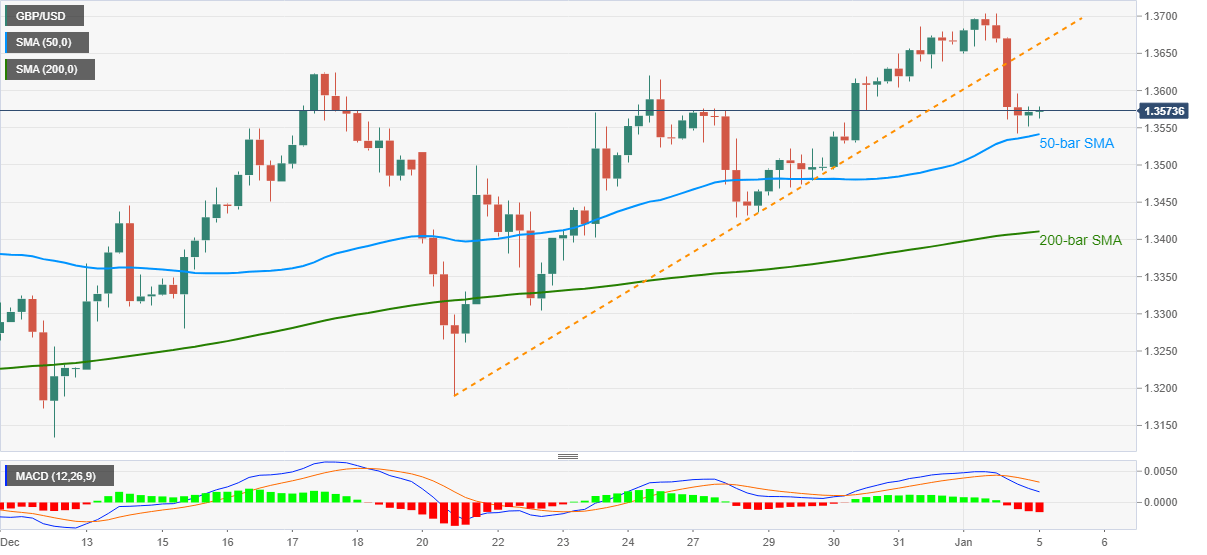

- GBP/USD bounces off 50-bar SMA towards regaining 1.3600.

- Bearish MACD, sustained trading below previous support line favor sellers.

- The 1.3700 threshold can lure bulls during further corrective pullback.

GBP/USD retraces the previous day’s heavy losses while picking up the bids near 1.3575-80 during Tuesday’s Asian session. The cable dropped the most in two weeks on Monday as the UK announced fresh lockdown measures to tame the coronavirus (COVID-19) outbreak.

While the quote’s latest bounce off 50-bar SMA favors further consolidation, a clear break of an ascending trend line December 21 and bearish MACD test the bulls.

Hence, the previous support line, currently around 1.3662 guard further recovery moves while the 1.3600 seems imminent on the GBP/USD buyers’ radar.

It should, however, be noted that the sterling’s ability to cross 1.3662, will eye the multi-month top flashed during December 2020, around 1.3705.

On the downside, 50-bar and 200-bar SMAs, respectively around 1.3540 and 1.3410 become strong supports to watch during the quote’s further weakness, more likely.

In a case where the GBP/USD bears refrain from stepping back from 1.3410, the previous month’s low near 1.3130 could return to the charts.

GBP/USD four-hour chart

Trend: Pullback expected