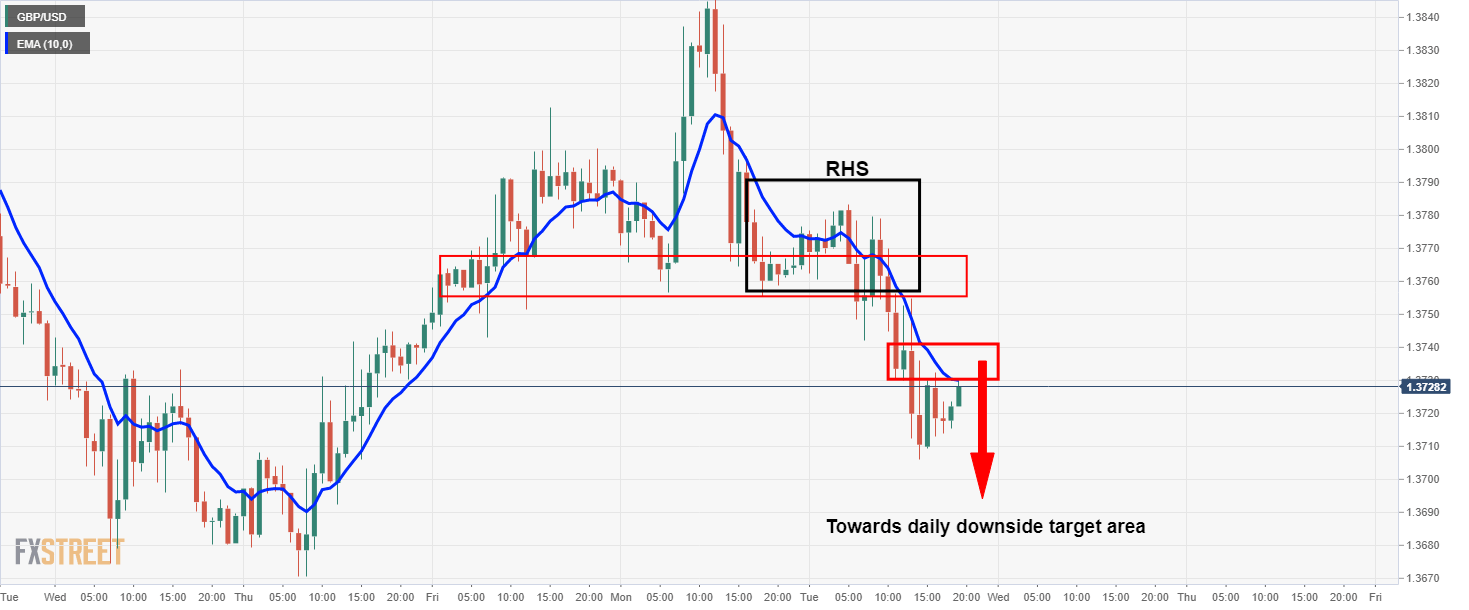

Meanwhile, as per the hourly chart, (above), the right-hand shoulder was formed and gave additional conviction to the downside bias with a perfect break and restest of the neckline for an optimal entry point.

Bears that are late to the trade can contemplate an entry from the 1.3730/35 area where the 10 EMA meets a prior support structure that would be expected to act as resistance.