- GBP/USD decline below the 1.3700 mark despite poor US retail sales.

- Broader risk-off sentiment continues to strengthen the US Dollar.

- Powell’s speech today is eyed by the investors.

The GBP/USD analysis reveals bearishness. Despite disappointing US macro data on Friday, the GBP/USD pair failed to rebound from below 1.3800.

Tuesday saw some follow-up selling to the prior day’s deviation from the supply zone of 1.3875-80. After the vacation ended in September, job losses were feared to increase, weighing on the pound sterling. However, the unexpected drop in UK unemployment and higher wage growth data are overshadowed by disappointment over the change in the number of applicants.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

A risk-off environment also boosted US dollar inflows, which added downward pressure on the GBP/USD pair. The global economic recovery remains threatened by a rapidly spreading Delta variant of Coronavirus. In addition, investor sentiment was affected by falling retail sales in the US, which benefited traditional safe currencies.

Overall sales plummeted 1.1% in July, far below the consensus forecast. The market expected a 0.1% increase in major retail sales (excluding automobiles), but actual declines of 0.4% were reported. As a result of the recent COVID-19 outbreak, consumers have become more cautious.

US Treasury yields have been declining steadily since the Fed’s policy tightening. This could further lower expectations of an early tightening. However, the dollar bulls did not appear to have been hurt by the development of events and instead focused on the generally weaker sentiment of equity traders.

Traders are now focusing on a scheduled speech by Fed Chairman Jerome Powell, which will be scrutinized for any clues to the next policy move. These will impact short-term price movements in the US dollar, giving GBP/USD a fresh direction.

–Are you interested to learn more about forex signals? Check our detailed guide-

GBP/USD technical analysis: 1.3700 to cap gains

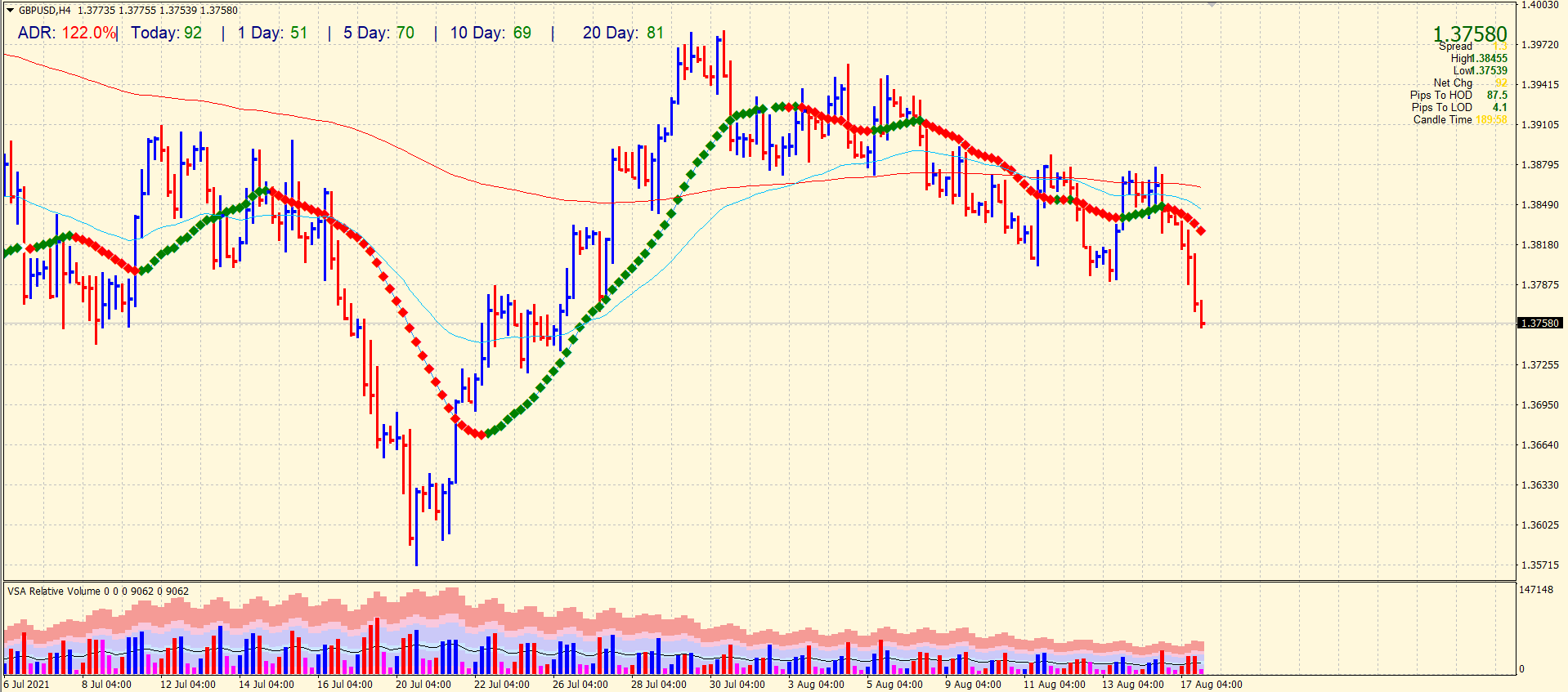

The GBP/USD price has dropped below the 20, 50 and 200 SMAs on the 4-hour chart. Moreover, the price has broken below the 1.3800 mark. The price has done 122% on the average daily range today. It indicates that the volatility is quite higher than normal. The price may test the next support at 1.3740 ahead of 1.3700 and then 1.3630. On the upside, 1.3800 will act as a key resistance.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.