- GBP/USD remained under some intense selling pressure for the second straight day.

- Bears now await a break below ascending channel support before placing fresh bets.

- Attempted recovery beyond the 1.3200 mark might be seen as a selling opportunity.

The GBP/USD pair added to the overnight losses and witnessed some heavy selling for the second consecutive session on Friday. The downward momentum dragged the pair to over three-week lows, around the 1.3175 region during the mid-European session.

The incoming headlines have been fueling worries about a no-deal Brexit, which, in turn, took its toll on the British pound. This, along with a softer risk tone, underpinned the US dollar’s relative safe-haven status and contributed to the intraday decline.

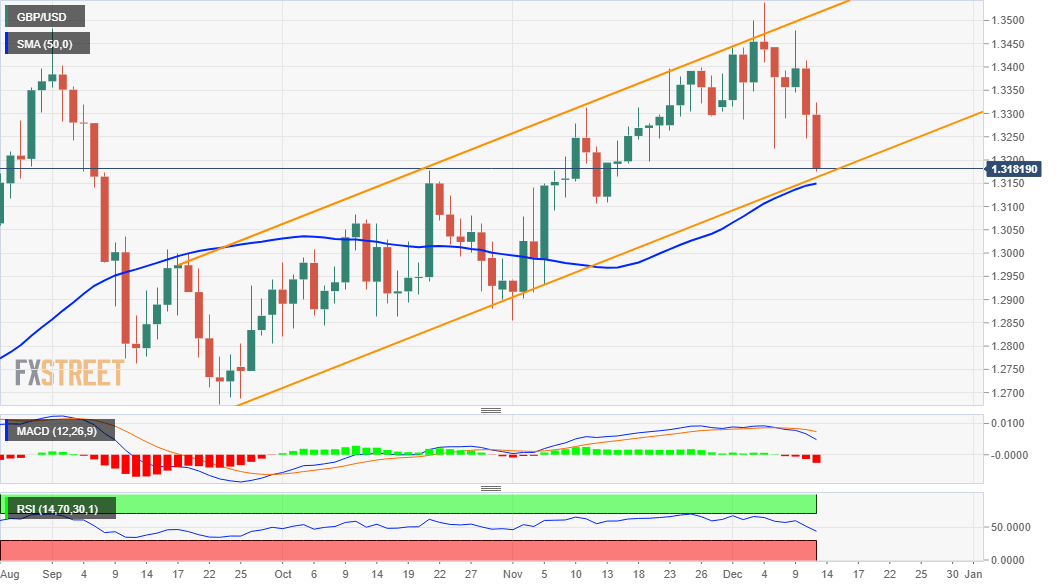

The GBP/USD pair was now seen hovering near short-term ascending channel support, extending from September monthly lows. Given last week’s false breakout through the mentioned channel, a convincing break below will be seen as a fresh trigger for bearish traders.

Meanwhile, technical indicators on the daily chart have just started drifting into the bearish territory and support prospects for an eventual breakdown. That said, traders might still wait for some follow-through selling before placing fresh bearish bets.

The GBP/USD pair might then turn vulnerable to weaken below the 1.3100 mark and accelerate the corrective slide further towards the next major support near the 1.3065-55 horizontal support.

On the flip side, any meaningful recovery attempt back above the 1.3200 mark might be seen as a selling opportunity and remain capped near the 1.3265-70 region. This is closely followed by the 1.3290-1.3300 area, which if cleared might trigger a short-covering move around the GBP/USD pair.

GBP/USD daily chart

Technical levels to watch