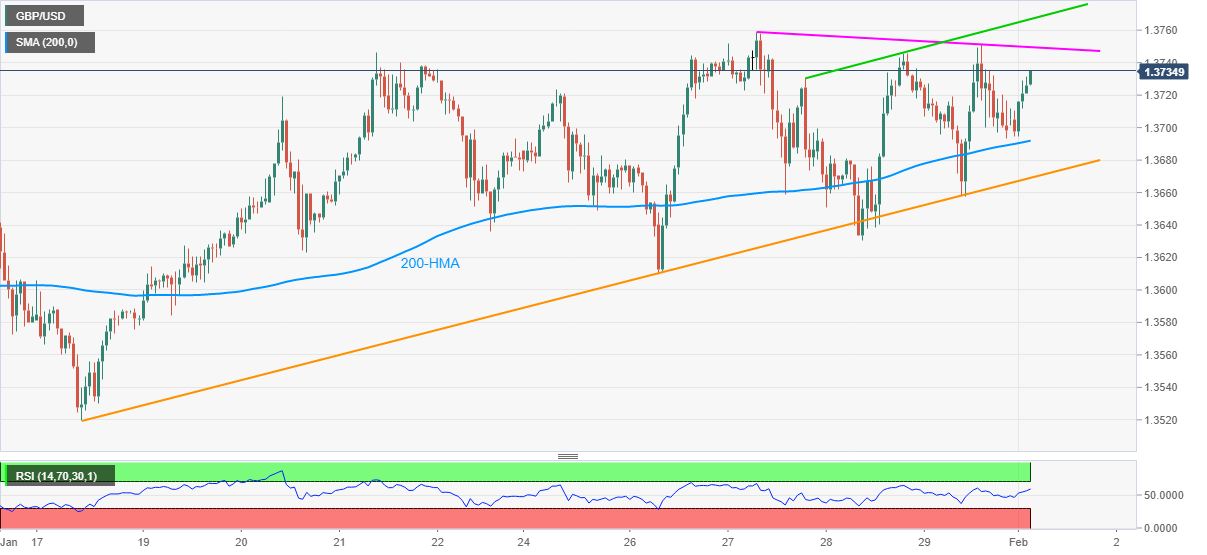

- GBP/USD bulls refresh intraday top while extending bounce before 200-HMA.

- A three-day-old falling trend line, short-term resistance line can offer intermediate stops to the upside.

- Ascending trend line from January 18 adds to the downside filter.

GBP/USD takes the bids near 1.3732, up 0.25% intraday, during early Monday. In doing so, the cable extends the early-day bounce off 1.3694, even before 200-HMA, amid strong RSI conditions.

The pair’s ability to remain strong beyond the key moving average, coupled with strong RSI conditions favor the further upside. As a result, a downward sloping trend line from last Wednesday, at 1.3750 now, lures the bulls.

Also acting as an upside filter is a falling resistance connecting Wednesday and Friday’s high, around 1.3765, as well as the recently flashed multi-month high of 1.3758.

If at all the GBP/USD bulls manage to keep the reins past-1.3765, the May 2018 high of 1.3772 and the 1.3800 will be in the spotlight.

Meanwhile, a downside break of 200-HMA level of 1.3692 needs validation from a short-term support line, currently around 1.3670, to recall GBP/USD sellers.

Following that, January 18 low near 1.3520 and the previous month’s low near 1.3450 should gain the market’s attention.

GBP/USD hourly chart

Trend: Bullish