- GBP/USD wavers in a choppy range near weekly top.

- Sustained trading beyond key EMA, trend lines joins hopes of easy budget to favor bulls.

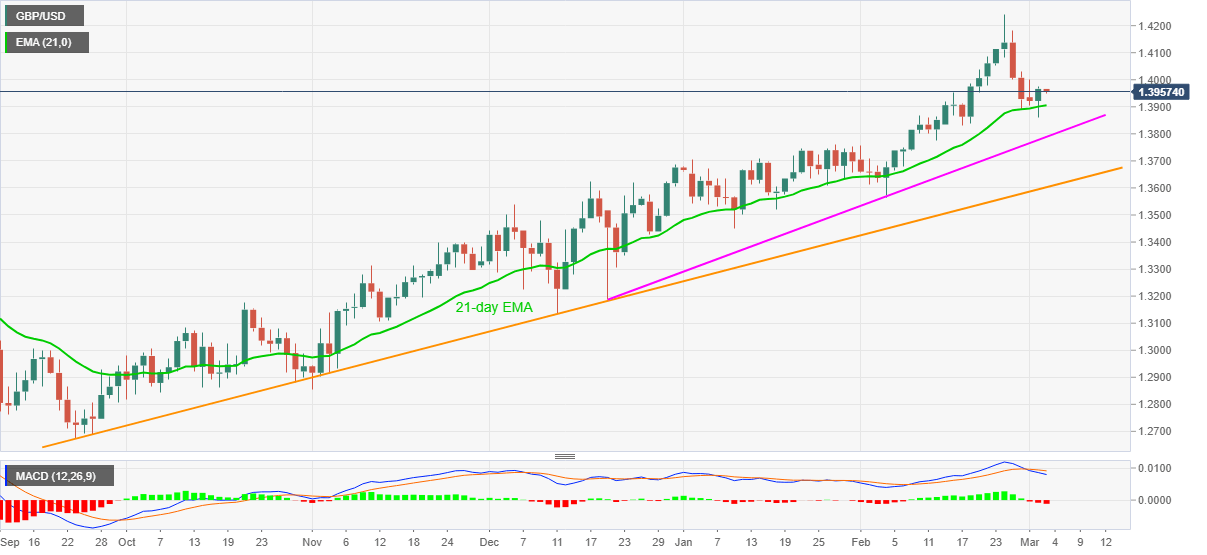

GBP/USD trims prior gains while declining to 1.3955, down 0.08% intraday, during Wednesday’s Asian session. In doing so, the quote fizzles Tuesday’s bounce off 21-day EMA amid the bearish MACD conditions.

However, the cable’s sustained trading beyond key trend lines from December and September 2020, coupled with hopes of a market-favorable UK budget, suggest further upside for the GBP/USD prices.

Read: UK furlough scheme will be extended from April to September in budget – FT

It’s worth mentioning that an upside break of the 1.4000 threshold will trigger a fresh rise targeting the 1.4085 and the 1.4100 resistances while February’s top, also the highest since early 2018, surrounding 1.4240, will challenge the bulls afterward.

Alternatively, a daily closing below the 21-day EMA level of 1.3905 will need to provide a daily closing below the 1.3900 round-figure to direct the bearish bias towards an ascending trend line from December 21, 2020, currently around 1.3790.

In a case where GBP/USD bears dominate past-1.3790, January’s top surrounding 1.3750 can offer an intermediate halt before dragging the quote back to a longer-term support line near 1.3600.

Overall, GBP/USD stays in an uptrend and hence any more positive from the budget will escalate the cable’s run-up to refresh multi-month high. On the contrary, the disappointment will also have larger repercussions.

GBP/USD daily chart

Trend: Bullish