- The pound rose after US producer inflation came in lower than expected.

- Investors are cautious ahead of the UK’s budget unveiling.

- Unemployment in the UK rose to 3.6% in Q3.

Today’s GBP/USD price analysis is bullish as the pair extends Tuesday’s move. On Tuesday, the pound surged to three-month highs versus the dollar as US producer inflation rose less than anticipated. Nevertheless, sterling investors exercised caution ahead of this week’s UK government budget.

–Are you interested in learning more about STP brokers? Check our detailed guide-

The increase in US prices at the farm and factory gate was considerably smaller than anticipated in October, adding to investors’ relief following last week’s consumer data that suggested inflation may have peaked. This gives the Federal Reserve room to wind down its tightening of monetary policy. This has also decreased the appeal of the dollar to yield-seeking foreign investors.

On Thursday, the newly appointed UK finance minister Jeremy Hunt unveils his autumn budget, which is expected to include several initiatives to close a 50 billion GBP ($59 billion) budget gap, including tax increases and spending reductions.

According to data released on Tuesday by the Office for National Statistics, the unemployment rate in Britain increased to 3.6% in the three months that ended in September, and job openings decreased for a fifth consecutive month due to companies’ concerns about the future of the economy.

In contrast, average weekly wages, excluding bonuses, increased by 5.7% in the three months ending in September, exceeding the forecast of 5.5% growth.

GBP/USD key events today

Investors will pay close attention to the UK’s inflation report, which will show whether the Bank of England is succeeding in its job. There will also be a retail sales report from the United States.

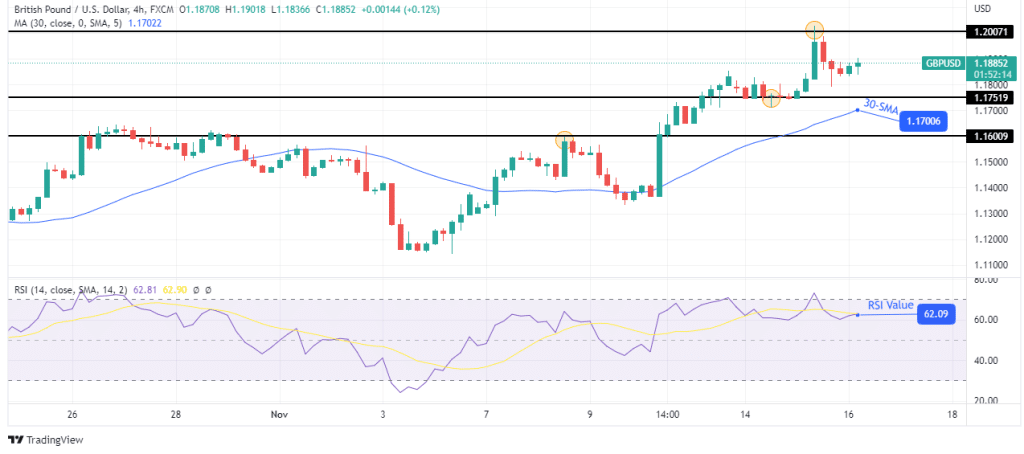

GBP/USD technical price analysis: Short-term pullback amid strong bullish momentum

Looking at the 4-hour chart, we see the price trading above the 30-SMA and the RSI above 50, showing bulls are holding the reins. The move up has, however, stopped at the 1.2007 resistance level and is pulling back.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

This pullback will come against strong support from the 1.1751 level and the 30-SMA. Therefore, it will be difficult for bears to break below and reverse the trend. Bulls might gather enough momentum at any point now and look to take out the 1.2007 resistance.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.